Rapid Read • 7 min read

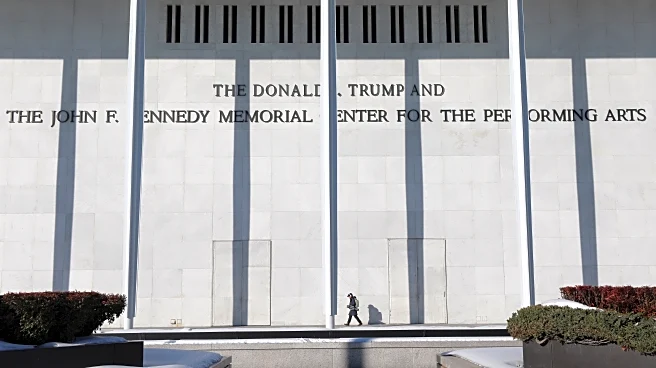

The U.S. dollar experienced gains on Tuesday, remaining close to recent lows as the market consolidates following a weak jobs report. This report has increased expectations for a Federal Reserve rate cut next month. Investors are also focused on President Trump's nominations to the Federal Reserve Board, including his choice for commissioner of the Bureau of Labor Statistics. The market is anticipating changes at the Fed that could lead to a more dovish stance, aligning with Trump's preferences. Additionally, the upcoming consumer price index data is expected to provide further insights into inflation trends.

AD

The potential shift in the Federal Reserve's approach to monetary policy could have significant implications for the U.S. economy. A more dovish Fed might lead to lower interest rates, impacting inflation and the strength of the U.S. dollar. This could benefit borrowers and stimulate economic activity but may also pose challenges for savers and investors seeking higher returns. The ongoing trade tensions and tariff threats from the Trump administration add further complexity to the economic landscape, influencing market sentiment and corporate strategies.

President Trump is expected to announce his nominee for the Fed Board vacancy and his choice for Fed Chair soon. The market will closely watch these announcements, as they could signal shifts in monetary policy. Additionally, upcoming economic data releases, such as the consumer price index, will provide further insights into inflation trends and the Fed's potential actions. Investors will continue to monitor the impact of tariffs and trade tensions on various sectors, with expectations of more substantial effects in the coming months.

AD

More Stories You Might Enjoy