What is the story about?

Shares of Ethos Ltd. are the best play on India's luxury growth story, brokerage firm Emkay wrote in a note on Monday, September 29. The stock on Tuesday, has snapped a five-day winning streak.

Emkay maintained its "buy" recommendation on Ethos with a price target of ₹3,500, which implies a potential upside of 27% from last Friday's closing levels. All four analysts covering the stock have a "buy" recommendation on it.

Ethos is the best play on the Indian luxury growth story, as Emkay believes that the key roadblocks in the company's expansion, such as people, capital and real estate, are now resolved.

The brokerage expects Ethos' Return on Capital Invested (RoIC) to improve, expecting an improvement of over 600 basis points between financial year 2025-2028.

Emkay values Ethos at 40 times and 30 times its estimated Earnings Per Share (EPS) for financial year 2027 and 2028 respectively.

The last instance of the index gaining five sessions in a row was back in July.

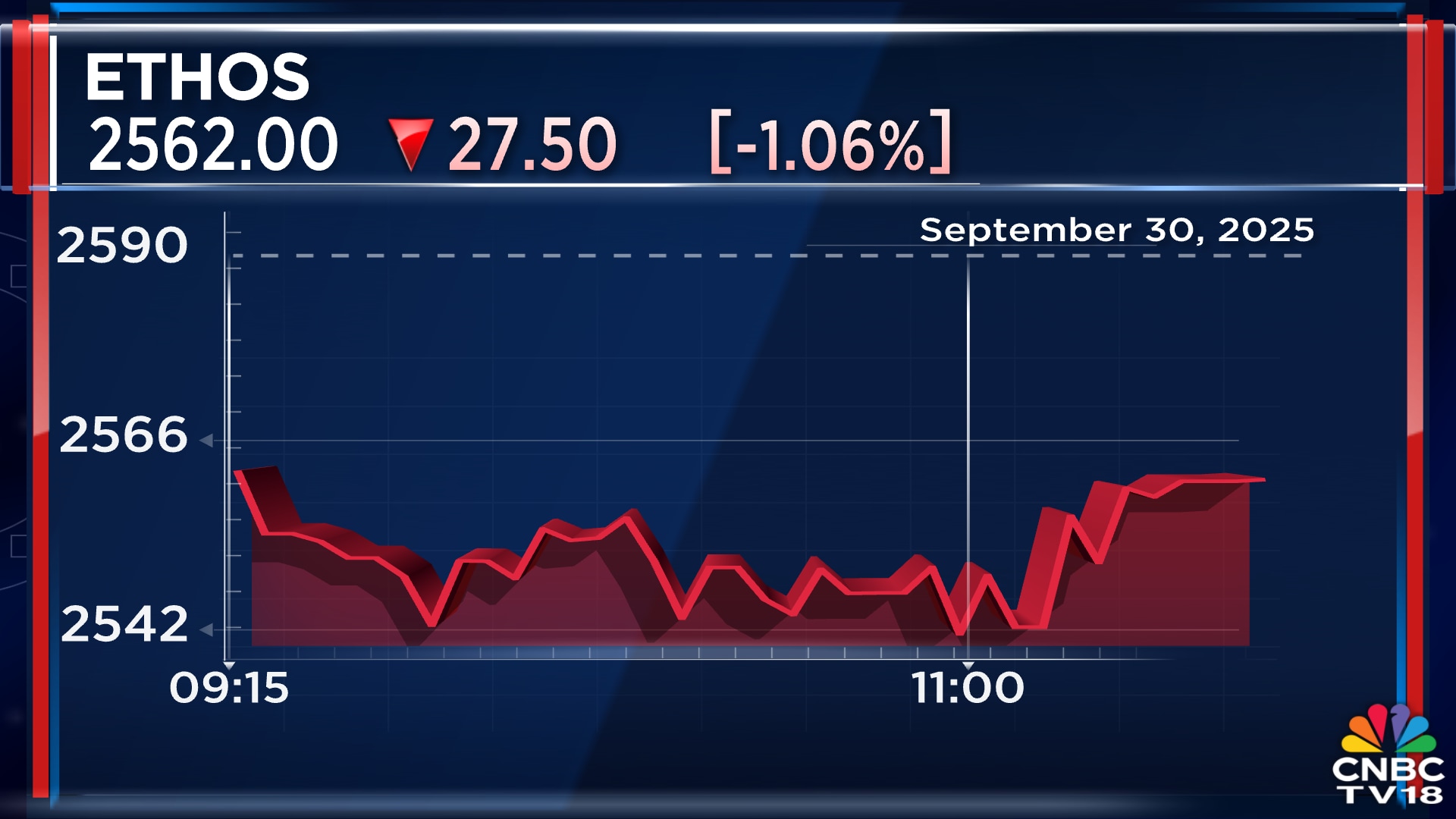

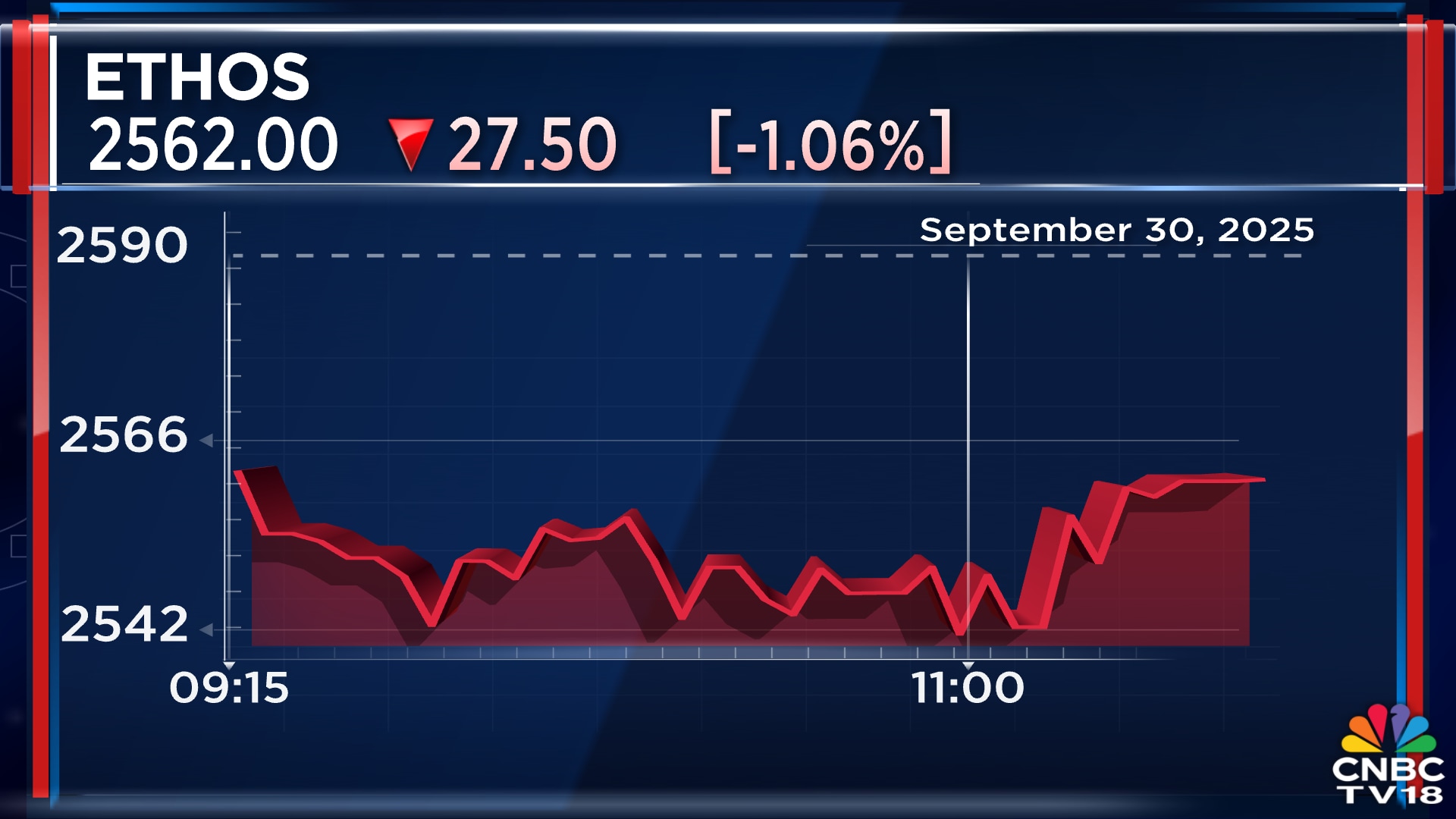

Shares of Ethos are looking for a recovery from the lows of the day, currently trading 1% lower at ₹2,562. The stock is down 24% from its 52-week high of ₹3,389. Before snapping a five-day gaining streak today, the stock had gained 6% during this period.

Shares have gained 15% in the last one month.

Also Read: HPCL, BPCL, Indian Oil shares surge on Petroleum Minister remarks — Explained

