What is the story about?

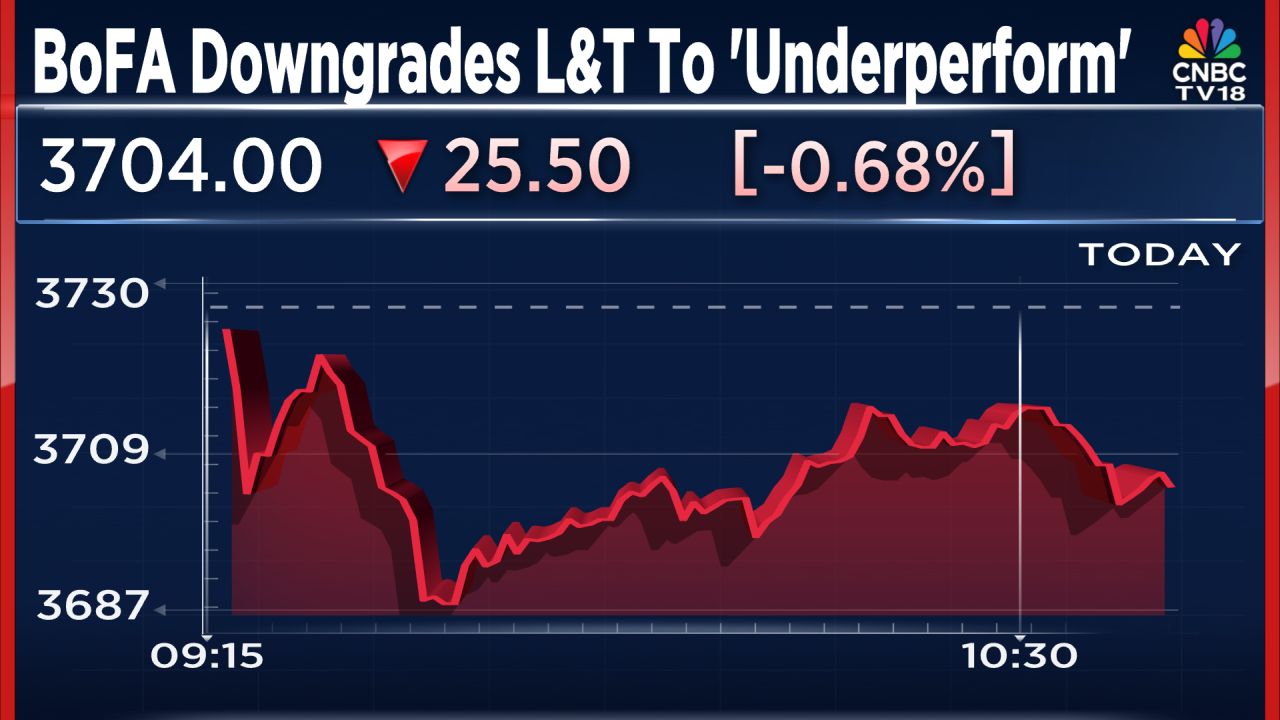

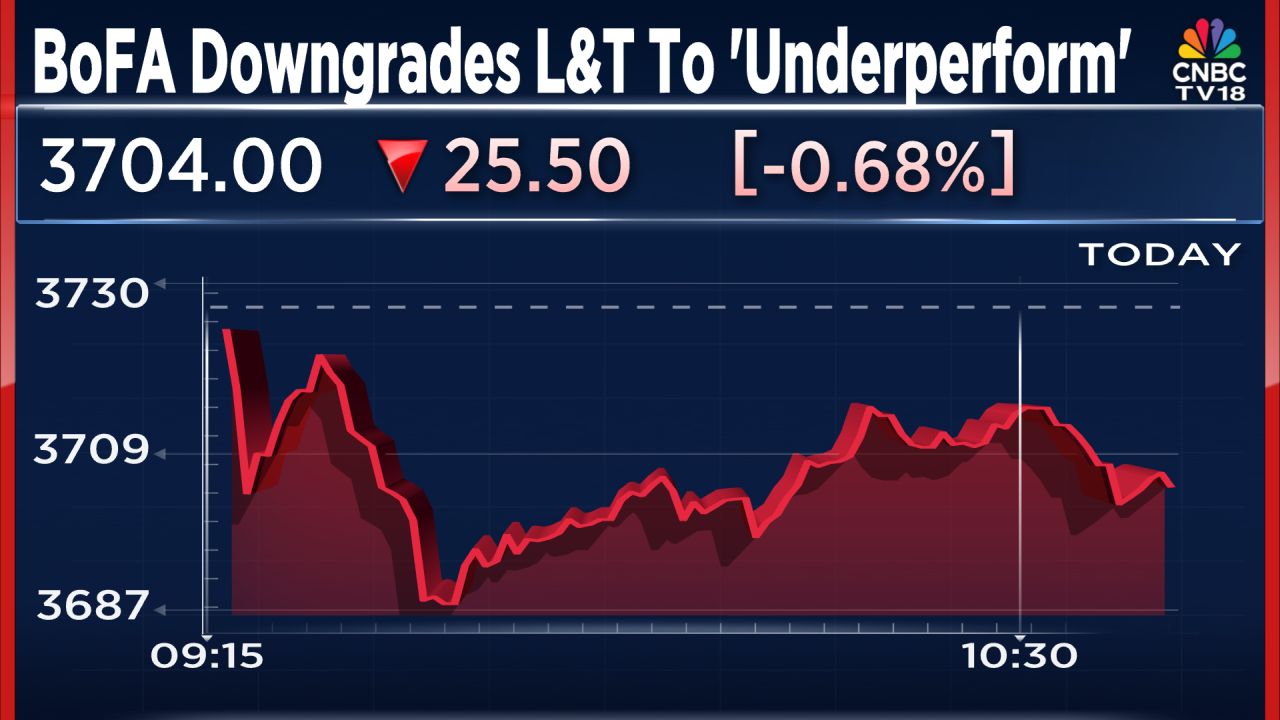

Shares of Larsen and Toubro Ltd. (L&T) declined on Monday, September 29, after brokerage BoFA Securities downgraded its recommendation on the infrastructure and construction conglomerate.

BoFA now has an "underperform" rating on the stock, which technically is a double-downgrade from the previous "buy" rating. It has a price target of ₹3,700 on the stock, which is near its closing price last Friday.

It said the stock's recent outperformance leaves little upside potential. L&T shares have gained 10% in the last two months.

The brokerage said L&T's exit from the Hyderabad Metro project is earnings and return on equity (RoE) accretive. As a result, BofA upgraded its financial year 2026-2028 earnings estimates by 3% - 4%.

The Telangana government is set to take over Phase 1 of the Hyderabad Metro Rail project and pay L&T ₹2,000 crore for its stake in it. The government will also take over the project's debt worth over ₹13,000 crore, which was one of the demands L&T had put forth. However, previous reports had indicated L&T had made a demand of ₹5,900 crore, in addition to the debt takeover before the Telangana government.

Brokerage firm JM Financial had highlighted last week that the exit from the Hyderabad Metro project lifts a major overhang on L&T.

Going ahead, BoFA said L&T's return on equity (RoE) expansion could be achieved via buybacks, along with continued margins and working capital improvement, which, according to the brokerage, is incrementally tough. The company has over $2.6 billion worth of surplus cash.

Domestic capex losing steam and lower crude prices are some of the other risk factors for L&T, according to BofA's note.

Of the 33 analysts that have coverage on the stock, 27 have a "buy" rating, four have a "hold" rating and two have a "sell" rating.

L&T shares were down 0.6% at ₹3,705.5 apiece around 10.40 am on Monday. The stock has gained 7.8% in the last six months.

Also Read: Glottis launches ₹307 crore IPO amidst Dalal Street rush — Should investors bid?

