Silver’s extraordinary run in 2025 has shifted investor focus firmly away from gold, with the white metal delivering far stronger returns both globally

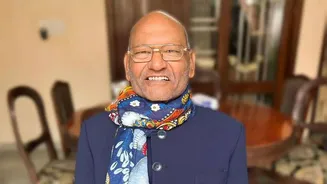

and in India. As prices continue to scale new highs, Vedanta Group chairman Anil Agarwal believes silver is no longer merely a supporting act to gold, but a metal entering a durable, long-term growth phase driven by technology-led demand. Highlighting the magnitude of the rally, Agarwal pointed out that silver has vastly outperformed gold this year. “This year, silver has emerged from the shadow of its precious metal sibling, gold. What a year for silver, with year-to-date appreciation of 125 per cent in dollar terms,” he said in a post on social media platform X (formerly Twitter). By comparison, gold, despite its own strong momentum, has gained 63 per cent over the same period, he noted. The divergence, according to Agarwal, signals a deeper structural shift rather than a short-term price spike. Why Silver’s Demand Story Is Different Agarwal attributed silver’s rising relevance to its unique position as both a store of value and an industrial input. “The silver story is just beginning. It is unique because it is the only metal which has an intrinsic value and also a functional demand,” he said. He added that new-age technologies are increasingly shaping long-term consumption patterns. “New technologies, whether in solar cells or defence, use silver as a key component,” Agarwal said, noting that India’s only primary silver producer has seen this trend play out directly at Hindustan Zinc. Despite inevitable volatility, Agarwal remains confident about the metal’s trajectory. “Prices will go up and down, but silver’s extraordinary shine is here to stay,” he said. Record Prices Lift Vedanta’s Earnings Silver’s rally has also delivered tangible financial gains for Vedanta, especially through Hindustan Zinc, one of the world’s top five silver producers. In the quarter ended September 2025, Hindustan Zinc reported a consolidated profit after tax of Rs 2,649 crore, marking a 19 per cent sequential increase. Nearly 40 per cent of this profit, about Rs 1,060 crore, came from silver. Revenue from silver stood at Rs 1,706 crore during the quarter, up 10 per cent quarter-on-quarter and 20 per cent year-on-year. The improvement was driven by higher global prices alongside stable operational performance. Produced as a by-product of lead and zinc mining, silver’s contribution to earnings has steadily expanded as prices strengthened. (Disclaimer: This article is meant solely for informational and educational purposes. The views and opinions expressed are those of individual analysts or brokerage firms and do not reflect the stance of Times Now. Readers are advised to consult certified financial experts before making any investment decisions.)