Rapid Read • 8 min read

Berkshire Hathaway, led by Warren Buffett, has reported a $3.76 billion writedown on its stake in Kraft Heinz during the second quarter. This decision reflects the challenges faced by the decade-old investment, which has not performed as expected. The writedown contributed to a 59% drop in overall net income for Berkshire, alongside a 4% decline in quarterly operating profit due to reduced insurance underwriting premiums. The company has maintained a cautious stance on market valuations, influenced by uncertainties surrounding tariffs and economic growth. Despite holding a near-record $344.1 billion cash stake, Berkshire has sold more stocks than it has purchased for the 11th consecutive quarter. The writedown follows Kraft Heinz's announcement of considering strategic alternatives, including a potential breakup, as it struggles with shifting consumer preferences towards healthier and private-label options.

AD

The writedown signifies a significant financial adjustment for Berkshire Hathaway, highlighting the challenges of investing in the food industry amid changing consumer trends. Kraft Heinz's difficulties reflect broader shifts in the market, where consumers increasingly favor healthier options over traditional processed foods. This development impacts Berkshire's financial performance and underscores the importance of strategic investment decisions in a volatile economic environment. The writedown also raises questions about the future direction of Kraft Heinz, which may undergo structural changes to adapt to market demands. Investors and stakeholders are closely monitoring these developments, as they could influence the company's market position and financial health.

Berkshire Hathaway is expected to continue its cautious approach to investments, particularly in light of ongoing economic uncertainties. The company may explore new investment opportunities or strategic adjustments to enhance its portfolio performance. Kraft Heinz's consideration of strategic alternatives, including a potential breakup, could lead to significant changes in its business operations and market strategy. Stakeholders will be watching for any announcements regarding these strategic decisions, which could impact the company's future trajectory and market competitiveness.

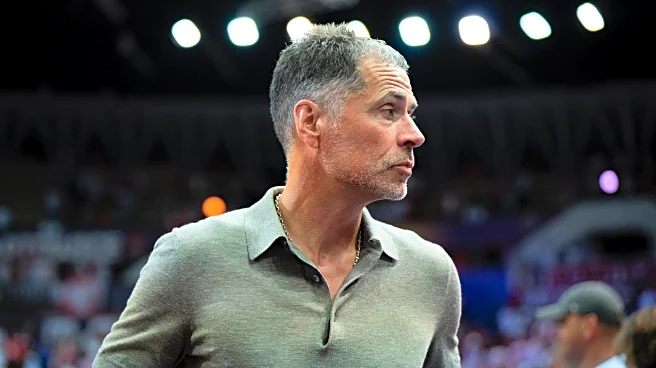

The writedown and potential restructuring of Kraft Heinz highlight the evolving landscape of the food industry, where companies must adapt to consumer preferences for healthier and more sustainable products. This shift may drive innovation and transformation within the sector, influencing product development and marketing strategies. Additionally, Berkshire Hathaway's investment strategy and leadership transition, with Vice Chairman Greg Abel set to succeed Warren Buffett, could shape the company's future direction and investment philosophy.

AD

More Stories You Might Enjoy