Rapid Read • 8 min read

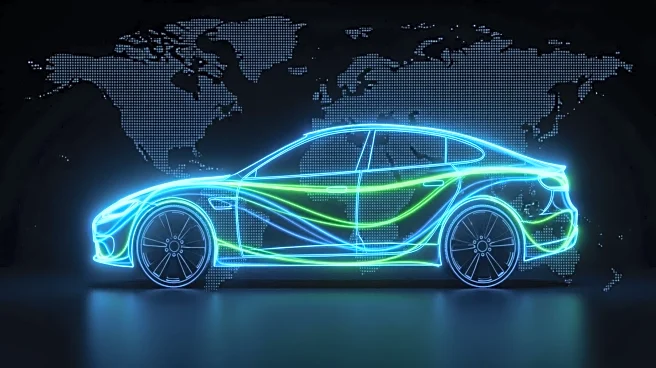

Foxconn Industrial Internet is undergoing a significant transformation, focusing on a strategic share buyback program and expanding its AI infrastructure. The company plans to repurchase shares worth between RMB 500 million and RMB 1 billion, aiming to stabilize investor sentiment and signal confidence in its intrinsic value. This move is expected to enhance earnings per share by reducing the number of outstanding shares. Concurrently, Foxconn is partnering with TECO Electric to build modular data centers, targeting the $33 billion AI server market. The company is also assembling NVIDIA's Blackwell-powered GB200 servers, which are priced at a premium compared to traditional models. These initiatives are part of Foxconn's strategy to remain relevant in the rapidly evolving tech landscape.

AD

Foxconn's strategic shift is crucial as it seeks to balance shareholder returns with high-growth opportunities in the AI sector. The share buyback could improve the company's return on equity, while the AI infrastructure expansion positions Foxconn as a key player in the global hyperscaler market. This transformation is vital for Foxconn to maintain its competitive edge against industry giants like ABB and Siemens. The company's financial performance, including a 50% year-on-year increase in net income driven by AI server shipments, underscores the potential success of these initiatives. However, challenges such as currency fluctuations and regulatory approvals could impact margins and timelines.

Foxconn's future success will depend on its ability to execute its dual strategy effectively. The company must navigate potential regulatory hurdles and geopolitical risks while leveraging its manufacturing expertise to scale in the high-tech sector. The partnership with TECO and geographic diversification efforts, including expansion into India and Mexico, are critical steps in hedging against these risks. Investors will be watching closely to see if Foxconn can replicate its past efficiency in the AI domain and secure high-margin contracts to drive growth.

Foxconn's transformation highlights broader trends in tech manufacturing, where traditional companies are pivoting towards AI to ensure long-term relevance. This shift raises questions about the sustainability of low-margin manufacturing models in a capital-intensive sector. The company's ability to adapt and innovate will be crucial in determining its place in the AI-driven future of tech manufacturing.

AD

More Stories You Might Enjoy