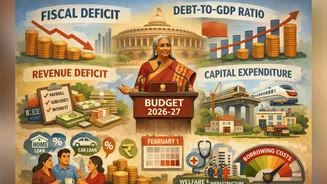

When the Union Finance Minister presents the Union Budget for 2026–27 on February 1, the spotlight will once again fall on a set of economic expressions

that often feel remote and academic. Phrases like fiscal deficit, capital expenditure and debt-to-GDP tend to dominate expert panels and market reactions. These concepts have a direct bearing on household finances. These factors influence interest rates on home and car loans, determine how much room the government has to lower taxes, and decide how aggressively it can invest in infrastructure, healthcare and welfare. With Budget 2026 being prepared amid constrained public finances, understanding these terms is more important than ever. Fiscal Deficit: The fiscal deficit reflects the difference between what the government spends and what it earns in a financial year, excluding borrowings. A wider gap means the government must raise more money from the market. Higher borrowing can push up interest rates, as the government competes with businesses and individuals for funds. It also adds to the overall debt burden. India’s fiscal deficit for FY26 was pegged at 4.4 per cent of GDP, but slower tax collections raise the risk of slippage. For FY27, the target is to move closer to 4 per cent, a goal that will require difficult trade-offs. Revenue Deficit Revenue deficit focuses only on routine income and expenditure. It shows whether tax revenues are sufficient to cover recurring costs such as salaries, pensions, subsidies and interest payments. Borrowing to fund daily expenses does little to support future growth. A declining revenue deficit, as seen in recent years, signals healthier finances, suggesting the government is using its own income for operations and reserving borrowings for investment. Primary Deficit The primary deficit removes interest payments from the fiscal deficit, offering a clearer picture of fresh borrowing needs. It highlights whether new debt is being taken on for productive spending or merely to service old loans. India’s primary deficit target of 0.8 per cent of GDP in Budget 2025–26 indicated that most borrowing was being channelled toward capital investment rather than debt servicing. Capital Vs Revenue Expenditure Capital expenditure, or capex, refers to spending on long-term assets such as highways, rail networks, hospitals and digital infrastructure. These investments generate economic returns over many years. Revenue expenditure, by contrast, covers immediate consumption, salaries, subsidies, pensions and administrative costs. Despite pressure from weaker tax inflows, the government is keen to shield capex, budgeted at Rs 10.18 lakh crore for FY26, as cutting it could hurt long-term growth prospects. Nominal GDP Growth While real GDP growth adjusts for inflation, nominal GDP growth includes it. Since taxes are collected on actual prices and incomes, governments rely on nominal growth assumptions when framing budgets. With real growth projected at 7.4 per cent and nominal growth slowing to around 8 per cent, well below last year’s assumption of 10.1 per cent, fiscal space has tightened, directly impacting tax collections. Debt-To-GDP Ratio And Section 87A The debt-to-GDP ratio measures total government debt against the size of the economy. A rising ratio limits future budgets and increases vulnerability to shocks. India aims to bring this down to about 50 per cent by FY31. Meanwhile, Section 87A remains central to middle-class tax relief. Any references to consumer support in Budget 2026 are likely to involve targeted tweaks here rather than sweeping tax overhauls.