Imagine going through piles of old documents and stumbling upon a forgotten share certificate of your father or grandfather. A minuscule investment decades ago that turns out to be worth a small fortune

today due to the power of compounding. That’s exactly what happened when a relative of an X (formerly Twitter) user rediscovered shares bought more than 30 years ago.

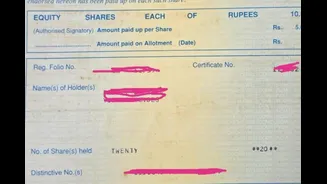

Sharing the picture of the physical share certificate, he highlighted the power of long-term investing and how forgotten investments could be financially rewarding. The user, who goes by the name The Chartians, shared that his relative found an old share certificate of Burroughs Wellcome India Ltd, purchased in 1993.

Current Amount Of The Shares

The certificate was for 20 shares bought at Rs 10 each, amounting to a total investment of just Rs 200 at the time. Over the years, Burroughs Wellcome India Ltd merged into GlaxoSmithKline (GSK), issued bonus shares, and continued to generate value through dividends.

Without any active monitoring, the investment quietly compounded. Today, the value of those original shares is estimated at around Rs 1.8 lakh.

“You find a piece of paper from 1993 worth Rs 1,80,000. A relative just found this 20-share certificate for Burroughs Wellcome. Turns out it merged into #GSK, issued bonuses…and sat there silently compounding for 30 years,” the X user wrote.

The post added, “Valuation then: Rs 200 (Face Value), valuation now: Rs 1,80,000 (with dividends)—according to GPT. The ultimate HODL is just forgetting you own it.”

POV: You find a piece of paper from 1993 worth ₹1,80,000. 😱

A relative just found this 20-share certificate for Burroughs Wellcome.

Turns out it merged into #GSK, issued bonuses…nd sat there silently compounding for 30 years.

Valuation then: ₹200 (Face Value)

Valuation… pic.twitter.com/MTdUEzcIQF— The Chartians (@chartians) December 14, 2025

According to the post, the shares were originally purchased on November 22, 1993, in Delhi. After nearly three decades, the minuscule investment has delivered a staggering return of nearly 89,900 per cent in nearly 33 years, including dividends.

What Is Compounding In Investment?

Compounding refers to the process where returns earned on an investment are reinvested to generate additional returns over time. In simple terms, investors earn returns not only on their original investment but also on the accumulated earnings.

Compounding works best when you are patient and consistent. The longer the investment horizon, the more powerful the effect of compounding, often leading to exponential growth in wealth.

How Compound Interest

Compound interest is calculated using the formula: A = P(1 + r/n)^(nt).

Here: A is the final amount, P is the initial investment, r is the annual interest rate, n is how often interest is added (monthly, quarterly, yearly) and t is the number of years.