The European Union has stepped up economic pressure on Russia with a fresh round of sanctions targeting individuals and entities linked to Moscow’s so-called

“shadow fleet” of oil tankers, said a TOI report. The measures form part of the EU’s 19th sanctions package since Russia’s invasion of Ukraine and are designed to cut off revenue streams that fund the Kremlin’s war effort by disrupting opaque shipping networks used to bypass Western price caps and trade restrictions. Key Traders Added to Sanctions List Among those sanctioned are prominent oil traders Murtaza Lakhani and Etibar Eyyub, whom the EU accuses of facilitating Russian crude exports. The bloc alleges that companies linked to Lakhani enabled oil shipments from Russian state giant Rosneft, while Eyyub and his associates—Anar Madatli and Talat Safarov—are connected to Coral Energy, now rebranded as 2Rivers Group, which has been active in Russian oil trading. In total, nine individuals and entities have been added to the sanctions list, including figures associated with Rosneft and Lukoil-linked businesses. With this update, more than 2,600 individuals and entities are now subject to EU sanctions. What the Sanctions Entail The new restrictions prohibit EU citizens and companies from providing:

- Shipping and logistics services

- Insurance and reinsurance

- Financial and technical support

to the listed parties.

Analysts expect the EU to go further in coming weeks, with discussions underway to sanction more than 40 additional vessels, potentially raising the total number of blacklisted shadow-fleet ships to around 600.

Moscow Pushes Back

Russia dismissed the sanctions as ineffective. Its Permanent Mission to the EU said Brussels was repeating failed policies and warned that continued restrictions would ultimately hurt European citizens through higher energy prices.

Spotlight on the Sanctioned Traders

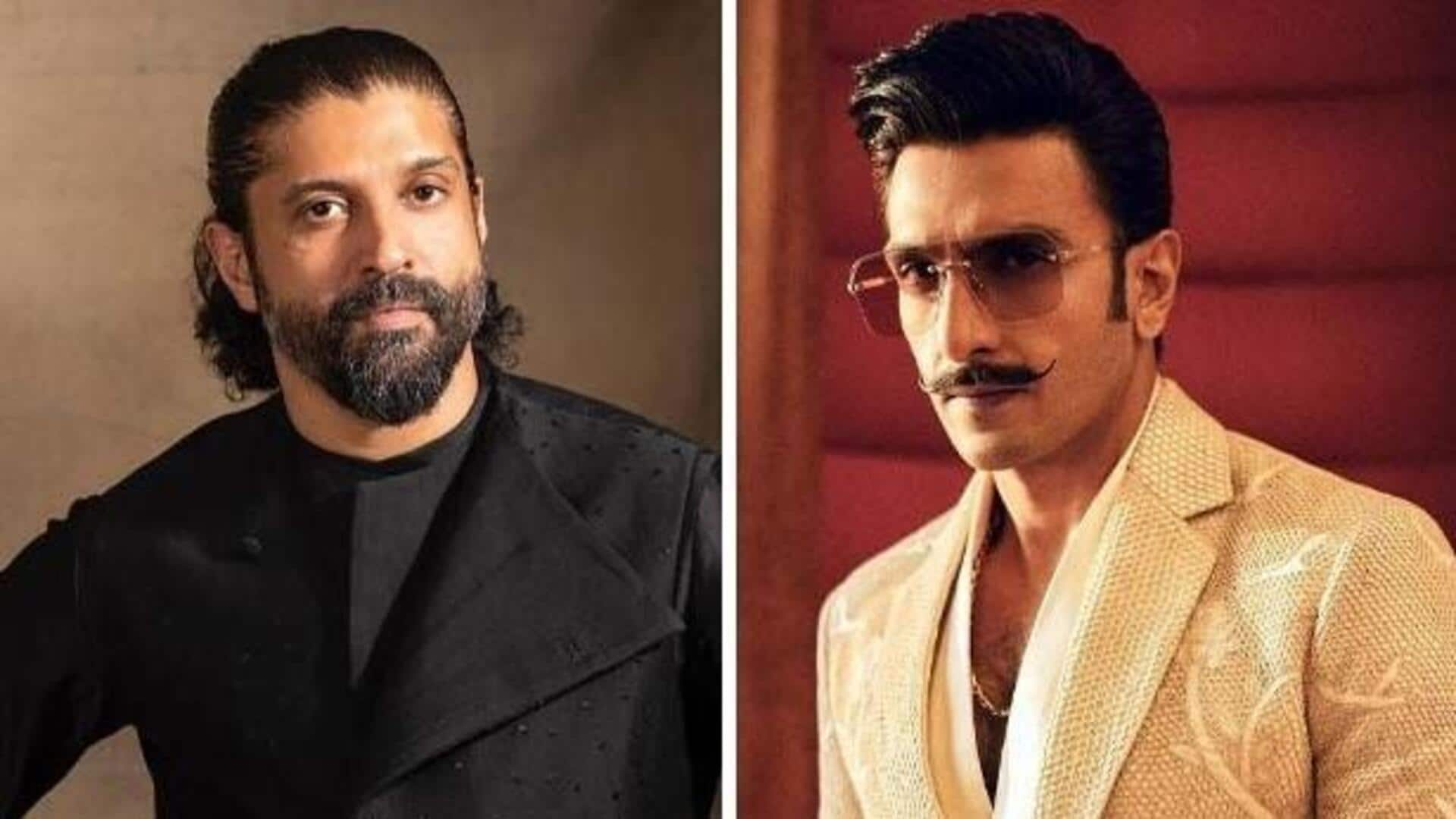

Murtaza Lakhani (63)

Lakhani heads the Singapore- and London-based Mercantile & Maritime Group. A former Glencore trader, he has been involved in oil deals in Iraqi Kurdistan and projects linked to Rosneft, including the Arctic Vostok development. EU authorities claim vessels connected to his network transported Russian crude and petroleum products.

Etibar Eyyub, Anar Madatli, and Talat Safarov

These individuals are linked to Coral Energy, now operating as 2Rivers Group. The firm was once a major Russian oil trader and later claimed it had exited Russian business by early 2024 following earlier sanctions.

Other sanctioned figures include executives associated with Lukoil-linked trading arms and shipping service providers. Requests for comment from those named did not receive a response.

Understanding Russia’s “Shadow Fleet”

After the G7 imposed a $60-per-barrel price cap and the EU banned seaborne Russian oil imports, Moscow redirected exports to countries such as India and China. This trade relies heavily on aging, poorly insured tankers operating outside Western regulatory systems—commonly referred to as the shadow or dark fleet.

Despite sanctions, this network has helped Russia sustain oil revenues, albeit at discounted prices. The EU’s latest move aims to starve these channels of essential services, though enforcement remains challenging due to complex ownership structures and constant rerouting.

What Comes Next

As Brussels intensifies its sanctions campaign, the global energy landscape continues to fragment. Europe faces higher costs and supply constraints, while Russia accelerates its pivot toward Asian markets.

With no immediate diplomatic breakthrough in sight, the latest crackdown signals that the battle over energy flows—and enforcement of sanctions—is far from over.