What is the story about?

Finally! Some relief for the bulls, but after months of being sideways and giving up every single rally that the index has had so far, they would be hopeful and desiring of more.

Of course, when you begin the series with FII long positions at just 6%, there was bound to be some short-covering sooner or later and RBI governor Sanjay Malhotra provided just that, with a slew of banking sector reforms announced in his post-policy statement on Wednesday.

The result? The Nifty Bank had its best day in nearly four months, closed above two out of three major resistance points, and also took the Nifty higher with it. It will be the Nifty Bank that will hold the key to the Nifty not just moving past 25,000, but also towards its recent swing high of 25,448.

The banking sector will continue to remain in focus as business updates have started coming in, and banking majors will also be reporting how the quarter has fared for them, particularly India's largest private lender HDFC Bank, which can provide a trend of sorts, as most of the other large private banking majors, from Axis to ICICI and Kotak, do not share business updates of their own until their quarterly results.

What will also please the bulls is the fact that the nine-day streak of lower highs and lower lows was also finally broken. The Nifty closed 30-points adrift of the highs of the day, but the bulls would take that instead of consistently watching the index close near the day's low.

Wednesday's high of 24,867 will be the first hurdle to cross for the Nifty, followed by the 25,000 mark. On the downside, this week's low of 24,587 becomes the first important level on the downside, and although that is now a fair distance away, it remains an important support zone. There are still important levels to cross before one can call a trend reversal, but the bulls would hope that this "closing at or near the day's high" trend continues for a few more sessions.

For the Nifty Bank, the index not only moved past 55,000, but also closed above the 55,300 mark. The next important level on the upside will first be 55,700, followed by the September 18 swing high of 55,835.

However, a major hurdle that lies for the Nifty to move higher, would be the availability of liquidity in the system over the next few days, as two of India's biggest IPOs of the year will be open simultaneously next week. Tata Capital's ₹15,000 crore-plus issue, along with LG Electronics India's ₹11,607 crore IPO and WeWork India's ₹3,000 crore issue will all be vying for investor attention together. It remains to be seen how the market would move in the biggest IPO week of the year.

