The Union Government on Friday withdrew the Income Tax Bill, 2025, which was introduced in the Lok Sabha on February 13 this year to replace the six-decade-old Income-Tax Act, 1961.

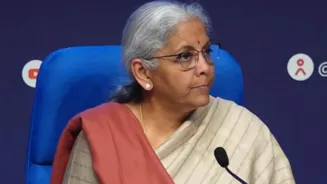

Finance Minister Nirmala

Sitharaman said that the government will come up with a revised version of the Bill after incorporating changes suggested by the Select Committee chaired by Baijayant Panda, and will be introduced in the House on Monday, August 11, news agency PTI reported.

To avoid confusion by multiple versions of the Bill and to provide a clear and updated version with all changes incorporated, the new version of the Income Tax Bill will be introduced for the consideration of the House on Monday, the news agency reported, citing sources.

The BJP MP-headed Select Committee had suggested a host of changes in the Income Tax Bill, which was introduced in the Lok Sabha on February 13.

Soon after its introduction in the Lower House, the Bill, which will replace the six-decade-old Income Tax Act, 1961, was referred to the Select Committee for scrutiny. The 31-member Select Committee had made some suggestions on the Bill.

According to the government, the new Bill aims to simplify language, eliminate redundancy, and streamline procedures and processes to enhance the taxpayer experience.

They also favoured continuing tax exemption on anonymous donations made to religious-cum-charitable trusts in the new law, besides suggesting that taxpayers be allowed to claim TDS refund even after the ITR filing due date, without paying any penal charges.

The government in the new Bill has exempted non-profit organisations (NPOs) from taxing anonymous donations received by purely religious trusts. However, such donations received by a religious trust that may also have other charitable functions, like running hospitals and educational institutions, will be taxed as per law, as per the Bill.

The government aims to implement the new Income Tax law from April 1, 2026.

(With inputs from agencies)