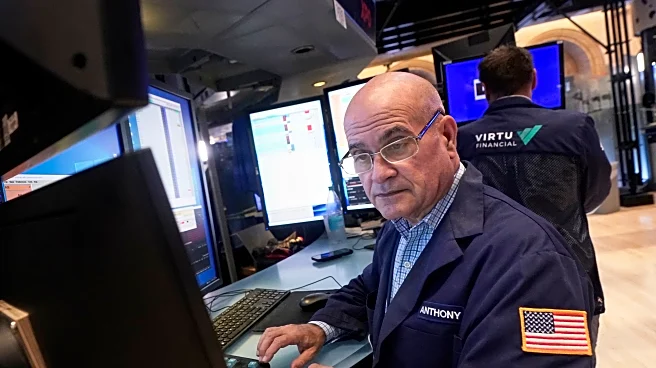

NEW YORK (AP) — U.S. stocks are ticking higher in the early going and recovering some of their loss from Wall Street’s first drop in four days. The S&P 500 was up 0.2% in the first few minutes of trading

Wednesday. The Dow Jones Industrial Average was up 113 points, or 0.2%, and the Nasdaq composite was up 0.3%. All three indexes are near their all-time highs, which were set on Monday. Lithium Americas soared following reports that the U.S. government is considering taking an ownership stake in the Canadian company that’s developing a lithium project in Nevada with General Motors.

THIS IS A BREAKING NEWS UPDATE. AP’s earlier story follows below.

Wall Street was poised to open with small gains Wednesday, a day after markets took a break from their relentless record-breaking rally.

Futures for the S&P 500 ticked up 0.1% before the bell, while Nasdaq futures rose 0.2%. Futures for the Dow Jones Industrial Average were unchanged.

Shares of Alibaba soared nearly 10% after the Chinese e-commerce giant announced a partnership with Nvidia and an expansion of data center operations into a handful of countries to bolster its artificial intelligence infrastructure. Alibaba is the latest in a string of companies announcing that they were plowing money into AI, many of which are also partnering with AI-chipmaker Nvidia.

U.S. markets paused from their recent rally on Tuesday after Federal Reserve Chair Jerome Powell said stock prices were “fairly highly valued.”

In his first public remarks since the Fed cut its main interest rate last week for the first time this year, Powell said that the Fed is stuck in an unusual position because worries about the job market are rising at the same time that inflation has stubbornly remained above its 2% target.

Analysts said his comments reiterated his stance that there is no risk-free path.

“Essentially the Fed Chairman confirmed what we already knew, which is that the central bank remains somewhat ‘between a rock and a hard place’ when it comes to managing the risks of rising inflation and falling employment,” said Tim Waterer, chief market analyst at KCM Trade.

Fed officials have penciled in more cuts to rates through the end of this year and into next, but they are remaining wary because lower rates can also give inflation more fuel.

An update Friday will show how much prices are rising for U.S. households based on the Fed’s preferred measure of inflation, and economists expect it to show a slight acceleration for last month.

Elsewhere, in Europe at midday France's CAC 40 slipped 0.6%, while the German DAX and Britain's FTSE 100 each fell 0.2%.

Japan's benchmark Nikkei 225 recouped morning losses to finish 0.3% higher at 45,630.31. Australia's S&P/ASX 200 slipped 0.9% to 8,764.50. South Korea's Kospi dropped 0.4% to 3,472.14. Hong Kong's Hang Seng rose 1.4% to 26,518.65, while the Shanghai Composite gained 0.8% to 3,853.64.