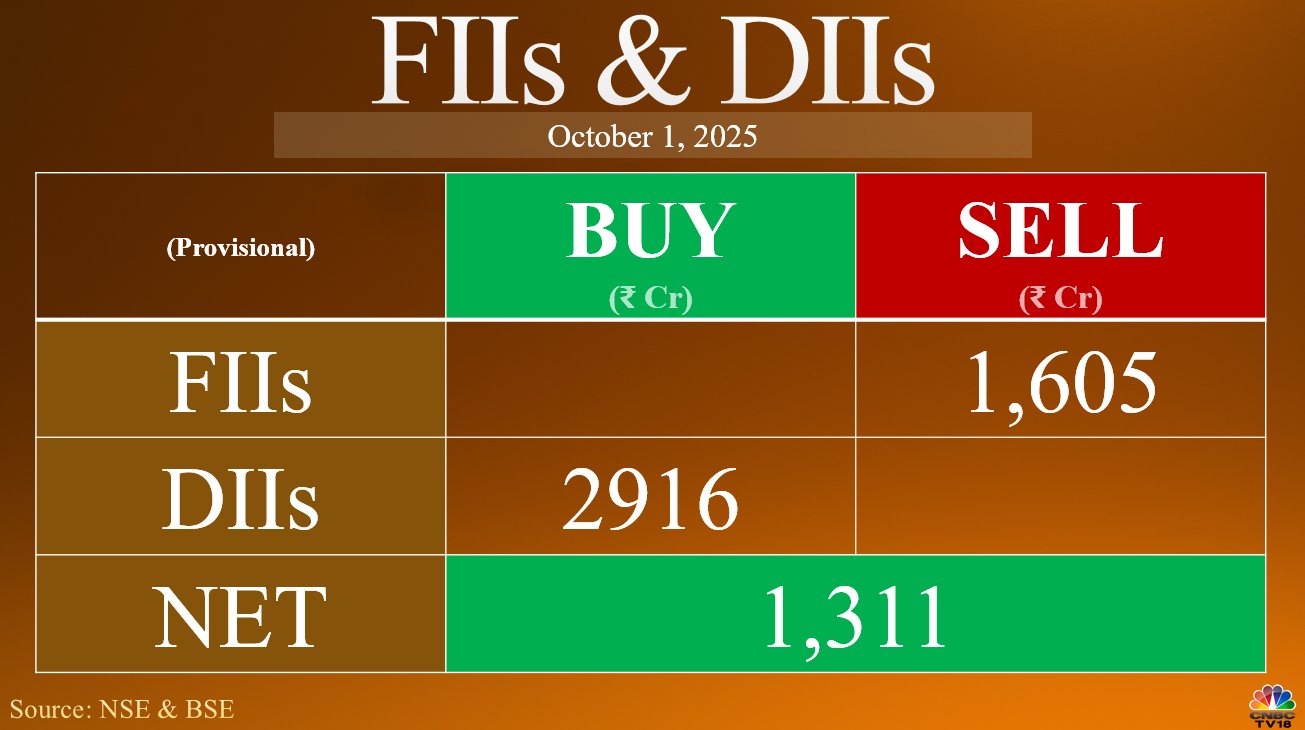

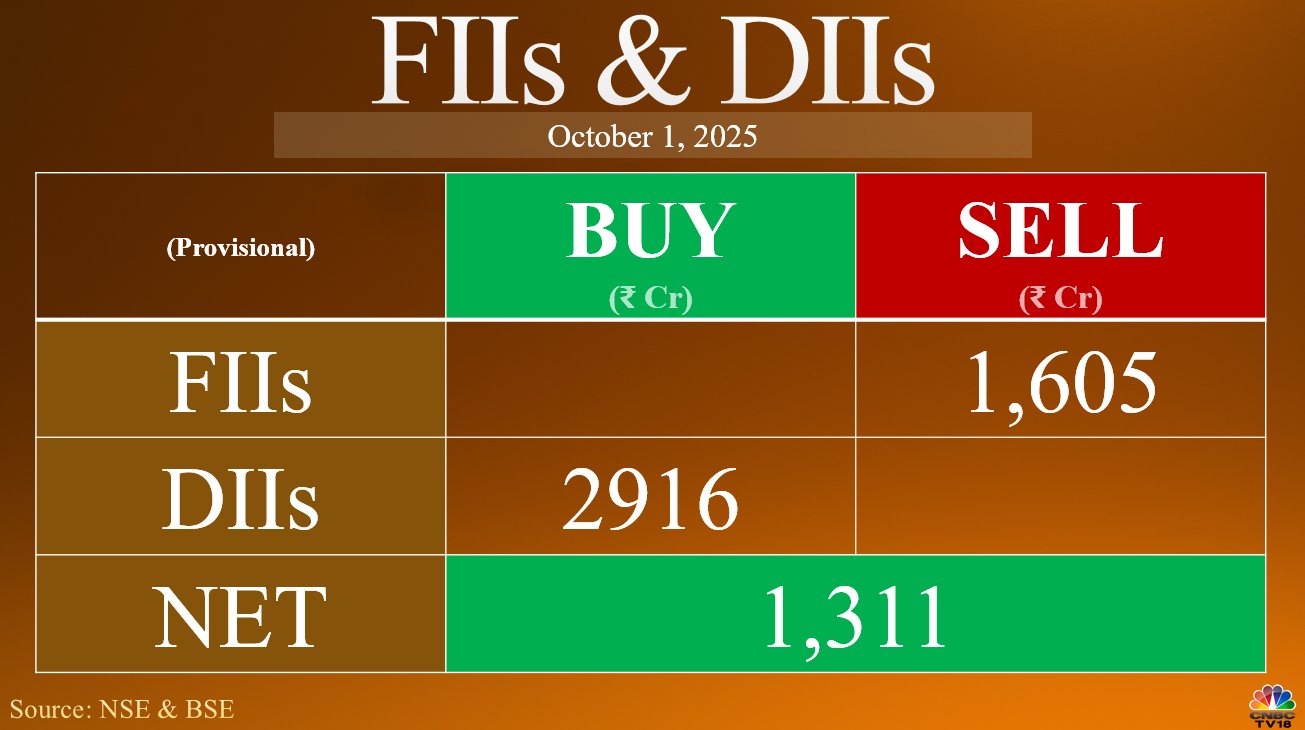

Foreign institutions continued to remain net sellers in the cash market on Wednesday, while domestic institutions were buyers.

