What is the story about?

Nilesh Shah, Managing Director of Kotak Mahindra AMC, has “one regret”, and that is passing on a chance to create a capital market fund.

“My team had advised me to launch a capital market fund. And I thought it was too narrow a concept. We should be more diversified,” Shah said while interacting with members of CNBC-TV18 ACCESS.

“We lost a great opportunity for our investors. My team is smart, smarter than me. So they had capital market exposures in their portfolios, and our performance has been good. But I missed an opportunity to create a product because I thought it was too narrow a theme,” he added.

Capital market stocks include broking firms, ratings agencies, mutual fund houses, depository services, exchanges, technology providers, and other diversified players.

Here's a list of stocks that have been trading on the bourses for at least three years, and their compounded average annual returns (CAGR) in that period.

Source: Screener

Some of the new entrants include Nuvama Wealth, NSDL, and Kfin Technologies.

The segment has grown in size by leaps and bounds since the pandemic, thanks to a massive spike in retail investors' interest in stocks, mutual funds, as well as futures and options (F&O). So much so that the market regulator has had to step in to curb the rampant speculation.

Initial public offerings (IPO) have boomed. There have been more mainboard IPOs in the last five years (327) than in the preceding 12 years (315). A big one, the National Stock Exchange (NSE) IPO, is expected to hit the market soon.

The number of mutual fund folios, each folio indicating a unique investor, has jumped nearly 2.5 times to nearly 249 million between May 2021 and August 2025. Shah believes this number can go exponentially in the coming years.

The assets under management for the MF industry has grown six fold in the last ten years to ₹ 75.2 lakh crore at the end of August 2025, according to the Association of Mutual Funds of India (AMFI).

In 2024 alone, the net inflow into equity mutual funds was more than all the investments in the category between 2016 and 2020, a report from Motilal Oswal showed.

“SIP has now become a common language. It is spoken by millions of investors, and SIP flows are likely to continue,” Shah said. SIP stands for systematic investment plans (SIP), whereby an individual sets aside a portion of her income to be invested in a mutual fund on a regular basis.

The rise of the retail investor has made India one of the most liquid markets in the world. Promoters of organisations, startups, and foreign investors have made the most of this boom in recent years.

