The rally comes as traders assess the US Federal Reserve's latest interest rate cut, which is generally seen as positive for IT company valuations. In an 11-to-1 vote, the Federal Open Market Committee (FOMC) lowered the overnight funds rate to a range of 4.00%-4.25%, a move that saw less dissent than Wall Street had anticipated.

However, Fed Chair Jerome Powell tempered market optimism, calling the decision "risk management" and warning against expectations of an aggressive easing cycle. Policymakers projected two more rate cuts in 2025 but just one in 2026, compared with traders' expectations of two to three cuts next year.

Lower interest rates can help revive spending in sectors such as telecom and mortgages. The US dollar index is already down 10% year-to-date, further aiding sentiment for IT exporters.

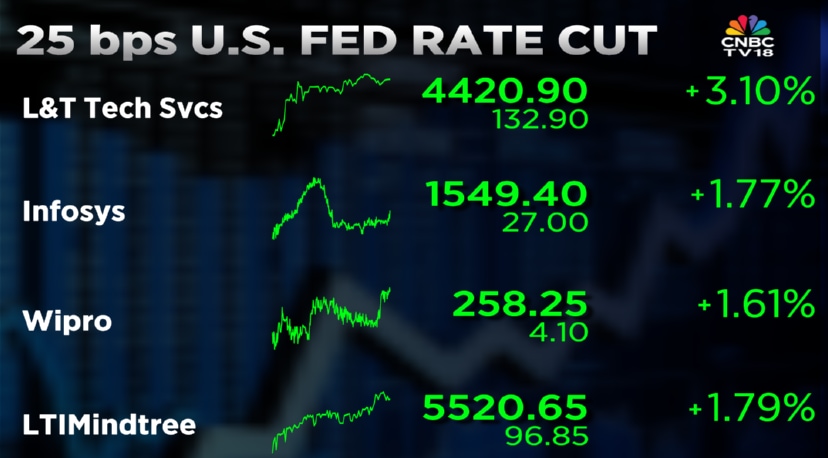

Back home, Infosys' buyback plan fueled expectations of similar announcements from TCS and Wipro. Among individual stocks, LTIMindtree jumped nearly 3% to trade at ₹5,573, while Infosys, Wipro, and Mphasis rose around 2% each. Persistent Systems, HCL Technologies, Coforge, and Tech Mahindra gained over 1% apiece, and TCS was up nearly 1%.

Despite Thursday's rebound, the Nifty IT index remains down 15% year-to-date, in contrast with the Nifty 50’s 7.5% gain. The Nifty IT index was trading 0.73% higher at 36,734.20.

Apurva Sheth of SAMCO Securities believes that Fed is walking a tight rope of balancing growth and inflation. "So far the corporates have been slow in passing the tariff hikes to consumers. If the delay too much then that will affect their profitability. If they pass on the costs then it will lead to inflation. Both these scenarios are not good for the markets. But why bother now when you can worry about it later."

/images/ppid_59c68470-image-175817752746678123.webp)

/images/ppid_a911dc6a-image-177101752951095973.webp)

/images/ppid_a911dc6a-image-177101403147018469.webp)

/images/ppid_a911dc6a-image-177101053501199609.webp)

/images/ppid_59c68470-image-177101003680064644.webp)