What is the story about?

Shares of IT services provider Infosys Ltd

. gained as much as 3% on Thursday, October 23, after it shared an update on its largest ever share buyback.

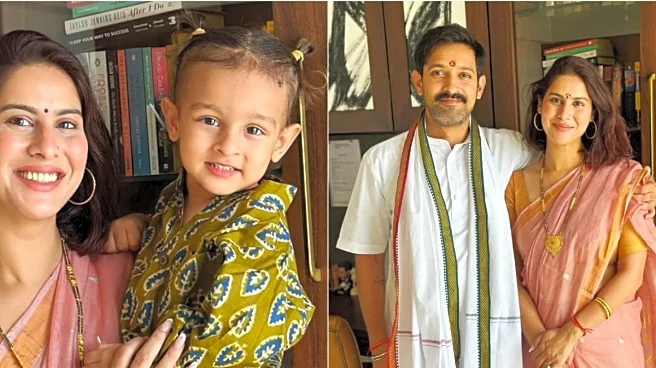

In an update to the exchanges on October 22, Infosys said that the promoters of the company, which include Nandan Nilekani, Sudha Murty and others, will not be participating in the ₹18,000 crore share buyback that it had announced in October.

Promoters not tendering shares in the buyback generally signals confidence in the company's prospects, and also the retail entitlement ratio could improve when the buyback process opens.

The entitlement ratio, record date, and other dates of the share buyback are yet to be announced by the company.

Infosys has announced its largest ever share buyback, where it will be repurchasing 10 crore shares of the company, at a price of ₹1,800 per share, which in comparison to Wednesday's closing price is a premium of 22%.

"Since the promoters and the promoter group of the company have declared their intention to not participate in the buyback, equity shares held by them have not been considered for the purpose of computing the entitlement ratio," the company said.

At the end of the September quarter, promoters of Infosys had a 14.3% stake in the company.

Infosys recently reported its results for the September quarter, which were better than estimates. However, the fact that the company only raised the lower end of its revenue growth guidance to 2% to 3% from 1% to 3% earlier, left many analysts disappointed, and who are now projecting a softer second half of the financial year for the company.

Shares of Infosys ended 0.7% higher on Tuesday at ₹1,471. The stock is down 22% so far in 2025.

In an update to the exchanges on October 22, Infosys said that the promoters of the company, which include Nandan Nilekani, Sudha Murty and others, will not be participating in the ₹18,000 crore share buyback that it had announced in October.

Promoters not tendering shares in the buyback generally signals confidence in the company's prospects, and also the retail entitlement ratio could improve when the buyback process opens.

The entitlement ratio, record date, and other dates of the share buyback are yet to be announced by the company.

Infosys has announced its largest ever share buyback, where it will be repurchasing 10 crore shares of the company, at a price of ₹1,800 per share, which in comparison to Wednesday's closing price is a premium of 22%.

"Since the promoters and the promoter group of the company have declared their intention to not participate in the buyback, equity shares held by them have not been considered for the purpose of computing the entitlement ratio," the company said.

At the end of the September quarter, promoters of Infosys had a 14.3% stake in the company.

Infosys recently reported its results for the September quarter, which were better than estimates. However, the fact that the company only raised the lower end of its revenue growth guidance to 2% to 3% from 1% to 3% earlier, left many analysts disappointed, and who are now projecting a softer second half of the financial year for the company.

Shares of Infosys ended 0.7% higher on Tuesday at ₹1,471. The stock is down 22% so far in 2025.

/images/ppid_59c68470-image-176119261419979386.webp)