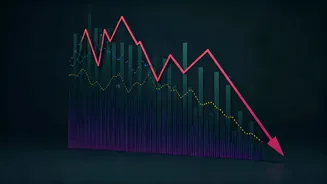

Market's Downward Trend

The stock market in India has seen a decrease recently, leading to concern among investors. The Sensex closed over 400 points lower, and the Nifty fell

below 25,900, indicating a period of downward pressure. This shift is linked to selling by FIIs, influencing market sentiment and causing a ripple effect throughout the financial landscape. These external influences, combined with other internal challenges, have contributed to a shift in market dynamics. The severity of the downturn has prompted questions about the underlying causes and the implications for those involved in investments, which makes it essential for investors to understand the market's movements and what they can mean for them.

FII Selling's Impact

Foreign Institutional Investor (FII) selling is a significant factor contributing to the market's downward trend. The actions of FIIs, who frequently trade in large volumes, have a substantial impact on market behavior. When FIIs sell their holdings, it can create a supply of shares, leading to lower prices and increased volatility. This creates challenges for Indian markets. The market's reaction shows the impact of global sentiment and economic developments. The influence of FII selling raises issues about the broader market and the need for investors to remain cautious and proactive in their investment strategies. Monitoring FII activities is crucial for understanding the market's direction and making informed decisions.

Liquidity Crunch Concerns

The presence of a potential liquidity crunch has become another important consideration within the market. A liquidity crunch refers to a situation where there is not enough money available in the market to support the level of trading activity. This scarcity of available funds can intensify the downward pressure on stock prices. The possibility of such a crunch adds more complexity to the market environment. These factors have led to a more difficult environment for investors, highlighting the need to understand how these elements interact. Investors must also be vigilant about the economic indicators and their effect on market liquidity. They must assess the potential risks associated with a potential liquidity crunch and adjust their strategies accordingly to protect their investments.

Investor Strategies Now

Investors are asking what steps they should take during the market's decline. During such periods of volatility, a clear investment strategy is essential. This would involve a reassessment of current investment portfolios. Investors might consider diversifying their portfolios to spread risk across different asset classes. It's also important to have a long-term perspective. Avoiding emotional decisions driven by short-term market fluctuations is essential. Seek advice from financial experts and stay updated with market developments to make the best decisions. Regular analysis of investment portfolios, informed decisions based on market analysis, and a steady approach will aid in navigating the uncertainties and making well-informed decisions.