Rapid Read • 6 min read

The Economist has published an analysis on the persistent inflation challenges facing America and other wealthy nations. Despite a significant drop in inflation rates since the peak in 2022, when inflation across the OECD reached nearly 11%, the issue remains unresolved. As of June, the average inflation rate across these countries was approximately 2.5%, slightly above the target set by most central banks. The report highlights that many English-speaking countries continue to experience lingering inflationary pressures, which are proving difficult to eliminate.

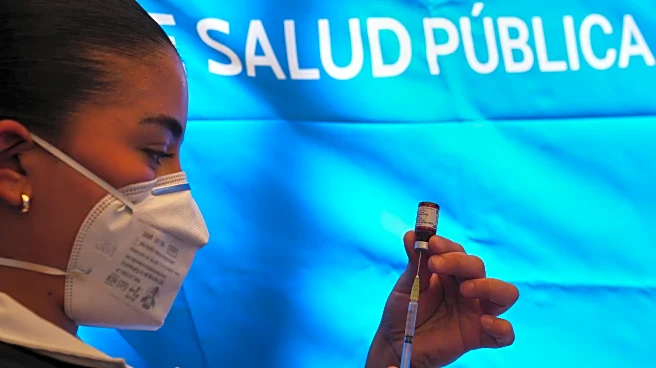

AD

The ongoing struggle with inflation is significant as it affects various aspects of the economy, including consumer purchasing power, interest rates, and economic growth. Persistent inflation can lead to increased costs for goods and services, impacting household budgets and potentially slowing economic recovery. Central banks may need to adjust monetary policies to address these challenges, which could influence interest rates and borrowing costs. The situation underscores the complexity of managing economic stability in a post-pandemic world, where supply chain disruptions and geopolitical tensions continue to play a role.

Economists and policymakers will likely continue to monitor inflation trends closely, adjusting strategies as necessary to mitigate its impact. Central banks may consider further interest rate hikes or other monetary policy tools to curb inflation. Additionally, governments might explore fiscal measures to support affected industries and consumers. The ongoing analysis and response to inflation will be crucial in shaping economic policies and ensuring long-term stability.

AD

More Stories You Might Enjoy