HONG KONG (AP) — U.S. futures were higher and world shares traded mixed Wednesday ahead of U.S. President Donald Trump’s speech to the World Economic Forum in Davos, Switzerland.

Markets have appeared to

steady somewhat after gyrating following Trump’s threats to slap higher tariffs on eight European countries over their opposition to his push for U.S. control of Greenland.

Gold prices crossed the $4,800 mark for the first time, gaining 2.2% as money flowed into assets considered to be safe havens at times of uncertainty.

Bouncing back from steep losses Tuesday, the future for the S&P 500 rose 0.4% and that for the Dow Jones Industrial Average was up 0.2%.

Germany’s DAX shed 0.4% to 24,607.57 and the CAC 40 in Paris slipped 0.2% to 8,050.40. Britain’s FTSE 100 was nearly unchanged at 10,124.24.

Traders were waiting for Trump’s planned speech to world leaders, elites and billionaires gathered in Davos. Trump told reporters he planned to highlight his administration’s accomplishments during his address.

U.S. Commerce Secretary Howard Lutnick, who spoke on a panel on Tuesday, said the U.S. message was that “globalization has failed.”

Trump’s Air Force One returned to Washington after its crew identified “a minor electrical issue” while he was on his way to Davos. He boarded another aircraft and resumed his trip.

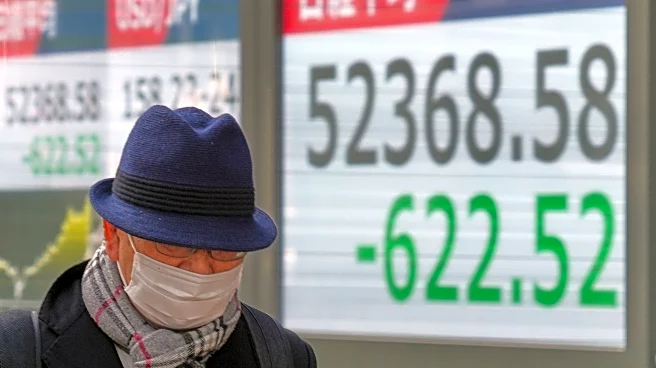

In Asian trading, Tokyo’s Nikkei 225 slipped 0.4% to 52,774.64. Markets in Japan have been riled both by geopolitical uncertainty and by domestic issues.

Japanese Prime Minister Sanae Takaichi has called a snap election for Feb. 8, sending yields of long-term government bonds to record levels. The assumption is that Takaichi, who is capitalizing on strong public support ratings to try to consolidate a majority for her Liberal Democratic Party, will cut taxes and boost spending, adding to the challenges Japan faces in handling its massive government debt.

The yield on the 40-year Japanese government bond was trading at 4.061% early Wednesday, down from the all-time high of 4.22% that it hit on Tuesday.

South Korea’s Kospi gained 0.5% to 4,909.93.

Hong Kong’s Hang Seng rebounded to add 0.4% to 26,585.06. The Shanghai Composite index edged 0.1% higher, to 4,116.94.

In Australia, the S&P/ASX 200 gave back 0.4% to 8,782.90.

Taiwan’s Taiex fell 1.6% and India’s Sensex lost 0.4%.

Trump has said he will impose 10% tariffs on Denmark, Norway, Sweden, Germany, France, the United Kingdom, the Netherlands and Finland beginning in February. That would be on top of a 15% tariff specified by a trade agreement with the European Union that has yet to be ratified.

European leaders have hit back as Washington’s relations with its Western allies sour, considering countermeasures, including perhaps slow-walking ratification of the trade agreement or ordering retaliatory tariffs, analysts say.

On Tuesday, the S&P 500 fell 2.1%, the steepest drop for the benchmark index since October. The Dow industrials dropped 1.8% and the Nasdaq composite fell 2.4%.

The Federal Reserve is set to meet next week for a policy meeting, and Wall Street is betting it will hold steady its benchmark interest rate. Japan’s central bank will wrap up its first monetary policy meeting of 2026 on Friday.

In other dealings early Wednesday, U.S. benchmark crude oil lost 71 cents to $59.65 per barrel. Brent crude, the international standard, shed 88 cents to $64.04 per barrel.

The U.S. dollar dropped to 157.94 Japanese yen from 158.16 yen. The euro fell to $1.1708 from $1.1726.