TCS: What's Changed?

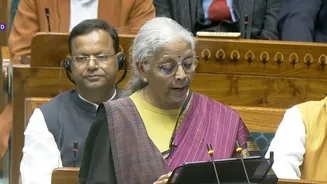

The Union Budget, presented by Nirmala Sitharaman, has made significant changes to the Tax Collected at Source (TCS) regime. Previously, TCS rates on overseas

tour packages varied, with some reaching as high as 20%. Now, the budget has streamlined this, reducing the TCS on overseas tour packages to a flat rate of 2%, irrespective of the amount. This will make international travel more affordable for everyone. In addition, the TCS on education and medical remittances under the Liberalised Remittance Scheme (LRS) has also been reduced from 5% to 2%. This means individuals and families will experience reduced upfront deductions when sending money abroad for educational or medical needs. This change is particularly helpful for parents funding children’s overseas studies or medical treatment abroad, easing the financial burden. The revised framework aims to alleviate the financial strain that travelers and service providers experienced following previous hikes in 2023. These adjustments are designed to help families manage their finances, especially when dealing with the high costs associated with international education or healthcare.

Easing Financial Burdens

These financial adjustments will bring substantial relief to many middle-class families. For example, the reduction in TCS is especially beneficial for parents financing overseas education. In the past, families might have needed additional loans or had to tap into their savings to cover upfront tax payments. Now, the lower TCS rates enable them to retain more of their funds when it's most needed. Expenses like tuition fees, medical treatments, or international travel often involve substantial sums, sometimes running into lakhs. With a reduced TCS, families will no longer need to allocate a significant amount of money to the government months before receiving refunds or adjustments. This allows them to manage their savings, EMIs, and daily expenses more comfortably. The new framework will also streamline payment processes and minimize the upfront tax burden for those booking travel. Many taxpayers encountered delays and confusion in claiming refunds under the old system. Lower collections will also lead to fewer reconciliation issues and simplify tax filing for individuals, leading to smoother financial operations.

Boosting Travel Sector

The measures implemented in the budget are expected to inject vitality into the travel and tourism industry. Tour operators are optimistic that the reduced upfront costs will result in a rise in overseas travel bookings. The Union Budget is viewed as a supportive measure for the travel and tourism industry, recognizing it as a key contributor to employment and economic growth. The focus on infrastructure development, mapping of tourist sites, and skill development will boost both domestic and inbound tourism. Nishant Pitti, founder & chairman of EaseMyTrip, commented that the budget lays a solid foundation for establishing India as a global tourism hub. The changes are expected to revitalize outbound tourism, particularly as overseas travel has rebounded strongly after the pandemic, becoming a significant source of foreign exchange outflows. This is a welcome sign for an industry striving for faster, simpler transactions and better liquidity.