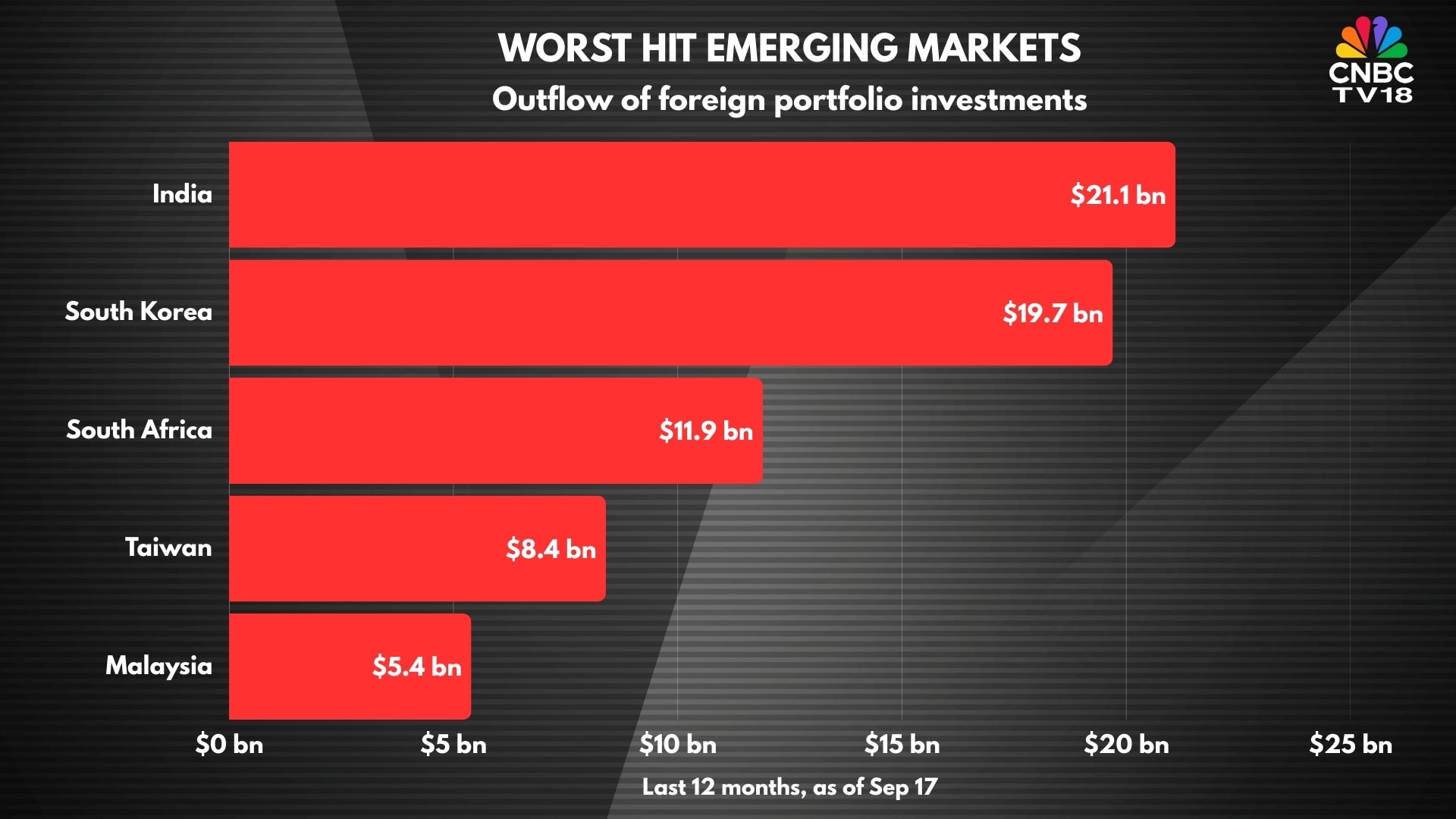

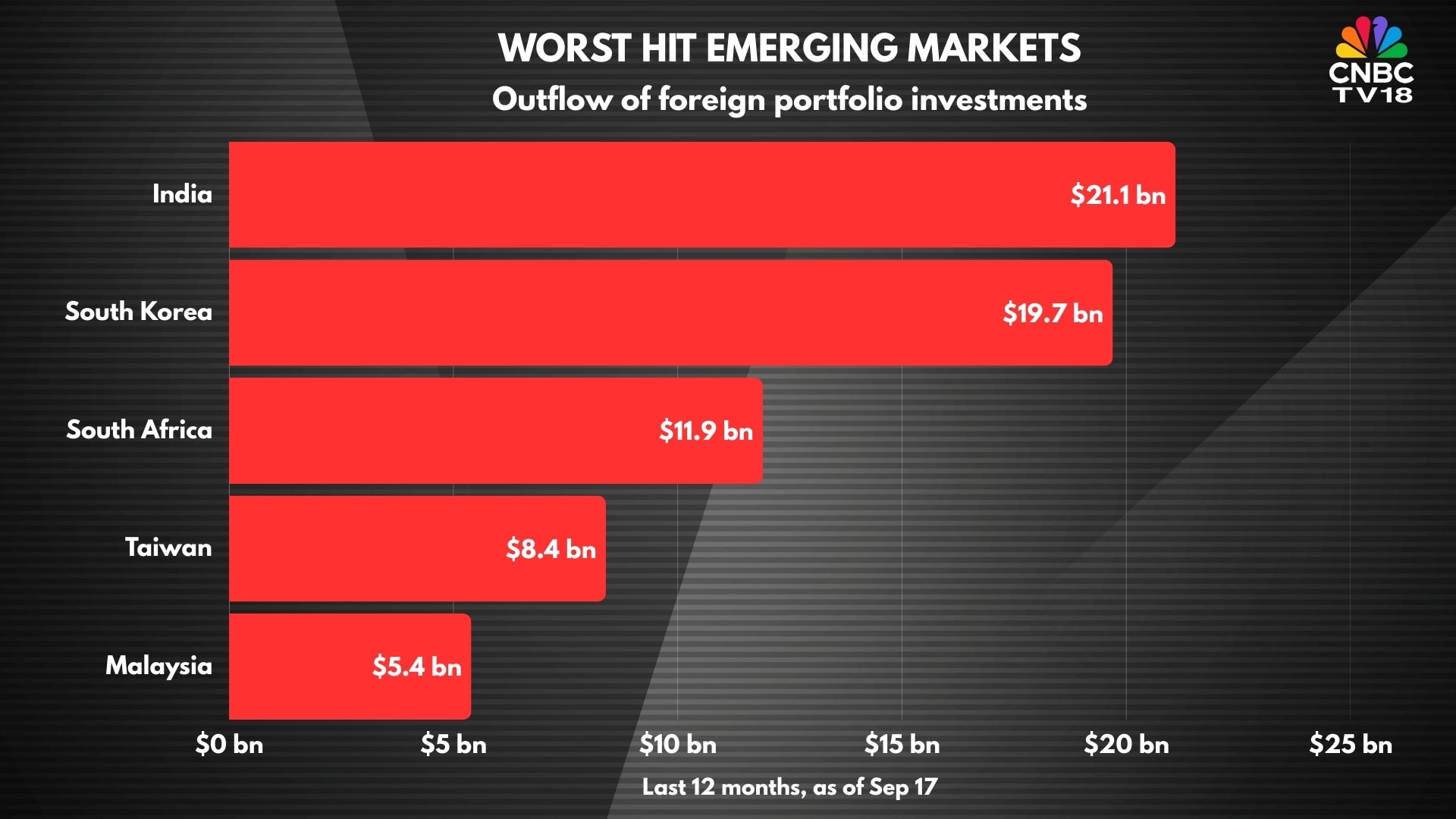

Despite the exodus of foreign portfolio investors — more than any other emerging market in the world — the Sensex has lost less than 5% in the last one year, thanks largely to sustained buying from domestic mutual funds backed by small investors.

