Strike's Core Reasons

The bank strike today arises from a confluence of factors, mainly centered around employee concerns and negotiations with bank management. Primarily, the

unions represent the bank employees and officers, who are often in disagreement with the bank management and the government regarding several pending issues such as the revision of wages, better working conditions, and job security. The negotiations include discussions over pay scales, benefits, and the terms of employment. Another factor influencing the strike is the ongoing discussions or disputes over the implementation of certain policies, changes in banking operations, and the impact these changes have on employees. These factors often trigger labor actions, resulting in the public being impacted as well. It is very important to consider the underlying issues driving the strike and how these issues are perceived by those involved in the negotiation and by the government.

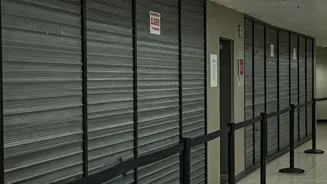

Impact on Services

The bank strike is poised to influence a wide array of banking services across India. Customers should anticipate disruptions in transactions, including withdrawals, deposits, and fund transfers. Branch operations could be either limited or entirely suspended, depending on the level of participation in the strike. The impact will likely vary across different banks, with some branches experiencing more significant effects than others. Online banking services might also encounter difficulties, although these are generally less susceptible to immediate disruptions compared to physical branches. However, heavy transaction volumes and staff shortages could lead to delays in processing transactions. The disruption will be felt by individuals, businesses, and the broader economy, thereby emphasizing the importance of planning for alternative options and contingency measures to deal with the potential delays and the inconvenience that may be experienced.

Mitigating the Effects

To navigate the bank strike, customers have several strategies at their disposal to minimize disruptions. It is advisable to plan ahead and anticipate delays. One of the most important steps to be taken is to complete as many financial transactions as possible before the strike begins, particularly those that require immediate processing. Consider using digital and online banking platforms to conduct your transactions, because they are usually less susceptible to interruptions. ATM withdrawals can also be a viable option for cash needs, but be aware that ATM availability can be affected by the strike. It is best to keep a reasonable amount of cash on hand to cover immediate needs. It is also important to stay updated with your bank’s communications and announcements; the bank might offer updates or provide alternative options during this period. Customers should also consider reaching out to their banks if they have any concerns.

Historical Context & Future

Bank strikes in India have a history of reflecting significant labor and financial issues. These events often signal broader concerns within the banking sector, including debates about policy, employee welfare, and the future of banking. Past strikes highlight recurring tensions between bank employees and management, particularly over pay, working conditions, and the incorporation of new technologies. These past incidents underscore the significance of negotiations and the need to address the root causes of disputes to maintain a stable financial environment. Looking ahead, the frequency and impact of such strikes will likely depend on developments in the banking sector, including technological advancements, policy changes, and the evolving relationship between banks and their employees. Moreover, the resolution of these types of strikes often sets precedents for future labor negotiations and shapes the banking landscape.