What is the story about?

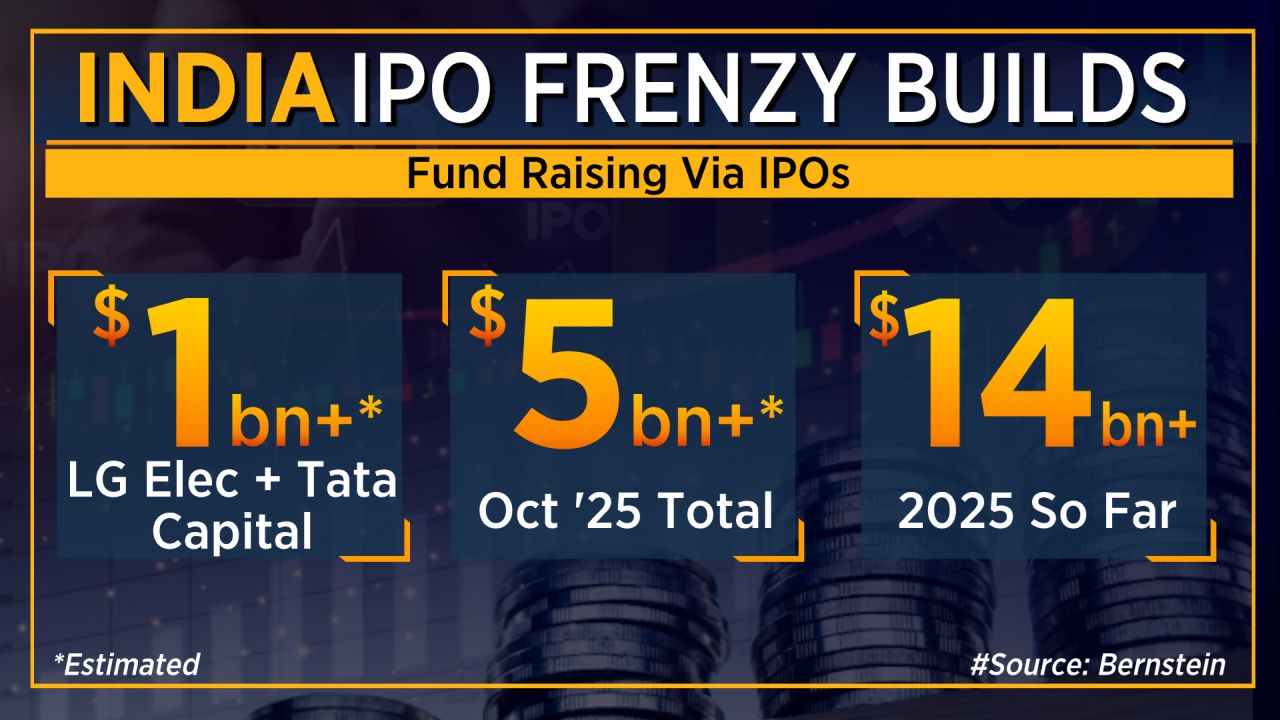

India’s IPO market is booming in 2025. So far, 78 mainboard IPOs have raised more than $14 billion, with three months still to go.

October is expected to be another strong month, with big launches from Tata Capital and LG Electronics India likely to add over $5 billion to the total.

A Bernstein Report shows that India now ranks fourth globally in IPO fund-raising this year. The US leads with $53 billion, followed by Hong Kong at $23 billion and China at $16 billion. India’s $14 billion puts it just behind these major markets.

The momentum has been strong in recent months, with a record 33 listings in the past two months and another 13 already on track for October. If this pace continues, India could match last year’s total of over $20 billion raised through IPOs.

While many believe that new-age tech companies are leading this wave, the Bernstein report highlights that most IPOs are coming from traditional sectors like industrials and discretionary businesses, including jewellery and digital consumer firms such as Swiggy.

Only about 16% of IPOs in 2025 so far belong to newer areas like consumer tech, green energy, or digital.