Emkay maintained its "buy" recommendation on Ethos with a price target of ₹3,500, which implies a potential upside of 27% from last Friday's closing levels. All four analysts covering the stock have a "buy" recommendation on it.

Ethos is the best play on the Indian luxury growth story, as Emkay believes that the key roadblocks in the company's expansion, such as people, capital and real estate, are now resolved.

The brokerage expects Ethos' Return on Capital Invested (RoIC) to improve, expecting an improvement of over 600 basis points between financial year 2025-2028.

Emkay values Ethos at 40 times and 30 times its estimated Earnings Per Share (EPS) for financial year 2027 and 2028 respectively.

The last instance of the index gaining five sessions in a row was back in July.

Shares of Ethos are looking for a recovery from the lows of the day, currently trading 1% lower at ₹2,562. The stock is down 24% from its 52-week high of ₹3,389. Before snapping a five-day gaining streak today, the stock had gained 6% during this period.

Shares have gained 15% in the last one month.

Also Read: HPCL, BPCL, Indian Oil shares surge on Petroleum Minister remarks — Explained

/images/ppid_59c68470-image-175921252832948068.webp)

/images/ppid_a911dc6a-image-177083556748629873.webp)

/images/ppid_a911dc6a-image-177083563836656334.webp)

/images/ppid_a911dc6a-image-177083553466311808.webp)

/images/ppid_59c68470-image-17708350320838052.webp)