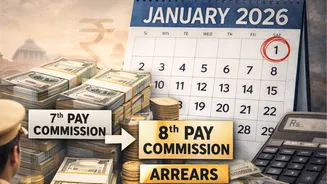

8th Pay Commission: With the tenure of the 7th Pay Commission ending on December 31, 2025, attention has now shifted to how and when the 8th Pay Commission (CPC)

will translate into higher salaries and arrears for central government employees and pensioners. While the formal rollout may still be some time away, the financial impact is expected to be significant due to retrospective implementation. Although the 8th Pay Commission is widely expected to be implemented around mid-2027, revised salaries are likely to apply retrospectively from January 1, 2026. This gap between the effective date and the actual announcement will result in arrears accumulating for central government employees. As Pratik Vaidya, MD & chief vision officer, Karma Management Global Consulting Solutions, told ET Wealth online, “The 8th Pay Commission is expected to be implemented around mid-2027, but salary revision is likely to take retrospective effect from 1 January 2026, creating arrears of around 12–24 months. The 7th Pay Commission tenure ended on December 31, 2025, making January 1, 2026, the logical effective date for the 8th CPC.” How Arrears Are Calculated Arrears under the 8th Pay Commission are determined by a straightforward formula. According to Ramachandran Krishnamoorthy, director, payroll services, Nexdigm, the calculation is based on: Monthly pay difference × number of delayed months The revised salary is arrived at by applying the approved fitment factor to the existing 7th CPC basic pay. Arrears generally consist of the difference in basic pay and the revised dearness allowance (DA), recalculated month-wise. The total payout depends heavily on the length of the delay, which could range between 18 and 24 months. Why The Fitment Factor Matters Most Experts agree that the fitment factor will play the biggest role in determining both revised salaries and arrears. Vaidya pointed out that while the 7th CPC used a fitment factor of 2.57, estimates for the 8th CPC range from 1.83 to 2.46. At the lower end, a Level 1 employee’s basic pay could rise from Rs 18,000 to Rs 32,940, while at the upper end it could reach Rs 44,280. Krishnamoorthy stressed that the fitment factor is “the single most important determinant of arrears.” Using the formula, revised basic pay equals existing basic pay multiplied by the fitment factor; even small changes can lead to large differences in arrears over time. What About Allowances Like HRA and TA? On allowances, Krishnamoorthy clarified that DA arrears are typically paid after being recalculated on the revised basic pay. However, HRA arrears are usually not paid since HRA revisions apply prospectively, while transport allowance arrears are generally excluded because the amount is fixed. “Employees should not expect arrears on fixed or policy-driven allowances unless explicitly notified,” he said. Vaidya added that allowances such as DA, HRA and TA are linked to basic pay and tend to rise automatically once the revised structure is notified. Sample calculations suggest that for Levels 1–5, moving from a 2.0× to a 2.57× fitment factor could raise arrears by Rs 2–3 lakh or more over 20 months. Employees at Levels 4 and 5 stand to gain the most in absolute terms due to higher base salaries.