BoFA now has an "underperform" rating on the stock, which technically is a double-downgrade from the previous "buy" rating. It has a price target of ₹3,700 on the stock, which is near its closing price last Friday.

It said the stock's recent outperformance leaves little upside potential. L&T shares have gained 10% in the last two months.

The brokerage said L&T's exit from the Hyderabad Metro project is earnings and return on equity (RoE) accretive. As a result, BofA upgraded its financial year 2026-2028 earnings estimates by 3% - 4%.

The Telangana government is set to take over Phase 1 of the Hyderabad Metro Rail project and pay L&T ₹2,000 crore for its stake in it. The government will also take over the project's debt worth over ₹13,000 crore, which was one of the demands L&T had put forth. However, previous reports had indicated L&T had made a demand of ₹5,900 crore, in addition to the debt takeover before the Telangana government.

Brokerage firm JM Financial had highlighted last week that the exit from the Hyderabad Metro project lifts a major overhang on L&T.

Going ahead, BoFA said L&T's return on equity (RoE) expansion could be achieved via buybacks, along with continued margins and working capital improvement, which, according to the brokerage, is incrementally tough. The company has over $2.6 billion worth of surplus cash.

Domestic capex losing steam and lower crude prices are some of the other risk factors for L&T, according to BofA's note.

Of the 33 analysts that have coverage on the stock, 27 have a "buy" rating, four have a "hold" rating and two have a "sell" rating.

L&T shares were down 0.6% at ₹3,705.5 apiece around 10.40 am on Monday. The stock has gained 7.8% in the last six months.

Also Read: Glottis launches ₹307 crore IPO amidst Dalal Street rush — Should investors bid?

/images/ppid_59c68470-image-175912506641095559.webp)

/images/ppid_59c68470-image-177079756041760388.webp)

/images/ppid_59c68470-image-177079752900923983.webp)

/images/ppid_59c68470-image-177079752787481340.webp)

/images/ppid_59c68470-image-177080002777660905.webp)

/images/ppid_59c68470-image-177080002609991575.webp)

/images/ppid_a911dc6a-image-177079842407186179.webp)