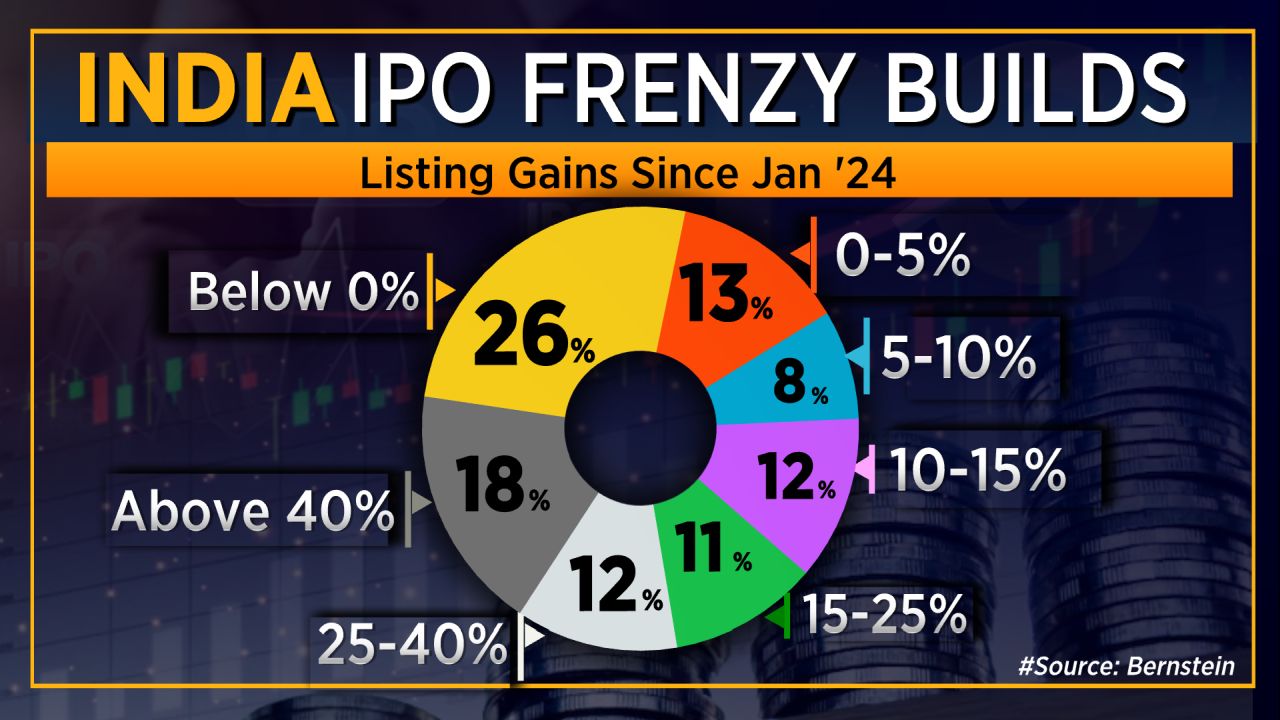

However, not all listings have delivered strong returns. Since January 2024, nearly one-fourth of the IPOs have given zero or negative listing gains.

Only 18% of the companies saw gains of more than 40%, while 12% delivered between 25% and 40%.

Despite the mixed performance, India’s IPO pipeline remains strong, showing growing investor appetite and a maturing market that continues to attract both domestic and global attention.

