However, an examination of her speech and the fine print in the Budget shows there are some reasons for the middle class to cheer.

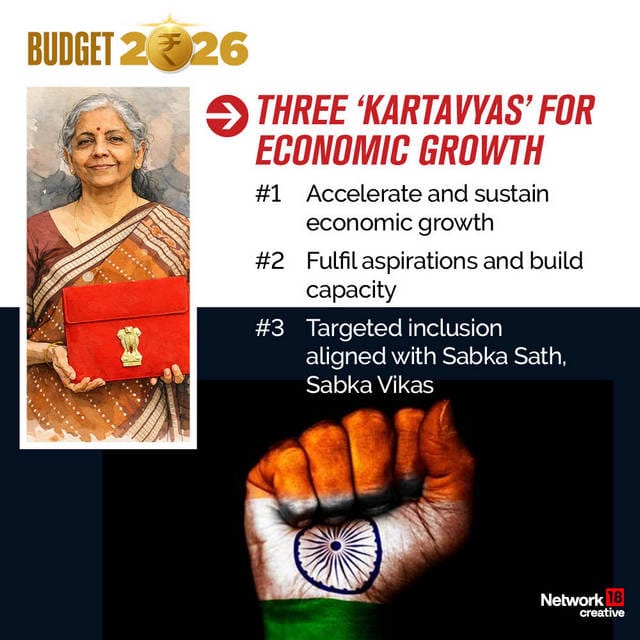

“We have pursued far-reaching structural reforms, fiscal prudence and monetary stability while maintaining a strong thrust on public investment. Keeping Atmanirbharta as a lodestar, we have built domestic manufacturing capacity, enhanced energy security, and reduced critical import dependencies,” Sitharaman said.

“These measures have delivered a growth rate of around 7 per cent and helped us make substantial strides in poverty reduction and improving lives,” she added.

But what’s in the Budget for the middle class?

Let’s take a closer look

While the headline announcement of no change in tax slabs left some taxpayers underwhelmed, a closer look at the Budget speech and fine print shows some measures aimed at helping the middle class.

Income Tax

Direct income tax slabs remain unchanged, meaning taxpayers will continue to pay taxes at the same rates as in the previous financial year. Salaried individuals can still choose between the old and new tax regimes.

Under the new tax regime, salaried taxpayers can claim a standard deduction of Rs 75,000. Under the old tax regime, the standard deduction remains Rs 50,000. While no fresh relief was announced this year, the Centre has stressed that last year’s overhaul of the personal income tax system was designed to put more disposable income in the hands of the middle class.

Finance Minister Nirmala Sitharaman also said income tax forms have been redesigned to make compliance easier for ordinary citizens.

The Income Tax Law, 2025 simplifies the tax framework by:

- Cutting the length of the law and the number of sections by nearly half compared to the 1961 Act

- Replacing “assessment year” and “previous year” with a single “tax year”

- Allowing taxpayers to claim TDS refunds even if ITRs are filed late, without penalty

These changes are expected to reduce litigation and make tax compliance less intimidating for salaried and self-employed individuals alike. It also makes it easier to file taxes without professional help.

Overseas travel and remittances

The Budget offers tangible relief to middle-class families spending on overseas travel, education, or medical needs. The tariff on dutiable personal imports has been reduced from 20 per cent to 10 per cent. TCS on overseas tour packages has been brought down to two per cent from earlier rates of five per cent and 20 per cent, making foreign travel less expensive.

Under the Liberalised Remittance Scheme (LRS), TCS on education and medical expenses has also been brought down from five per cent to two per cent. Taxpayers can now obtain lower or nil TDS certificates through a rule-based automated system, without approaching an assessing officer. Individuals holding shares in multiple companies can submit Form 15G or 15H to depositories, which will automatically send them to the firms.

The Budget offers tangible relief to middle-class families spending on overseas travel, education, or medical needs. Representational/Pixabay

These steps will help families with children studying abroad or relatives undergoing medical treatment overseas, offering indirect relief to NRIs and their India-based dependants.

Sitharaman also announced that the interest on claims awarded by the Motor Accident Claims Tribunal to individuals would be exempt from income tax. Any tax deducted at source (TDS) applied to this will be removed.

Drugs, cheaper electrical products

The Centre has announced that it will make over a dozen cancer medications duty-free.

It will allow duty-free personal imports of medicines for over half a dozen rare diseases. The prices of products used to make microwave ovens, TV equipment, leather goods, and footwear have also been brought down.

