By Mike Dolan

LONDON (Reuters) - What matters in U.S. and global markets today

By Mike Dolan, Editor-At-Large, Finance and Markets

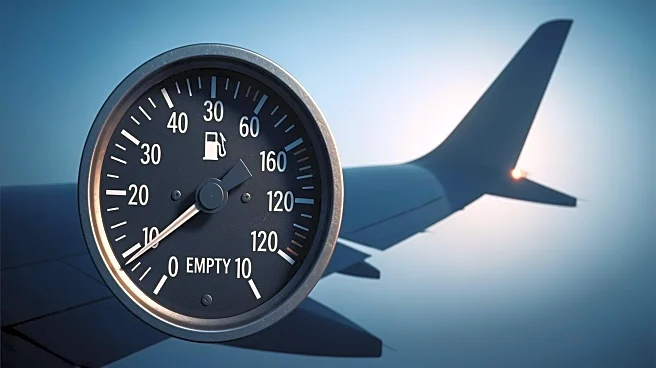

The dollar is on course for its best week of the year, as unfolding U.S.

trade deals are succeeding in raising tariffs without attracting much retaliation or causing major economic damage so far.

A weekend agreement by the European Union to accept a 15% U.S. tariff hike, with promises of hefty spending on U.S. energy and arms to boot, saw the dollar notch its best day since May against the euro. Sustained dollar gains are a mixed blessing for Wall Street stocks and for President Donald Trump's administration, as it sees dollar depreciation as an integral part of tackling trade deficits and boosting competitiveness.

I’ll review today’s market news and then look at whether the dollar's considerable tariff risk premium may be dissipating as trade deals get done.

* The dollar rebound comes as the Federal Reserve starts its two-day policy meeting, though with no change in rates expected this week as eyes drift to its September gathering instead. A big week for labor market data kicks off with the release of U.S. June job openings, and then we’ll see June goods trade, which will figure into the week's second-quarter U.S. GDP report.

* In the thick of the corporate earnings season - with four big tech megacaps reporting this week and the likes of UPS, Merck and Boeing out later today - Wall Street indexes eked out new records on Monday. U.S. futures were positive again ahead of Tuesday's bell, with European and Chinese stocks rebounding too and only Japan bucking the trend.

* Treasury markets were steady after hefty debt auctions on Monday. The Treasury announced plans to borrow $1.007 trillion in the third quarter, largely in line with forecasts though likely frontloaded with bill sales. Details of the quarterly refunding will be released on Wednesday. Along with the Fed meeting, bonds kept a close eye on higher crude oil prices after Trump set a new deadline of "10 or 12 days" for Russia to make progress toward ending the war in Ukraine or face more sanctions on both Moscow and buyers of its oil exports.

Today's Market Minute

* U.S. and Chinese trade negotiators met for a second day of talks in Stockholm to defuse the bilateral trade war between the world's two biggest economies. The meetings are expected to agree another 90-day extension of a tariff truce struck in mid-May.

* South Korea's Finance Minister Koo Yun-cheol said he would seek a mutually beneficial trade deal when he meets U.S. Treasury Secretary Scott Bessent for talks this week.

* U.S. President Donald Trump unexpectedly shortened his deadline for hitting Russia with the most severe sanctions on its oil exports to date. While the market has called the president’s bluff thus far, the sheer scale of the threat may force investors to start pricing in this meaningful tail risk, writes ROI energy columnist Ron Bousso.

* The earnings season is ramping up, and investors are once again focusing on whether companies will beat or miss expectations. However, Panmure Liberum investment strategist Joachim Klement claims the major driver of share prices can be found in the bond market.

* As investors brace for the busiest week of the U.S. earnings season, debate is picking up again about the ‘Mag 7’ influence over U.S. equity indexes and whether we could be seeing the beginnings of true market broadening. Read the latest from ROI columnist Jamie McGeever.

Chart of the day

Dollar selling has abated in recent weeks, but the weekend U.S.-EU trade deal has catapulted it higher across the board as investors start to remove a tariff risk premium dogging the currency all year. The dollar's DXY index surged more than 1% on Monday, its biggest one day gain in more than two months, and has added to that on Tuesday. After just two days, it's on course for its best week of the year.

Today's events to watch

* U.S. June goods trade balance (8:30ED AM T), June retail/wholesale inventories (8:30 AM EDT) May house prices (9:00 AM EDT), July consumer confidence (10:00 AM EDT) June JOLTS job openings data (3:00 PM EDT) Dallas Federal Reserve July service sector survey (3:30 PM EDT)

* International Monetary Fund releases its update World Economic Outlook (9:00 AM EDT)

* U.S. and Chinese negotiators meet for a second day in Stockholm

* Federal Reserve's Federal Open Market Committee starts its two-day meeting on interest rates, decision Wednesday

* U.S. corporate earnings: UPS, Merck, Boeing, PayPal, Starbucks, Visa, Corning, UnitedHealth, Procter & Gamble, Stanley Black & Decker, Sysco, Incyte, Norfolk Southern, Booking, Ecolab, Carrier, PPG, Regency Centers, Caesars, Royal Caribbean, American Tower, CBRE, Teradyne, Mondelez, BXP, Seagate, DTE

* U.S. Treasury sells $44 billion of 7-year notes, $30 billion of 2-year floating rate notes

Want to receive the Morning Bid in your inbox every weekday morning? Sign up for the newsletter here. You can find ROI on the Reuters website, and you can follow us on LinkedIn and X.

Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias.

(by Mike Dolan; editing by Sharon Singleton)