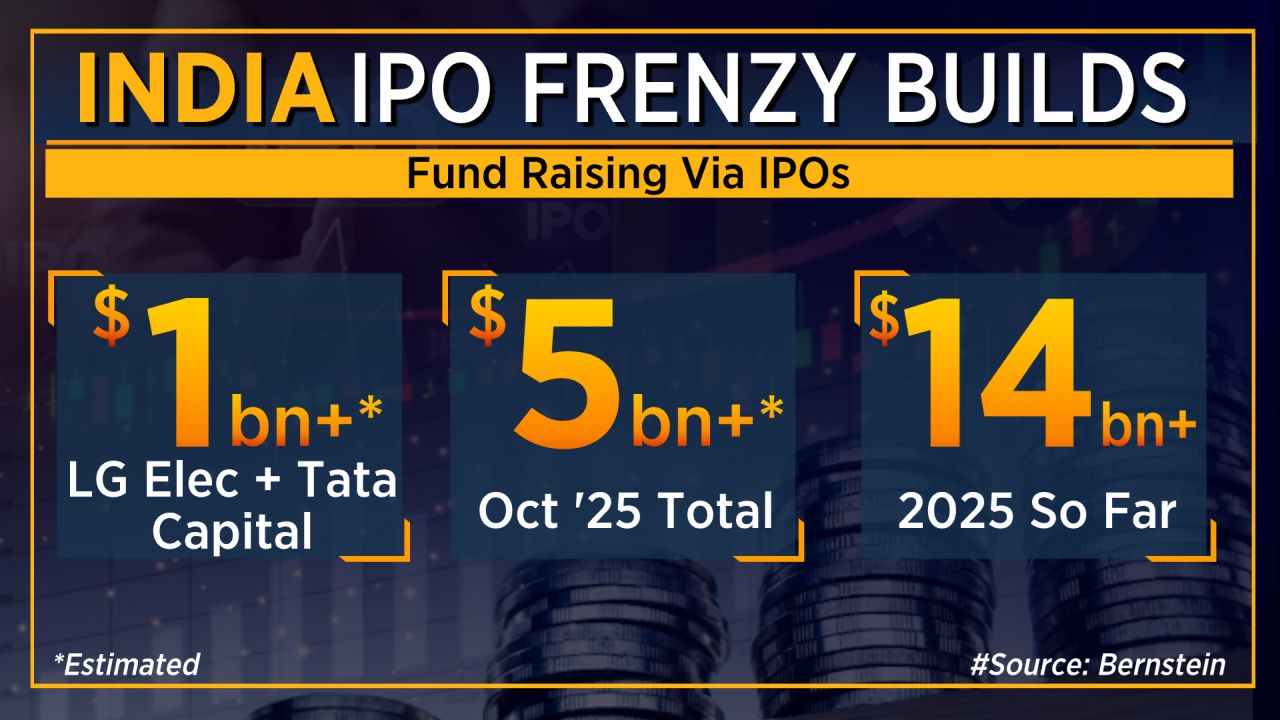

October is expected to be another strong month, with big launches from Tata Capital and LG Electronics India likely to add over $5 billion to the total.

A Bernstein Report shows that India now ranks fourth globally in IPO fund-raising this year. The US leads with $53 billion, followed by Hong Kong at $23 billion and China at $16 billion. India’s $14 billion puts it just behind these major markets.

The momentum has been strong in recent months, with a record 33 listings in the past two months and another 13 already on track for October. If this pace continues, India could match last year’s total of over $20 billion raised through IPOs.

While many believe that new-age tech companies are leading this wave, the Bernstein report highlights that most IPOs are coming from traditional sectors like industrials and discretionary businesses, including jewellery and digital consumer firms such as Swiggy.

Only about 16% of IPOs in 2025 so far belong to newer areas like consumer tech, green energy, or digital.

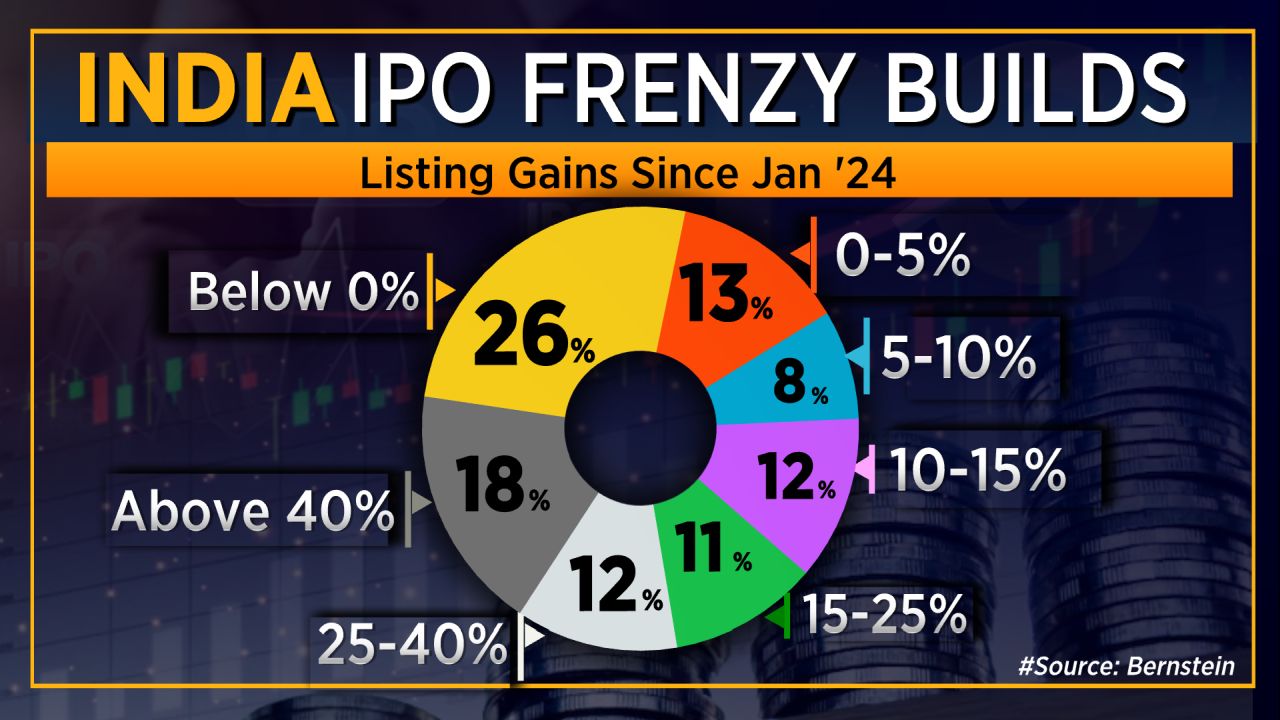

However, not all listings have delivered strong returns. Since January 2024, nearly one-fourth of the IPOs have given zero or negative listing gains.

Only 18% of the companies saw gains of more than 40%, while 12% delivered between 25% and 40%.

Despite the mixed performance, India’s IPO pipeline remains strong, showing growing investor appetite and a maturing market that continues to attract both domestic and global attention.

/images/ppid_59c68470-image-17600125358579848.webp)