What is the story about?

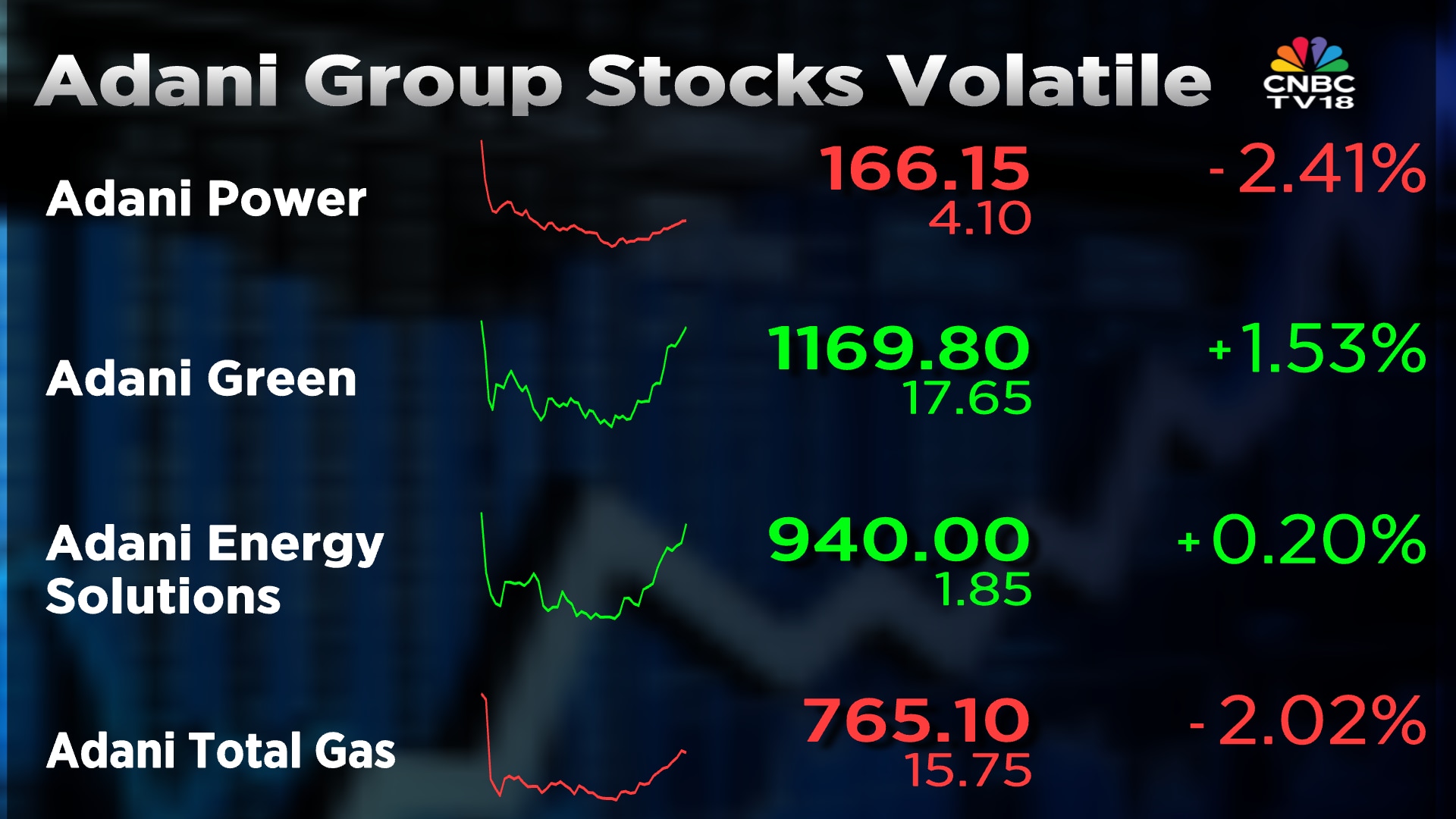

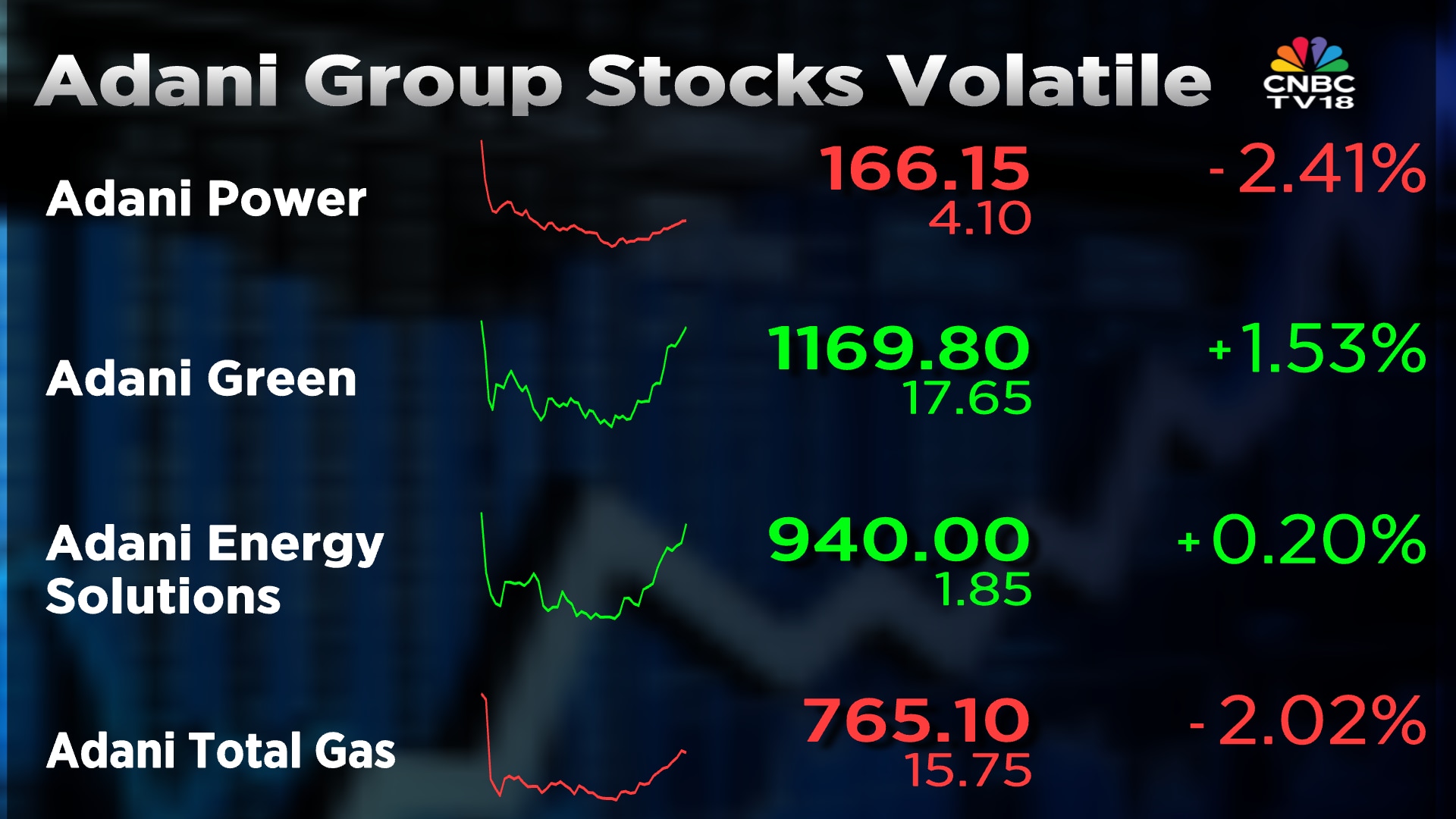

Shares of Adani Group companies, Adani Power Ltd., Adani Enterprises Ltd., Adani Ports Ltd., Adani Green Energy Ltd., Adani Total Gas Ltd. and Adani Energy Solutions Ltd. are looking to recover from opening lows after witnessing profit booking in the initial 30 minutes of the trading session.

Shares of Adani Power fell as much as 5.3% on Tuesday, after a 35% surge in the last two trading sessions, while those of other group companies such as Ports, Enterprises, Green Energy and Energy Solutions also fell between 1% to 5%.

The stocks are now looking to recover from the opening lows, with Adani Enterprise briefly moving into positive territory.

Adani Power's shares surged over the last two sessions on the back of multiple triggers. First being the SEBI clean chit to the group with regards to some allegations levelled by Hindenburg Research. The same day, Morgan Stanley initiated coverage on the stock with a price target of ₹818 and an "overweight" rating, calling it a turnaround story in India's corporate history.

The stock also began to trade adjusted for its stock split on Monday.

On the same day of the SEBI clean chit, Jefferies had issued a bullish note on Adani Green Energy with a price target of ₹1,300.

Shares of Adani Total Gas and Adani Green Energy also saw healthy gains on Monday, with volumes that were significantly higher than their 20-day average.

In a video message on Monday, Adani Group Chairman Gautam Adani said that what hung over the group for over two years has finally being lifted. He also added that the time has come to accelerate the pace of innovation and drive bold advance in energy, logistics and other infrastructure aspects.

