What is the story about?

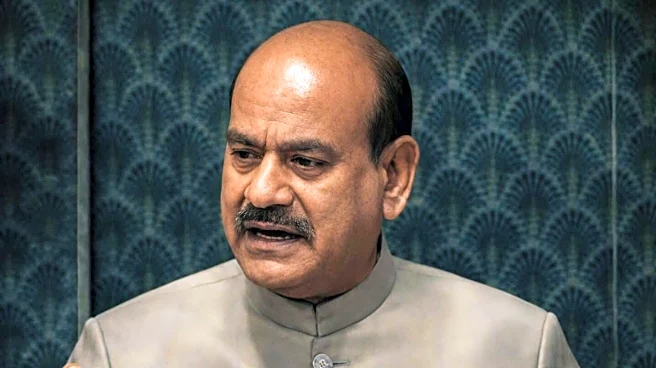

Tata Trusts has issued a circular seeking the renewal of Venu Srinivasan's term as a trustee of the Sir Dorabji Tata Trusts. All trustees are required to give their approval for the renewal before October 23, sources close to the Tata Group told CNBC-TV18. Mehli Mistry's term is also expected to come up for renewal soon.

The Sir Dorabji Tata Trusts and the Sir Ratan Tata Trusts together hold a 51% stake in Tata Sons, while the Shapoorji Pallonji Group holds an 18% stake. Venu Srinivasan serves as a trustee in both Tata Trusts and is also a nominee director on the board of Tata Sons.

The alleged rift within Tata Trusts, the entity controlling 66% of Tata Sons, has made headlines this month. However, experts believe the situation is being overstated. Thomas Mathew, author of Ratan Tata's biography, described the differences among trustees as normal.

"It is true that there may be some difference of opinion, but I think you're making a mountain out of a molehill," Mathew said. He added that there was no question of a coup against Noel Tata, and that the trustees, all experienced professionals, would be able to resolve their differences.

"There could be differences of opinion on processes; there could be differences of opinion on objectives, on goals, but that's not causing any seismic tremors anywhere," he added, emphasising that such debates are inevitable in any organisation, even within families.

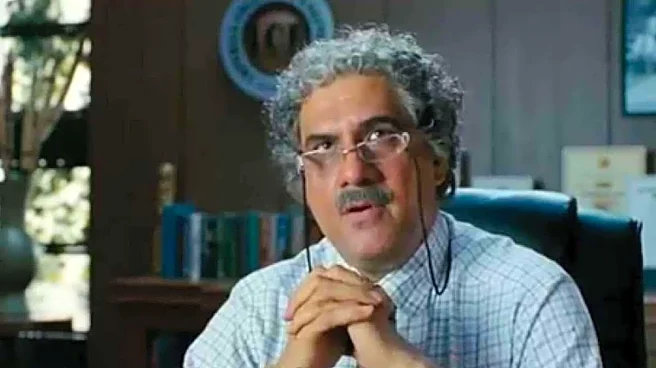

While internal disagreements may not threaten the company, experts point to the need for Tata Sons to be publicly listed to ensure transparency and accountability. Nirmalya Kumar, former member of the Group Executive Council and former head of strategy at Tata Group, said, "Listing of Tata Sons is actually a very good thing. It is good for Tata Sons; it is good for the country."

Kumar explained that public listing would provide transparency for a company holding significant stakes in major Indian firms and would also give minority shareholders an opportunity to exit if desired. He said that the Shapoorji Pallonji Group, which owns an 18.3% stake, has been advocating for listing to protect its investment.

The debate around listing comes amid heightened scrutiny following reports that four Tata Trusts trustees, Darius Khambata, Jehangir HC Jehangir, Pramit Jhaveri, and Mehli Mistry, were allegedly trying to challenge Noel Tata's leadership. Sources close to the trustees have denied these claims, calling the narrative that portrays them as "villains" false.

While internal differences attract media attention, analysts believe the bigger focus should remain on Tata Sons' governance and the potential benefits of listing for both the company and the wider Indian economy.

The Sir Dorabji Tata Trusts and the Sir Ratan Tata Trusts together hold a 51% stake in Tata Sons, while the Shapoorji Pallonji Group holds an 18% stake. Venu Srinivasan serves as a trustee in both Tata Trusts and is also a nominee director on the board of Tata Sons.

The alleged rift within Tata Trusts, the entity controlling 66% of Tata Sons, has made headlines this month. However, experts believe the situation is being overstated. Thomas Mathew, author of Ratan Tata's biography, described the differences among trustees as normal.

"It is true that there may be some difference of opinion, but I think you're making a mountain out of a molehill," Mathew said. He added that there was no question of a coup against Noel Tata, and that the trustees, all experienced professionals, would be able to resolve their differences.

"There could be differences of opinion on processes; there could be differences of opinion on objectives, on goals, but that's not causing any seismic tremors anywhere," he added, emphasising that such debates are inevitable in any organisation, even within families.

While internal disagreements may not threaten the company, experts point to the need for Tata Sons to be publicly listed to ensure transparency and accountability. Nirmalya Kumar, former member of the Group Executive Council and former head of strategy at Tata Group, said, "Listing of Tata Sons is actually a very good thing. It is good for Tata Sons; it is good for the country."

Kumar explained that public listing would provide transparency for a company holding significant stakes in major Indian firms and would also give minority shareholders an opportunity to exit if desired. He said that the Shapoorji Pallonji Group, which owns an 18.3% stake, has been advocating for listing to protect its investment.

The debate around listing comes amid heightened scrutiny following reports that four Tata Trusts trustees, Darius Khambata, Jehangir HC Jehangir, Pramit Jhaveri, and Mehli Mistry, were allegedly trying to challenge Noel Tata's leadership. Sources close to the trustees have denied these claims, calling the narrative that portrays them as "villains" false.

While internal differences attract media attention, analysts believe the bigger focus should remain on Tata Sons' governance and the potential benefits of listing for both the company and the wider Indian economy.

/images/ppid_59c68470-image-176094003675114305.webp)

/images/ppid_59c68470-image-177070764076491735.webp)

/images/ppid_59c68470-image-177070757930160756.webp)

/images/ppid_59c68470-image-177070760755585975.webp)

/images/ppid_a911dc6a-image-177070882633398788.webp)