Infrastructure: Roads & Railways

The Union Budget 2026-27 placed a strong emphasis on boosting infrastructure, with considerable funding allocated to railways and roadways. This approach

signaled the government's dedication to improving connectivity and facilitating economic activity nationwide. Investments in these areas are anticipated to enhance transportation efficiency, reduce logistics costs, and stimulate employment in the construction and related industries. The ongoing focus on infrastructure development aligns with a broader strategy to support long-term economic growth. This will modernize the country's infrastructure, facilitating trade, commerce, and overall economic expansion for India.

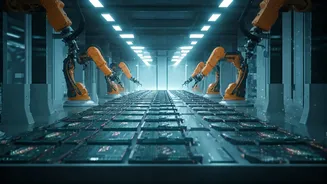

Tax Benefits: Data Centers

In an effort to attract investment and foster technological advancements, the budget included tax incentives for data centers. The government's decision to offer conditional tax-free benefits to data centers demonstrated its recognition of the vital role data infrastructure plays in the digital economy. These incentives are expected to encourage cloud giants to establish and expand their data center operations within India. Such moves will not only boost technological capabilities but also create employment opportunities. This strategy reflects a clear commitment to leveraging technology for economic growth.

Growth & Resilience

The budget was designed to position India to govern growth with judgement and resilience. This overarching theme suggested a commitment to responsible fiscal management and a strategic approach to economic challenges. The government's focus was on maintaining economic stability and navigating uncertainties while pursuing a growth-oriented agenda. The budget emphasized long-term planning, seeking to balance immediate needs with sustainable growth prospects. This forward-thinking strategy aims to build a robust and resilient economy capable of withstanding various global economic pressures. Furthermore, it ensured that the country could continue its development trajectory without compromising stability.

Sectors Impacted

The Union Budget 2026-27 had notable implications for various sectors across the economy. The emphasis on infrastructure directly benefits the construction and related industries, boosting employment and economic activity. Tax incentives for data centers were expected to propel growth within the technology sector, attracting investment and technological advancements. The budget’s strategic allocations reflected a comprehensive approach aimed at boosting economic growth while addressing the country’s needs. The government demonstrated its willingness to support sectors that promote both growth and sustainability. It signaled that the government was ready for the future.