Spot gold prices surged 16.4% during the quarter as investors sought refuge amid global economic uncertainties, driving an increase in average ticket sizes that offset a slight decline in buyer numbers.

The jewellery segment, which accounts for nearly 90% of Titan’s overall revenue, continued to perform strongly. Studded jewellery from the Tanishq, Mia, and Zoya brands recorded mid-teen growth rates, outpacing the expansion seen in plain gold jewellery.

Meanwhile, investment-grade gold coins maintained robust demand as Indian consumers turned to bullion as a store of value. However, the company noted that the growing preference for coins, which have lower profit margins compared to jewellery, has somewhat constrained margin expansion in recent quarters.

Early festive demand and aggressive consumer promotions further supported sales momentum during the quarter.

Titan expanded its jewellery retail footprint by adding 34 new stores, bringing the total to 1,120 outlets. A key highlight was the launch of ‘Rivaah’, Tanishq’s first dedicated wedding destination store in Delhi, aimed at the premium bridal market.

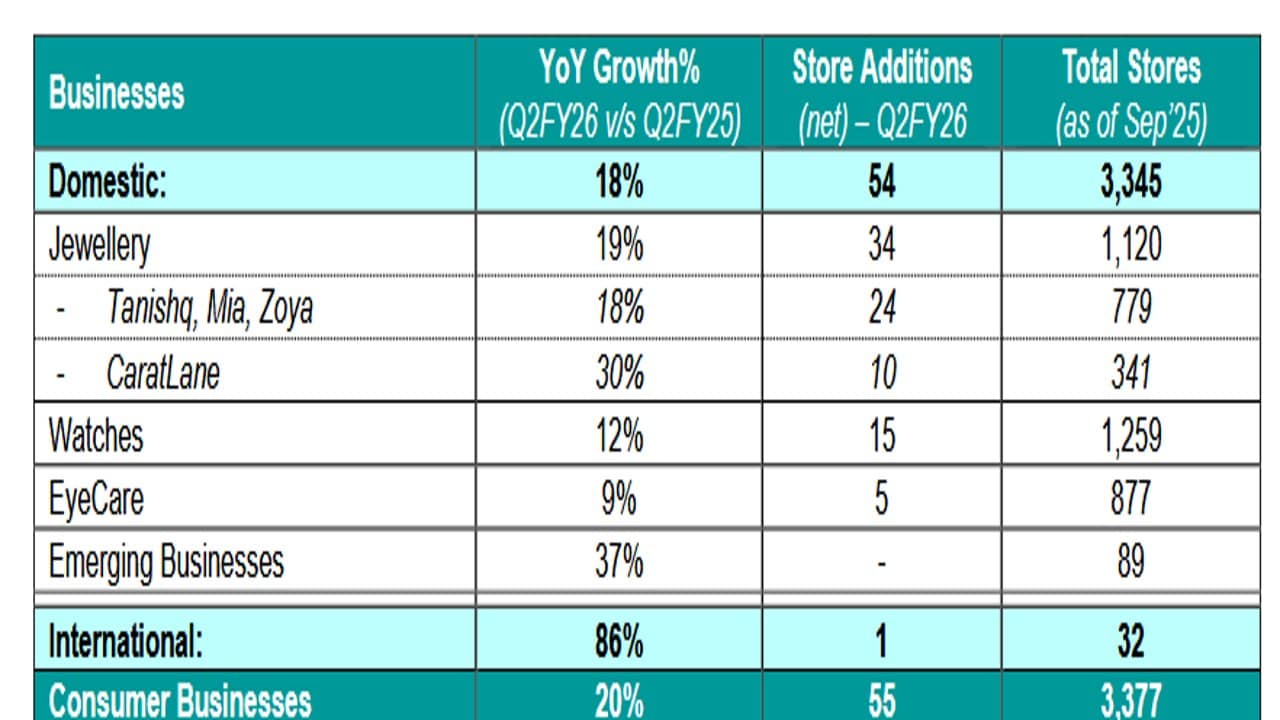

Titan’s broader consumer business grew 20% YoY, with the domestic segment up 18% and the international segment soaring 86%, driven by strong performances in the USA and GCC markets. Across all divisions, the company added 55 net new stores during the quarter, taking the overall store count to 3,377.

The watches division posted a 12% increase, led by strong sales in the analog segment, while the smart wearables segment continued to face challenges, declining 23%. EyeCare grew 9%, propelled by international brands and e-commerce channels.

Emerging businesses also demonstrated strong growth, with fragrances up 48% and women’s bags surging 90%, reflecting successful network expansion and growing consumer demand.

Internationally, Titan doubled its business in the US market and opened a new store in Virginia, underscoring its global ambitions.

Note: Growth percentages rounded to nearest integer; Metrics exclude bullion and Digi-gold sales.

At the close of trading on Tuesday, Titan’s shares settled at ₹3,418.20 on the NSE, marginally down by 0.21%. Year-to-date, the stock has gained just over 5%, while its one-month return stands at a negative 7%.

/images/ppid_59c68470-image-175984752460216086.webp)

/images/ppid_a911dc6a-image-177101053501199609.webp)

/images/ppid_59c68470-image-177101003680064644.webp)

/images/ppid_59c68470-image-177100753350744656.webp)

/images/ppid_a911dc6a-image-17710070301901476.webp)

/images/ppid_a911dc6a-image-177100572282276854.webp)