What is the story about?

As the global race for artificial intelligence accelerates, Big Tech’s growing appetite for power is triggering a high-stakes showdown with America’s electricity grid operators.

Tech giants are requesting hundreds of gigawatts of additional capacity to fuel data centres, the infrastructure at the heart of the AI boom, but ageing grid systems and lagging investments are creating unprecedented tensions.

Operators of US power grids are struggling to accommodate the massive energy needs of hyperscale data centres, reported Wall Street Journal. These facilities, which run cloud computing and AI training systems, demand continuous and enormous electricity loads, but the existing grid cannot keep up.

To bridge the gap, grid operators are asking companies such as Microsoft, Amazon, and Google to either bring their own energy sources or agree to conditional connections.

One option being floated is “bring your own generation,” where companies must pair their data centres with dedicated power sources, such as small natural gas plants, renewables, or even nuclear microreactors, instead of relying solely on the public grid.

Another controversial proposal allows tech giants to connect early, but with strings attached, their data centres could be temporarily disconnected from the grid during times of extreme demand to prevent blackouts.

The standoff is particularly intense in areas under PJM Interconnection, the regional grid operator serving parts of 13 US states including Pennsylvania, Virginia, and Ohio, as well as in Texas under ERCOT and regions managed by the Southwest Power Pool (SPP).

These regions have become the epicentres of data centre development, driven by access to cheap land and relatively low electricity costs.

But with proposed data centre demand far exceeding current grid capacity, operators say they must prioritise grid reliability over rapid expansion.

Tech firms, however, are pushing back against the idea of being cut off, even temporarily. For the companies, uninterrupted electricity is non-negotiable.

Their data centres power critical sectors such as finance, healthcare, and national security, where even seconds of downtime can cause widespread disruption.

“A reliable power grid is essential for data centres, which depend on consistent, uninterrupted power to support critical operations,” the Data Center Coalition, a trade group representing industry players, said in a statement.

Big Tech companies also argue that relying on backup diesel generators to guarantee uptime could clash with local air-quality rules and environmental goals. Despite these concerns, grid operators insist they must balance rapid industrial demand with system stability, especially as renewable energy integration adds further complexity.

The power tug-of-war underscores a growing dilemma for economies betting on artificial intelligence. AI data centres are voracious energy consumers, and the speed at which they’re multiplying is testing national grids like never before.

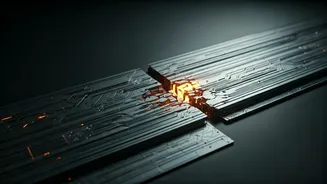

In the United States alone, data centre electricity demand is expected to double by the end of the decade, according to several reports. The clash between Big Tech’s growth and infrastructure limitations highlights a deeper problem, that innovation is outpacing investment.

Without significant upgrades to grid capacity and transmission infrastructure, even the most advanced AI systems could be throttled by something as old-fashioned as a lack of electricity.

For now, hyperscalers appear reluctant to compromise on reliability, while grid operators are under pressure to maintain stability. The battle over power access for AI data centres is not just an energy story, it’s a glimpse into the growing pains of the digital future.

Tech giants are requesting hundreds of gigawatts of additional capacity to fuel data centres, the infrastructure at the heart of the AI boom, but ageing grid systems and lagging investments are creating unprecedented tensions.

Operators of US power grids are struggling to accommodate the massive energy needs of hyperscale data centres, reported Wall Street Journal. These facilities, which run cloud computing and AI training systems, demand continuous and enormous electricity loads, but the existing grid cannot keep up.

A new kind of power struggle

To bridge the gap, grid operators are asking companies such as Microsoft, Amazon, and Google to either bring their own energy sources or agree to conditional connections.

One option being floated is “bring your own generation,” where companies must pair their data centres with dedicated power sources, such as small natural gas plants, renewables, or even nuclear microreactors, instead of relying solely on the public grid.

Another controversial proposal allows tech giants to connect early, but with strings attached, their data centres could be temporarily disconnected from the grid during times of extreme demand to prevent blackouts.

The standoff is particularly intense in areas under PJM Interconnection, the regional grid operator serving parts of 13 US states including Pennsylvania, Virginia, and Ohio, as well as in Texas under ERCOT and regions managed by the Southwest Power Pool (SPP).

These regions have become the epicentres of data centre development, driven by access to cheap land and relatively low electricity costs.

But with proposed data centre demand far exceeding current grid capacity, operators say they must prioritise grid reliability over rapid expansion.

Big Tech pushes back

Tech firms, however, are pushing back against the idea of being cut off, even temporarily. For the companies, uninterrupted electricity is non-negotiable.

Their data centres power critical sectors such as finance, healthcare, and national security, where even seconds of downtime can cause widespread disruption.

“A reliable power grid is essential for data centres, which depend on consistent, uninterrupted power to support critical operations,” the Data Center Coalition, a trade group representing industry players, said in a statement.

Big Tech companies also argue that relying on backup diesel generators to guarantee uptime could clash with local air-quality rules and environmental goals. Despite these concerns, grid operators insist they must balance rapid industrial demand with system stability, especially as renewable energy integration adds further complexity.

The bigger picture

The power tug-of-war underscores a growing dilemma for economies betting on artificial intelligence. AI data centres are voracious energy consumers, and the speed at which they’re multiplying is testing national grids like never before.

In the United States alone, data centre electricity demand is expected to double by the end of the decade, according to several reports. The clash between Big Tech’s growth and infrastructure limitations highlights a deeper problem, that innovation is outpacing investment.

Without significant upgrades to grid capacity and transmission infrastructure, even the most advanced AI systems could be throttled by something as old-fashioned as a lack of electricity.

For now, hyperscalers appear reluctant to compromise on reliability, while grid operators are under pressure to maintain stability. The battle over power access for AI data centres is not just an energy story, it’s a glimpse into the growing pains of the digital future.