Rapid Read • 7 min read

Artificial intelligence tools are increasingly being used to assist individuals in planning for retirement, especially those who have transitioned from corporate jobs to freelance work. These AI tools can analyze financial data and forecast retirement trends, helping users determine how much money they need to retire by a certain age and calculate spending power at retirement. While AI tools like ChatGPT provide a starting point for financial planning, they are not a substitute for professional financial advice. Users are advised to use specific queries to maximize the benefits of AI tools, while being cautious about sharing personal financial data.

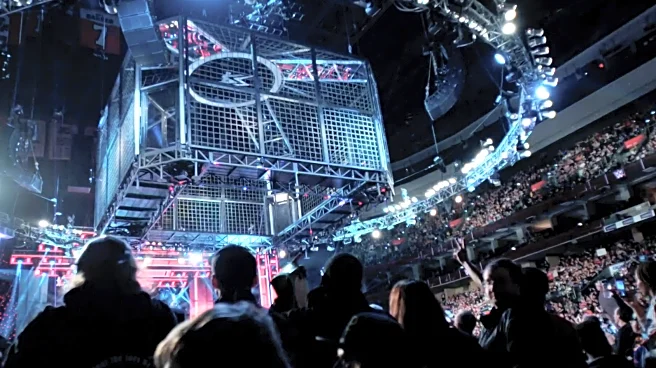

AD

The use of AI in retirement planning is significant as it offers a cost-effective alternative to traditional financial advisory services, making financial planning more accessible to freelancers and those without employer-sponsored retirement plans. AI tools provide transparency and objective insights, free from the biases of human advisors. However, reliance solely on AI can be risky due to potential inaccuracies and lack of personalized advice. The integration of AI with professional financial advice can enhance retirement planning, offering a balanced approach that leverages technology while ensuring human oversight.

As AI tools continue to evolve, they are expected to become more sophisticated, offering even more personalized and accurate financial planning solutions. Users may increasingly adopt a hybrid approach, combining AI insights with professional advice to optimize their retirement strategies. Financial institutions may also integrate AI features into their services, providing clients with advanced tools for managing their retirement portfolios.

The ethical implications of using AI for financial planning include concerns about data privacy and the potential for AI to replace human advisors. As AI tools become more prevalent, there may be a shift in the financial advisory industry, with professionals needing to adapt to new technologies and offer complementary services.

AD

More Stories You Might Enjoy