Shares of Adani Power fell as much as 5.3% on Tuesday, after a 35% surge in the last two trading sessions, while those of other group companies such as Ports, Enterprises, Green Energy and Energy Solutions also fell between 1% to 5%.

The stocks are now looking to recover from the opening lows, with Adani Enterprise briefly moving into positive territory.

Adani Power's shares surged over the last two sessions on the back of multiple triggers. First being the SEBI clean chit to the group with regards to some allegations levelled by Hindenburg Research. The same day, Morgan Stanley initiated coverage on the stock with a price target of ₹818 and an "overweight" rating, calling it a turnaround story in India's corporate history.

The stock also began to trade adjusted for its stock split on Monday.

On the same day of the SEBI clean chit, Jefferies had issued a bullish note on Adani Green Energy with a price target of ₹1,300.

Shares of Adani Total Gas and Adani Green Energy also saw healthy gains on Monday, with volumes that were significantly higher than their 20-day average.

| Stock | Volumes | 20-Day Average |

| Adani Total Gas | 3.9 Crore | 14.4 Lakh |

| Adani Green Energy | 1.76 Crore | 20 Lakh |

| Adani Power | 13.5 Crore | 1.14 Crore |

In a video message on Monday, Adani Group Chairman Gautam Adani said that what hung over the group for over two years has finally being lifted. He also added that the time has come to accelerate the pace of innovation and drive bold advance in energy, logistics and other infrastructure aspects.

/images/ppid_59c68470-image-175860509973456943.webp)

/images/ppid_59c68470-image-177083752855419301.webp)

/images/ppid_a911dc6a-image-177084603066450478.webp)

/images/ppid_a911dc6a-image-177084257810510483.webp)

/images/ppid_a911dc6a-image-177084253417916956.webp)