The segment has emerged as one of the safer spaces within the financial industry in the latest first quarter ended June 2025. Outside of their valuation, stocks in the capital market space have fewer issues concerns to deal with, analysts at Kotak Institutional Equities said in a August report.

While the recent stagnation in the market may have a sobering impact in the near term, the long-term outlook remains positive given the capital market in India is still in its growth phase. About a fifth of the country's households invest in the market directly, according to a report in Feb 2025.

"When indexed to 2019, India’s capital market returns have grown twice in value," a recent report from Deloitte, a consulting firm, said.

“My team had advised me to launch a capital market fund. And I thought it was too narrow a concept. We should be more diversified,” Shah said while interacting with members of CNBC-TV18 ACCESS.

“We lost a great opportunity for our investors. My team is smart, smarter than me. So they had capital market exposures in their portfolios, and our performance has been good. But I missed an opportunity to create a product because I thought it was too narrow a theme,” he added.

Capital market stocks include broking firms, ratings agencies, mutual fund houses, depository services, exchanges, technology providers, and other diversified players.

Here's a list of stocks that have been trading on the bourses for at least three years, and their compounded average annual returns (CAGR) in that period.

Stock

|

Last 3 year returns (CAGR) |

| BSE | 118% |

| MCX | 87% |

| Motilal Oswal | 72% |

| IIFL Capital | 61% |

| HDFC AMC | 44% |

| CDSL | 33% |

| Aditya Birla Sun Life AMC | 20% |

| ICRA | 17% |

| Angel one | 16% |

| CAMS | 14% |

| CRISIL | 12% |

Source: Screener

Some of the new entrants include Nuvama Wealth, NSDL, and Kfin Technologies.

The segment has grown in size by leaps and bounds since the pandemic, thanks to a massive spike in retail investors' interest in stocks, mutual funds, as well as futures and options (F&O). So much so that the market regulator has had to step in to curb the rampant speculation.

Initial public offerings (IPO) have boomed. There have been more mainboard IPOs in the last five years (327) than in the preceding 12 years (315). A big one, the National Stock Exchange (NSE) IPO, is expected to hit the market soon.

The number of mutual fund folios, each folio indicating a unique investor, has jumped nearly 2.5 times to nearly 249 million between May 2021 and August 2025. Shah believes this number can go exponentially in the coming years.

The assets under management for the MF industry has grown six fold in the last ten years to ₹ 75.2 lakh crore at the end of August 2025, according to the Association of Mutual Funds of India (AMFI).

In 2024 alone, the net inflow into equity mutual funds was more than all the investments in the category between 2016 and 2020, a report from Motilal Oswal showed.

“SIP has now become a common language. It is spoken by millions of investors, and SIP flows are likely to continue,” Shah said. SIP stands for systematic investment plans (SIP), whereby an individual sets aside a portion of her income to be invested in a mutual fund on a regular basis.

The rise of the retail investor has made India one of the most liquid markets in the world. Promoters of organisations, startups, and foreign investors have made the most of this boom in recent years.

Despite the exodus of foreign portfolio investors — more than any other emerging market in the world — the Sensex has lost less than 5% in the last one year, thanks largely to sustained buying from domestic mutual funds backed by small investors.

The segment has emerged as one of the safer spaces within the financial industry in the latest first quarter ended June 2025. Outside of their valuation, stocks in the capital market space have fewer issues concerns to deal with, analysts at Kotak Institutional Equities said in a August report.

While the recent stagnation in the market may have a sobering impact in the near term, the long-term outlook remains positive given the capital market in India is still in its growth phase. About a fifth of the country's households invest in the market directly, according to a report in Feb 2025.

"When indexed to 2019, India’s capital market returns have grown twice in value," a recent report from Deloitte, a consulting firm, said.

/images/ppid_59c68470-image-175921259219549805.webp)

/images/ppid_a911dc6a-image-177077322976413782.webp)

/images/ppid_59c68470-image-177077258165510745.webp)

/images/ppid_59c68470-image-177077272281824806.webp)

/images/ppid_59c68470-image-177077760046699504.webp)

/images/ppid_59c68470-image-177077752738996998.webp)

/images/ppid_59c68470-image-177077764100798849.webp)

/images/ppid_59c68470-image-177077755993327863.webp)

/images/ppid_59c68470-image-177077759049498278.webp)

/images/ppid_59c68470-image-177077754454222790.webp)

/images/ppid_59c68470-image-177077753316323586.webp)

/images/ppid_a911dc6a-image-177077683848562681.webp)

/images/ppid_a911dc6a-image-177077603394625504.webp)

/images/ppid_59c68470-image-177077512106794299.webp)