Speaking on the sidelines of JPMorgan’s 10th India Conference in Mumbai, Batra said these are the top concerns he hears from global investors. “The number one question is, when we expect a thaw happening in US and India relationship? The second one is, when we can expect the double-digit growth handle… And last but not the least, when do we expect foreign investors to come back to India after last four years of exodus?” he said.

Foreign portfolio investors have pulled money out of India in four consecutive years, even as other emerging markets have staged a comeback. Batra noted that India has suffered “the worst ever underperformance since 1990 of close to 25–30%,” while peers such as Korea, Taiwan and China have rallied on domestic inflows.

He argued that US-India relations could be the catalyst for a re-rating of Indian equities. “Maybe by reducing tariff by 25%… thawing of relationship is the catalyst number one, which can let the risk premia in India to get lower, and India’s PE re-rating can happen in line,” he said, adding that this would allow India to enjoy the valuation gains seen in other emerging markets.

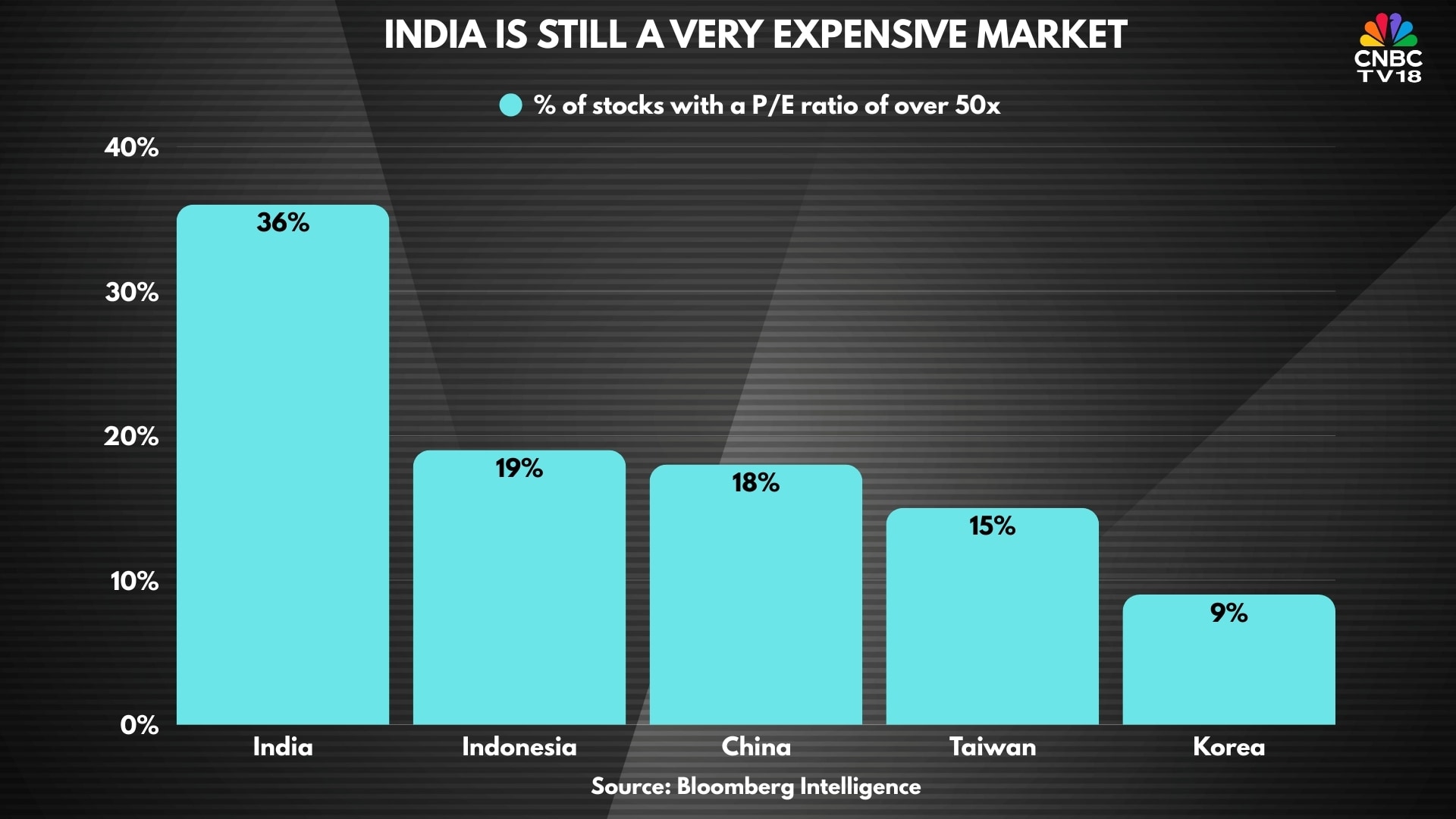

Earnings growth is the second big hurdle. India’s trailing 12-month earnings growth has been stuck at about 4.5–5%, while valuations remain elevated near 22 times price-to-earnings. Investors want double-digit earnings to return, he said.

The third factor is reforms. After monetary easing, corporate tax cuts, and the GST overhaul, Batra said markets are now “waiting for the fourth arrow” in the form of deregulation and easier foreign direct and portfolio investment rules. Combined with GST 2.0, he expects consumption rather than capex to remain India’s dominant growth driver for the next four to five years, with autos, jewellery, and other discretionary categories benefiting.

Batra believes emerging market (EM) equities could deliver another 20–25% upside in the next 12 months. “A 1% dollar depreciation leads to 4.50% increase in EM equity performance. This year, dollar has gone down 12%... which means there is still performance pending,” he explained.

JPMorgan expects the US Dollar Index (DXY) to drop to 95 by end-2025 and 92 by mid-2026.

“We are entering into synchronised easing cycle… which means we are just at the start. I will not be surprised, the regional index is going to trade at even at 20 PE,” he said.

Read Here | EXCLUSIVE | India should remain America’s best friend despite non-alignment, says JPMorgan CEO Jamie Dimon

Catch all the stock market live updates here

Also Read | Jamie Dimon Exclusive: US economy weakening but not yet in 'disaster' mode

/images/ppid_59c68470-image-17586125296373590.webp)