What is the story about?

As Indian investors pour money into US equities through Portfolio Management Services (PMS) accounts, global trading platforms and fintech apps, few realise that their overseas wealth could be hit by a tax most have never heard of.

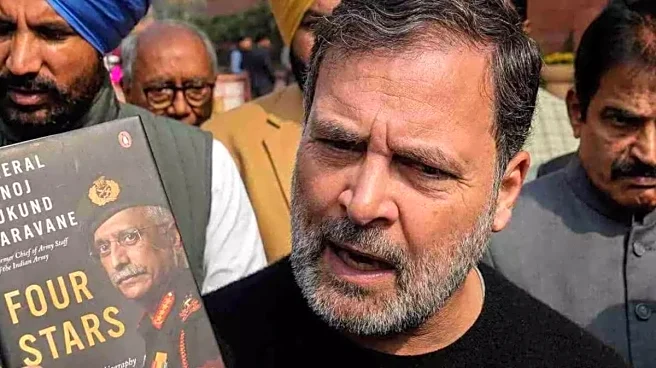

Samir Arora, founder of Helios Capital, recently warned that Indians holding US stocks in their own name may be exposed to estate tax of up to 40% if they pass away while owning those assets.

The concern is particularly relevant as direct exposure to US markets has surged in recent years.

Why this matters now?

While the Nifty 50 has delivered modest gains of 4.5% this year, the S&P 500 has climbed over 15%. The return gap has pushed many Indians—especially HNIs and PMS clients—to chase performance abroad.

But what many overlook is that the US estate tax kicks in at an exemption limit of just $60,000 for foreign investors. If the market value of directly held US stocks crosses that threshold, heirs may be required to pay tax to the US government before inheriting the assets.

What is US estate tax?

The US estate tax is similar to an inheritance tax.

If a non-US resident dies owning US-situated assets—including shares of American companies—the US government can levy tax on the value passed to heirs.

This applies even if the investor lives in India, uses an Indian broker with a global tie-up, or holds the shares through a PMS account where assets are registered in their individual name, according to INDMoney, a personal finance super app.

Why most investors are unaware?

The risk is most commonly overlooked by:

India does not have an estate tax treaty with the US, so there is no relief from the $60,000 threshold.

How to legally avoid or mitigate the tax?

Several structures can help investors gain US exposure without triggering US estate tax:

Foreign-domiciled mutual funds and ETFs

Investing through funds based in Ireland or Luxembourg helps avoid estate tax because these vehicles are not treated as US assets, even if they hold American stocks.

GIFT City offshore funds

When US shares are held through pooled fund structures registered in India’s International Financial Services Centre (IFSC), individual investors are not classified as direct owners of US assets.

Corporate and trust structures

Setting up a non-US “blocker” company or an irrevocable foreign trust can shift legal ownership away from the individual. This is more common among HNIs and family offices.

Life insurance cover

For those unwilling to restructure, a life insurance policy covering the estimated estate tax liability can provide liquidity to heirs.

Proceed with caution

Each of these options involves compliance requirements under:

Legal and tax experts recommend professional guidance before adopting any structure.

Samir Arora, founder of Helios Capital, recently warned that Indians holding US stocks in their own name may be exposed to estate tax of up to 40% if they pass away while owning those assets.

The concern is particularly relevant as direct exposure to US markets has surged in recent years.

These

days everyone in India wants to invest in US stocks and fund managers are doing PMS to invest in US (where stocks will presumably be held in individual's names).

Hope these investors are aware of the 40% estate tax if they pass away (applicable to foreign investors with a…

— Samir Arora (@Iamsamirarora) October 2, 2025

Why this matters now?

While the Nifty 50 has delivered modest gains of 4.5% this year, the S&P 500 has climbed over 15%. The return gap has pushed many Indians—especially HNIs and PMS clients—to chase performance abroad.

But what many overlook is that the US estate tax kicks in at an exemption limit of just $60,000 for foreign investors. If the market value of directly held US stocks crosses that threshold, heirs may be required to pay tax to the US government before inheriting the assets.

What is US estate tax?

The US estate tax is similar to an inheritance tax.

If a non-US resident dies owning US-situated assets—including shares of American companies—the US government can levy tax on the value passed to heirs.

- Exemption for non-US individuals: $60,000

- Tax rate: Progressive, up to 40%

This applies even if the investor lives in India, uses an Indian broker with a global tie-up, or holds the shares through a PMS account where assets are registered in their individual name, according to INDMoney, a personal finance super app.

Why most investors are unaware?

The risk is most commonly overlooked by:

- Retail investors using global trading apps

- PMS portfolios investing directly in US equities

- HNIs building concentrated exposure to US tech stocks

- Family offices holding US stocks outside pooled structures

India does not have an estate tax treaty with the US, so there is no relief from the $60,000 threshold.

How to legally avoid or mitigate the tax?

Several structures can help investors gain US exposure without triggering US estate tax:

Foreign-domiciled mutual funds and ETFs

Investing through funds based in Ireland or Luxembourg helps avoid estate tax because these vehicles are not treated as US assets, even if they hold American stocks.

GIFT City offshore funds

When US shares are held through pooled fund structures registered in India’s International Financial Services Centre (IFSC), individual investors are not classified as direct owners of US assets.

Corporate and trust structures

Setting up a non-US “blocker” company or an irrevocable foreign trust can shift legal ownership away from the individual. This is more common among HNIs and family offices.

Life insurance cover

For those unwilling to restructure, a life insurance policy covering the estimated estate tax liability can provide liquidity to heirs.

Proceed with caution

Each of these options involves compliance requirements under:

- FEMA and RBI rules in India

- US trust, tax and reporting regulations

- Double taxation and disclosure norms

Legal and tax experts recommend professional guidance before adopting any structure.

/images/ppid_59c68470-image-175947509156388179.webp)