In its note, the brokerage said public sector undertaking (PSU) banks are resetting to a new normal in profitability.

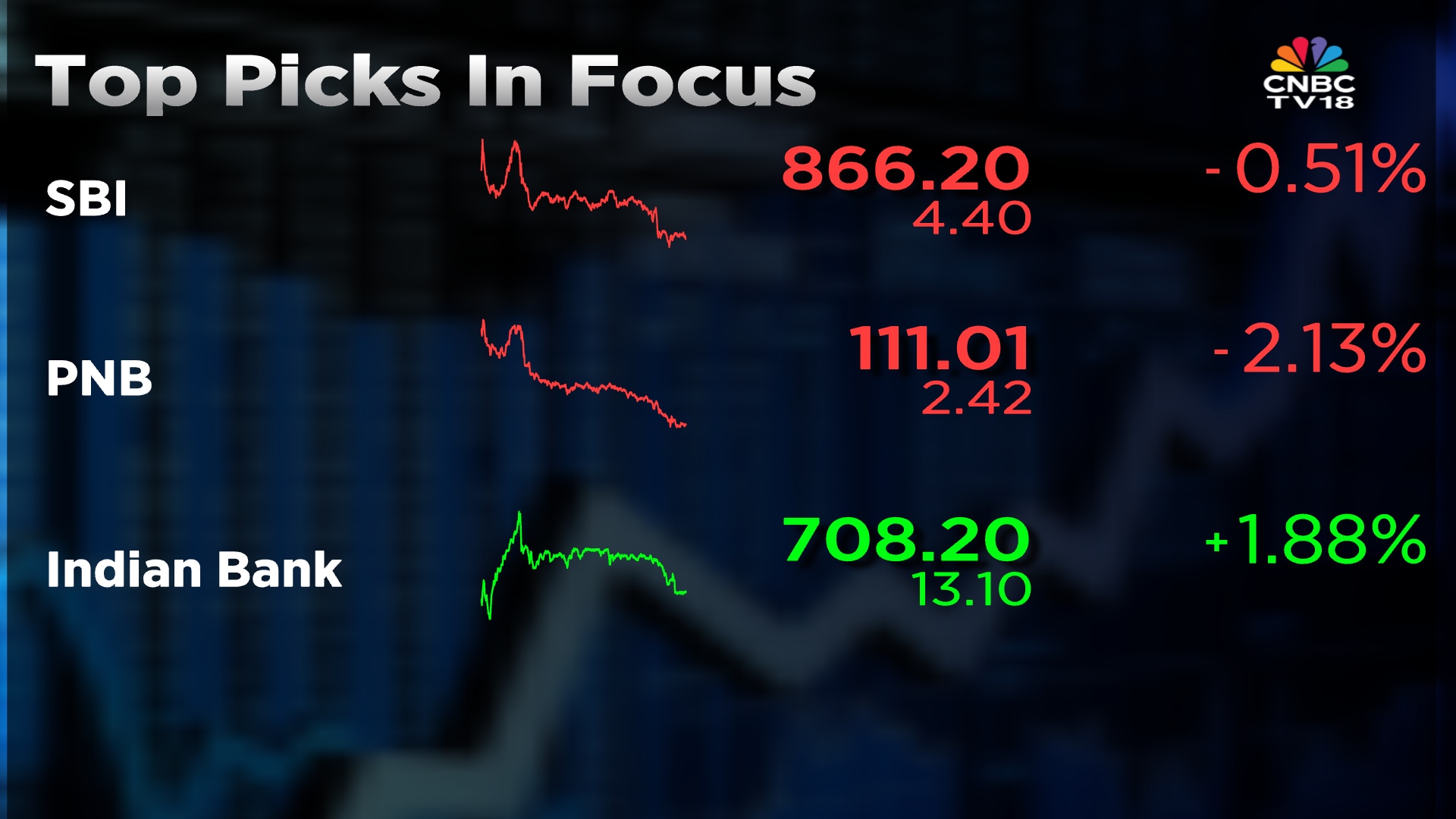

Motilal Oswal has "buy" ratings on both SBI and PNB, with price targets of ₹1,000 and ₹130 per share, indicating an upside potential of 15% and 17% respectively, in comparison to their closing price on Wednesday.

Among mid-sized lenders, Indian Banks stands out for Motilal Oswal, where the brokerage maintained its "buy" rating with a price target of ₹800 per share, indicating an upside potential of 13% from its previous close.

Motilal Oswal is of the view that stronger capital positions, cleaner balance sheets and prudent provisioning make PSU banks more resilient and limit cyclicality in earnings and asset quality relative to past cycles.

Meanwhile, while the brokerage remains "neutral" on Bank of Baroda and Union Bank.

| Bank | Buy | Hold | Sell |

| SBI | 41 | 9 | 1 |

| PNB | 11 | 4 | 6 |

| Indian Bank | 12 | 1 | 1 |

Motilal Oswal wrote in its note that PSU banks are likely to sustain the 1% return on assets (RoA) and their valuations also remain inexpensive, despite most of them hitting their respective 52-week high levels in intraday trading on Wednesday.

Can sustain 1% RoA

Motilal Oswal believes that with margins recovering in the second half of this fiscal and asset quality remaining stable, the lenders are well-poised to deliver steady return ratios in the upcoming years.

The overall profitability of PSU Banks has reached a record high of ₹1.5 lakh crore, while their RoAs surpassed 1%. For the PSU Banks under its coverage, Motilal Oswal expects their earnings to grow at a Compounded Annual Growth Rate (CAGR) of 14% over financial year 2026-2028.

Motilal Oswal expects strong returns for PSU Banks despite near-term headwinds arising from pressure on Net Interest Margins (NIMs), modest loan growth, and the implementation of the ECL norms.

Still A Large Presence

Historically, PSU banks have maintained a robust deposit franchise and comfortable liquidity position, Motilal Oswal said.

Despite a gradual erosion in market share, the lenders still command 62% of system deposits due to extensive presence of their branches and strong depositor trust. This in turn has enabled most of the lenders to maintain controlled cash deposit ratios. Also, a healthy liquidity coverage ratio in the 130% to 145% range further reinforces their balance sheet position.

With this, PSU banks can fund loan growth and ensure stable 11 to 12% credit growth year-on-year.

Credit market share to decline at milder pace

PSU Banks have also reversed a decade-long trend of losing market share, by gaining 40 basis points in the previous financial year, taking their share back to 58%. Motilal Oswal believes that unlike the 200 basis points annual decline seen over financial year 2011-2021, the trend of market share losses is going to be slower till financial year 2028.

NIM pressure

Motilal Oswal is the of the view that net interest margin (NIM) pressure may weigh on the near-term outlook for PSU banks. However, rising fee income, a gradual moderation in cost ratios and healthy coverage levels will help keep the RoA stable between 1% - 1.1%.

Shares of SBI and PNB ended the previous session 0.5% and 2.2%, respectively, while Indian Bank closed 1.9% higher.

Also Read: Tata Motors shares in focus as reports indicate JLR cyberattack can result in £2 billion bill

/images/ppid_59c68470-image-175877006664583666.webp)