Rajesh Bhosale of Angel One advises traders to now have a buy-on-dips approach as the Nifty is holding on to important support levels on the downside. "On the upside, the retracement levels of the recent fall from 25448 to 24588 come into play, with the 50% retracement at 25000 and the 61.8% retracement at 25,100, both coinciding with a cluster of key moving averages, acting as immediate resistance zones," he said.

"Nifty has reclaimed a level above its 5-DEMA after 7 sessions. Nifty has also broken the bearish formation of lower highs and lower lows on daily time frame. Resistances for the Nifty are now seen at 24,916 and 25,018, derived from 38.2% and 50% retracement of the entire fall seen from 25,448 to 24,587. On the downside, 24,731 could offer support to the Nifty," Vinay Rajani of HDFC Securities said.

Of course, when you begin the series with FII long positions at just 6%, there was bound to be some short-covering sooner or later and RBI governor Sanjay Malhotra provided just that, with a slew of banking sector reforms announced in his post-policy statement on Wednesday.

The result? The Nifty Bank had its best day in nearly four months, closed above two out of three major resistance points, and also took the Nifty higher with it. It will be the Nifty Bank that will hold the key to the Nifty not just moving past 25,000, but also towards its recent swing high of 25,448.

The banking sector will continue to remain in focus as business updates have started coming in, and banking majors will also be reporting how the quarter has fared for them, particularly India's largest private lender HDFC Bank, which can provide a trend of sorts, as most of the other large private banking majors, from Axis to ICICI and Kotak, do not share business updates of their own until their quarterly results.

What will also please the bulls is the fact that the nine-day streak of lower highs and lower lows was also finally broken. The Nifty closed 30-points adrift of the highs of the day, but the bulls would take that instead of consistently watching the index close near the day's low.

Wednesday's high of 24,867 will be the first hurdle to cross for the Nifty, followed by the 25,000 mark. On the downside, this week's low of 24,587 becomes the first important level on the downside, and although that is now a fair distance away, it remains an important support zone. There are still important levels to cross before one can call a trend reversal, but the bulls would hope that this "closing at or near the day's high" trend continues for a few more sessions.

For the Nifty Bank, the index not only moved past 55,000, but also closed above the 55,300 mark. The next important level on the upside will first be 55,700, followed by the September 18 swing high of 55,835.

However, a major hurdle that lies for the Nifty to move higher, would be the availability of liquidity in the system over the next few days, as two of India's biggest IPOs of the year will be open simultaneously next week. Tata Capital's ₹15,000 crore-plus issue, along with LG Electronics India's ₹11,607 crore IPO and WeWork India's ₹3,000 crore issue will all be vying for investor attention together. It remains to be seen how the market would move in the biggest IPO week of the year.

Foreign institutions continued to remain net sellers in the cash market on Wednesday, while domestic institutions were buyers.

Rajesh Bhosale of Angel One advises traders to now have a buy-on-dips approach as the Nifty is holding on to important support levels on the downside. "On the upside, the retracement levels of the recent fall from 25448 to 24588 come into play, with the 50% retracement at 25000 and the 61.8% retracement at 25,100, both coinciding with a cluster of key moving averages, acting as immediate resistance zones," he said.

"Nifty has reclaimed a level above its 5-DEMA after 7 sessions. Nifty has also broken the bearish formation of lower highs and lower lows on daily time frame. Resistances for the Nifty are now seen at 24,916 and 25,018, derived from 38.2% and 50% retracement of the entire fall seen from 25,448 to 24,587. On the downside, 24,731 could offer support to the Nifty," Vinay Rajani of HDFC Securities said.

/images/ppid_59c68470-image-175939756927282526.webp)

/images/ppid_59c68470-image-177061758044051537.webp)

/images/ppid_59c68470-image-177061752503670543.webp)

/images/ppid_59c68470-image-177061755522237761.webp)

/images/ppid_a911dc6a-image-177061852520461579.webp)

/images/ppid_a911dc6a-image-177061825419274749.webp)

/images/ppid_a911dc6a-image-177061828450475546.webp)

/images/ppid_a911dc6a-image-177061822453038648.webp)