STT Rates Hike: The Budget 2026 has brought a shock to derivative traders when the government has proposed to hike the Securities Transaction Tax (STT) on Futures and Options from April 01, 2026. This

step is seen as an attempt by the government to curb speculative trading in F&O, as part of the broad strategy with various measures in recent times.

Following the hike in STT on F&O, trading in these segments will become costlier and less profitable for traders.

Brokerage firms and experts have questioned the rationale behind the hike in the STT by the government.

Zerodha co-founder Nithin Kamath wondered the exact reasoning behind the increase in STT. “Having said that, if the goal was to reduce speculative activity in F&O, then I’m not sure this will do anything,” he questioned in an X post.

He further explained that 95 per cent of trading is already in options, so this STT increase will only push that share higher. “Because the impact falls mostly on futures, while options are far more speculative than futures,” Kamath added.

Kamath suggested to establishing product suitability (who can trade) criteria for reduction in speculation in trading.

Kresha Gupta, Director, Steptrade Capital said that the increase in STT on F&O transactions further affected near term sentiment rather than supporting. “This naturally limits the possibility of a sudden boost to market confidence or flows,” Gupta added.

What Is STT?

STT (Securities Transaction Tax) is a tax charged by the Indian government on the buying or selling of securities in the stock market.

The tax is collected by the exchange and paid to the government, so investors don’t have to file it separately.

Check Current Vs Upcoming STT Rates

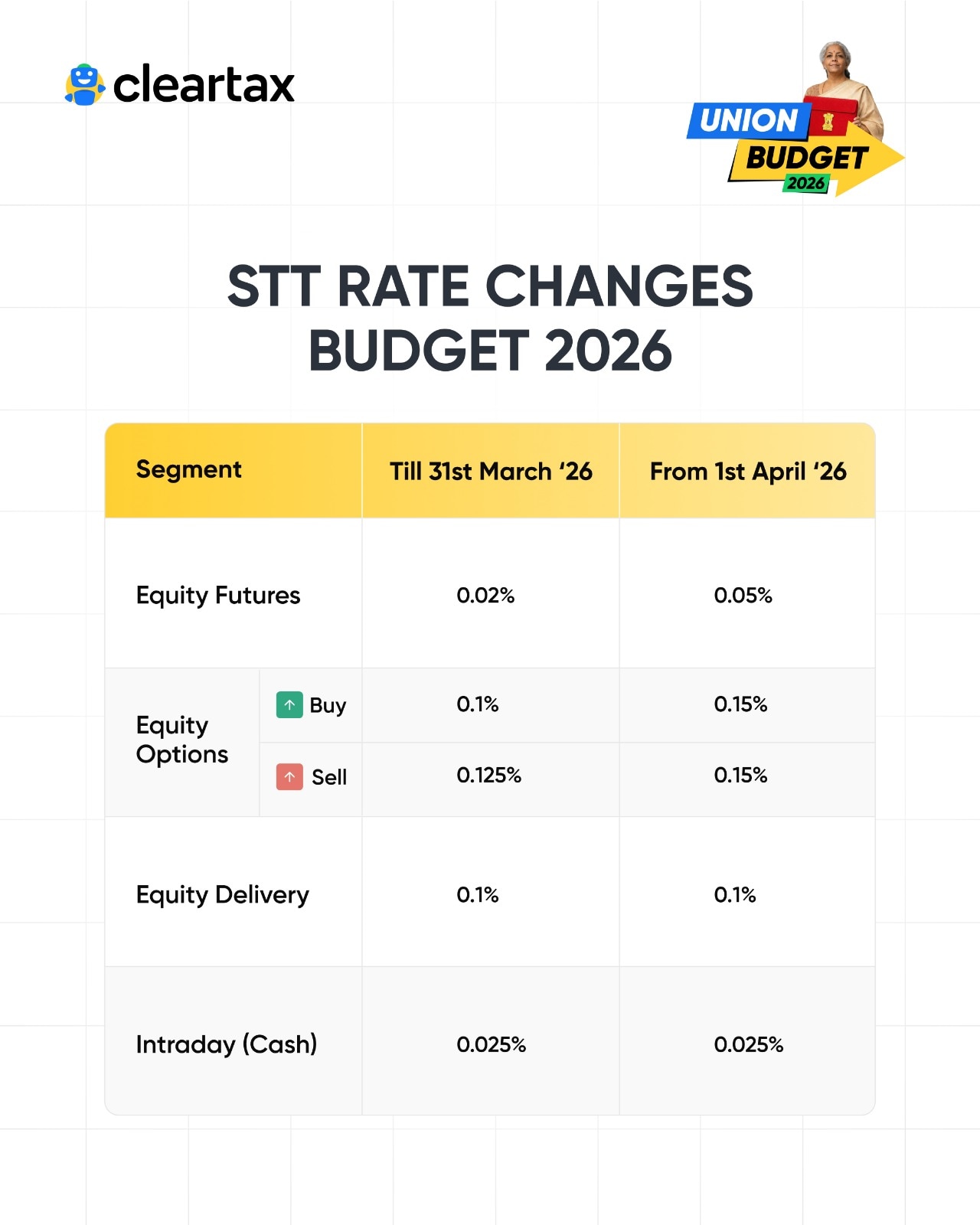

As per the new rules effective April 1, 2026, STT on equity futures has been increased to 0.05% from 0.02%, while equity options will now attract a uniform 0.15% STT on both buy and sell sides, up from 0.1% and 0.125% respectively.

In contrast, the government has left STT rates unchanged for equity delivery and intraday cash trades. Equity delivery transactions will continue to attract 0.1% STT, while intraday cash trades remain at 0.025%, offering relief to long-term investors and retail participants focused on the cash segment.