Railways

Sitharaman announced plans for over half a dozen high-speed rail corridors.

She said the proposed routes comprise:

- Mumbai–Pune

- Pune–Hyderabad

- Hyderabad–Bengaluru

- Hyderabad–Chennai

- Chennai–Bengaluru

- Delhi–Varanasi

- Varanasi–Siliguri

She said the Centre had laid 34,428 kilometres of new railway tracks between 2014 and 2025 – an average of 8.57 kilometres per day.

Sitharaman also said new trains would be introduced for Himachal Pradesh, Uttarakhand, and Jammu and Kashmir.

Job creation, energy savings

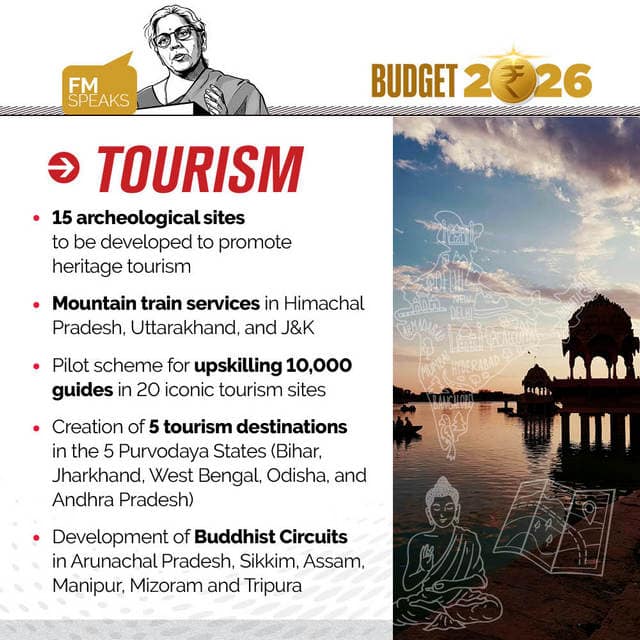

The government has increased its capital expenditure outlay to over Rs 12 lakh crore. Generous provisions have been made for the tourism and railway sectors, both of which will create jobs.

The government has also announced Rs 22,000 crore for the PM Surya Ghar Muft Bijli Yojana. This will encourage people to install solar panels and bring down their electricity bills.

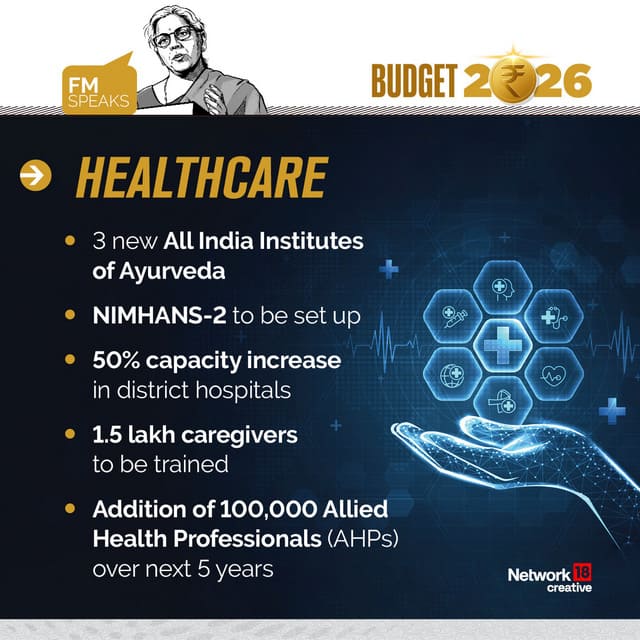

Sitharaman also announced the setting up of five regional medical hubs via public-private partnerships. She said these would integrate healthcare delivery, education, and research facilities.

“These hubs will generate diverse employment opportunities for doctors and allied health professionals,” Sitharaman added.

Education and skills development

The Budget also announced that one girls’ hostel will be set up in every district. This will increase access and safety for those in STEM fields.

Sitharaman announced the setting up of an Indian Institute of Creative Technology in Mumbai. She said this would help India’s content and creative ecosystem. She added that 5,000 content creator labs would be set up in schools and colleges across the nation.

The government also announced it would train 1.5 lakh caregivers. It also declared the launch of a pilot programme to upskill 10,000 tourist guides at iconic destinations.

With inputs from agencies