What is the story about?

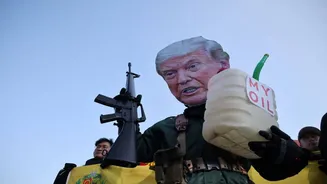

President Donald Trump said Tuesday night that Venezuela will hand over between 30 million and 50 million barrels of oil to the United States, which will sell the crude at market value and control the proceeds.

In a post on Truth Social, Trump said Venezuela’s interim authorities would transfer what he described as “sanctioned oil.” He added that the funds raised would be used “to benefit the people of Venezuela and the United States!”

Trump said Energy Secretary Chris Wright has been ordered to “execute this plan, immediately,” and that the oil “will be taken by storage ships, and brought directly to unloading docks in the United States.”

A senior administration official, speaking on condition of anonymity, told CNN that the oil has already been produced and placed into barrels. Most of it is currently aboard ships and will be sent to U.S. Gulf Coast facilities for refining.

While 30 million to 50 million barrels is a significant volume, it is small relative to U.S. consumption, which averaged just over 20 million barrels of oil per day over the past month.

As a result, the influx may have only a modest effect on prices at the pump. By comparison, former President Joe Biden released about 180 million barrels of oil from the US Strategic Petroleum Reserve in 2022, roughly four to six times as much, which reduced gasoline prices by only 13 to 31 cents per gallon over four months, according to a Treasury Department analysis.

U.S. oil prices fell by about $1 a barrel, or just under 2 per cent, to $56 shortly after Trump’s announcement on Truth Social.

At current prices, selling up to 50 million barrels could generate substantial revenue. Venezuelan crude is trading at roughly $55 per barrel, meaning total proceeds could range from about $1.65 billion to $2.75 billion if buyers pay market rates.

Venezuela has accumulated large crude stockpiles since the United States imposed an oil embargo late last year. However, transferring such a large quantity of oil to the U.S. could significantly draw down the country’s reserves.

The oil is expected to come from a combination of onshore storage facilities and seized tankers that had been transporting crude. Venezuela has about 48 million barrels of storage capacity and was nearly full, according to Phil Flynn, senior market analyst at the Price Futures Group. Industry estimates suggest the tankers were carrying between 15 million and 22 million barrels of oil.

It remains unclear over what period the oil will be delivered to the United States. The senior administration official said the transfer would happen quickly because Venezuela’s crude is very heavy, limiting how long it can be stored.

In a post on Truth Social, Trump said Venezuela’s interim authorities would transfer what he described as “sanctioned oil.” He added that the funds raised would be used “to benefit the people of Venezuela and the United States!”

Trump said Energy Secretary Chris Wright has been ordered to “execute this plan, immediately,” and that the oil “will be taken by storage ships, and brought directly to unloading docks in the United States.”

A senior administration official, speaking on condition of anonymity, told CNN that the oil has already been produced and placed into barrels. Most of it is currently aboard ships and will be sent to U.S. Gulf Coast facilities for refining.

Market impact likely limited

While 30 million to 50 million barrels is a significant volume, it is small relative to U.S. consumption, which averaged just over 20 million barrels of oil per day over the past month.

As a result, the influx may have only a modest effect on prices at the pump. By comparison, former President Joe Biden released about 180 million barrels of oil from the US Strategic Petroleum Reserve in 2022, roughly four to six times as much, which reduced gasoline prices by only 13 to 31 cents per gallon over four months, according to a Treasury Department analysis.

U.S. oil prices fell by about $1 a barrel, or just under 2 per cent, to $56 shortly after Trump’s announcement on Truth Social.

At current prices, selling up to 50 million barrels could generate substantial revenue. Venezuelan crude is trading at roughly $55 per barrel, meaning total proceeds could range from about $1.65 billion to $2.75 billion if buyers pay market rates.

Source of the oil and timing unclear

Venezuela has accumulated large crude stockpiles since the United States imposed an oil embargo late last year. However, transferring such a large quantity of oil to the U.S. could significantly draw down the country’s reserves.

The oil is expected to come from a combination of onshore storage facilities and seized tankers that had been transporting crude. Venezuela has about 48 million barrels of storage capacity and was nearly full, according to Phil Flynn, senior market analyst at the Price Futures Group. Industry estimates suggest the tankers were carrying between 15 million and 22 million barrels of oil.

It remains unclear over what period the oil will be delivered to the United States. The senior administration official said the transfer would happen quickly because Venezuela’s crude is very heavy, limiting how long it can be stored.