Battling Digital Deception

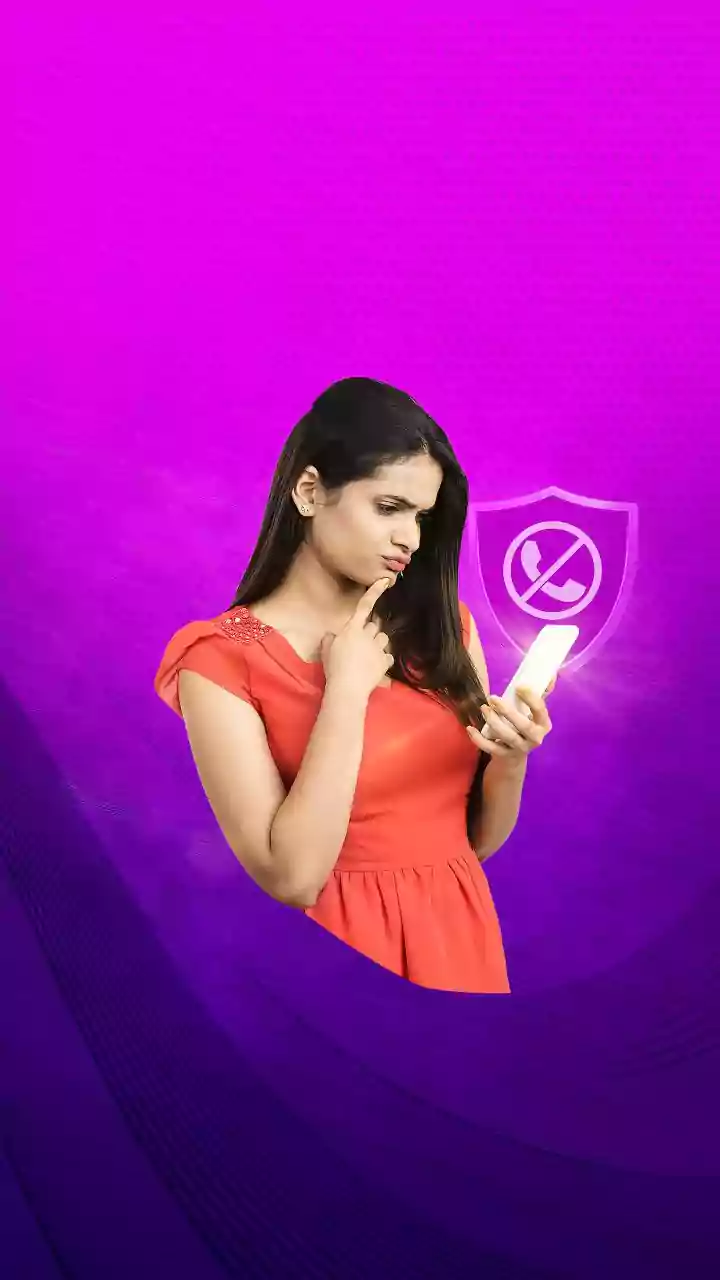

In an era of escalating digital fraud, a significant initiative has been launched to protect individuals from the pervasive threat of OTP-related banking

scams. This new AI-powered system is specifically engineered to identify and neutralize these fraudulent attempts in real-time, offering a crucial layer of defense. The technology aims to intercept deceptive tactics where fraudsters impersonate legitimate service representatives to extract sensitive One-Time Passwords. By proactively detecting suspicious call patterns and conversations that indicate a potential OTP request, the system intervenes before financial compromise can occur. This development marks a substantial advancement in safeguarding users against common yet devastating cybercrimes that prey on trust and urgency. The implementation is being rolled out progressively, ensuring wider accessibility to this enhanced security measure.

AI's Real-Time Intervention

The core of this advanced fraud alert system lies in its sophisticated ability to detect suspicious activities during active phone calls. When the artificial intelligence identifies that a bank's One-Time Password (OTP) is being requested or discussed within a call flagged as potentially risky, it triggers an immediate alert to the user. This alert serves as a critical warning, advising the user that sharing banking OTPs during such a conversation could lead to severe financial consequences. This intelligent integration of AI and instant notifications provides individuals with a vital moment to pause, reassess the legitimacy of the caller's request, and avoid becoming a victim of these sophisticated scams. It effectively closes a prevalent security loophole that has been extensively exploited by malicious actors seeking unauthorized access to bank accounts.

Proven Impact and Future Steps

The effectiveness of this proactive, network-level AI solution has been rigorously tested and demonstrated. Trials have revealed a remarkable degree of accuracy in preventing fraudulent activities, significantly curbing the menace of such scams. This system represents an ongoing commitment to fortifying user security, building upon previous AI-driven measures such as spam call identification and blocking malicious links. Data indicates a substantial reduction in cybercrime-related financial losses, with one analysis showing a decrease of nearly 68.7% in monetary losses on the network. Furthermore, overall cybercrime incidents recorded within the analyzed period saw a notable drop of approximately 14.3%. This demonstrates the tangible positive impact of employing advanced AI in network security to protect consumers.