TOKYO (AP) — Asian shares were trading mixed on Tuesday after overseas markets got a big lift from optimism over AI technology.

Japan's benchmark Nikkei 225 dipped 0.5% to 52,163.84, coming off a national holiday on Monday.

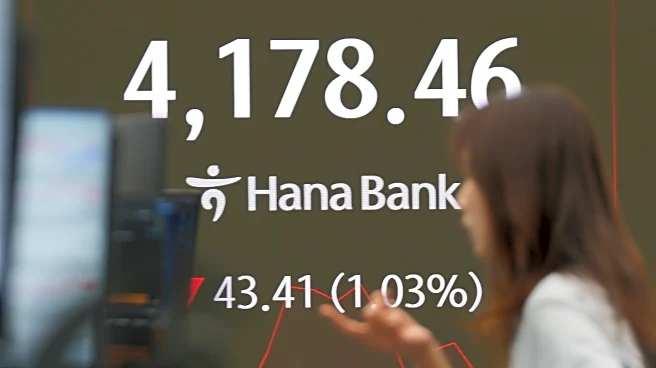

Australia's S&P/ASX 200 shed 0.9% to 8,818.00. South Korea's Kospi dipped 2.0% to 4,138.88. Hong Kong's Hang Seng jumped 0.2% to 26,209.39, while the Shanghai Composite lost 0.2% to 3,969.05.

On Wall Street, more gains for Nvidia,

Amazon and other AI superstars propped up share prices. The S&P 500 rose 0.2% and pulled closer to its all-time high set last week, even though the majority of stocks in the index sank. The Dow Jones Industrial Average dropped 226 points, or 0.5%, and the Nasdaq composite climbed 0.5%.

Nvidia was the strongest force lifting the S&P 500, just like it has been for the year so far. The chip company rose 2.2% to bring its gain for the year to date to 54.1%.

Amazon was the No. 2 force pushing the market higher. It rallied 4% after announcing a $38 billion agreement with OpenAI, which will use Amazon’s cloud computing services to run its AI workloads.

IREN, an AI cloud service provider, jumped 11.5% after Microsoft announced a $9.7 billion contract with it that will give the tech giant access to some of Nvidia’s chips.

Palantir Technologies, which came into the day with a stunning 165% gain for the year so far, rose another 3.3%. Traders pushed the AI darling higher in the final hours before the data platform company reported its latest quarterly results after trading closed for the day.

Companies across the U.S. stock market will need to hit expectations for growth in profit to justify the big gains for their stock prices since April. Criticism has been rising that the broad U.S. market, and AI stocks in particular, have become too expensive and could be inflating into a dangerous bubble similar to the 2000 dot-com bust.

For the most part, companies have been meeting the high expectations for profits. Four out of every five companies in the S&P 500 have topped analysts’ forecasts so far this reporting season, according to FactSet. With roughly two-thirds of all S&P 500 reports in, companies in the index are on track to deliver healthy growth of nearly 11% versus a year earlier.

On the losing end of Wall Street on Monday was Kimberly-Clark, which dropped 14.6% after it said it would buy Kenvue in a deal valuing it at $48.7 billion. Kenvue, which sells Tylenol, Band-Aids and Listerine, jumped 12.3%.

All told, the S&P 500 rose 11.77 points to 6,851.97. The Dow Jones Industrial Average dropped 226.19 to 47,336.68, and the Nasdaq composite rose 109.77 to 23,834.72.

In the bond market, the yield on the 10-year Treasury edged down to 4.10% from 4.11% late Friday.

A discouraging report on U.S. manufacturing said that activity shrank by more last month than economists expected. Several manufacturers told surveyors for the Institute for Supply Management that President Donald Trump’s tariffs are creating financial pain.

In energy trading, benchmark U.S. crude fell 13 cents to $60.92 a barrel. Brent crude, the international standard, declined 15 cents to $64.74 a barrel.

In currency trading, the U.S. dollar slipped to 153.95 Japanese yen from 154.19 yen. The euro cost $1.1517, down from $1.1525.

___

AP Business Writer Stan Choe contributed.