Market Overview

The Indian stock market on January 19, 2026, presents a dynamic landscape, and understanding the performance of key players is vital for informed investment

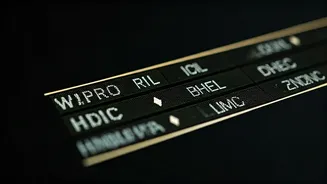

decisions. This report highlights several significant stocks, offering a snapshot of their potential and the prevailing market trends. Investors and financial analysts often look to such reports to navigate the complexities of the market, identifying opportunities, and assessing risks. Focusing on companies like Wipro, RIL, ICICI Bank, and HDFC Bank, among others, the analysis aids in forming a strategic approach to investment. By tracking the movements of these stocks, individuals can stay abreast of changes in the Indian financial sector.

Wipro and RIL

Wipro and Reliance Industries Limited (RIL) represent significant aspects of the Indian market. Wipro, a major IT services provider, is often scrutinized for its performance in the technology sector, including its project wins, and strategic initiatives. The analysis typically covers revenue growth, profit margins, and market positioning. RIL, a conglomerate with interests in energy, retail, and digital services, is a bellwether for the broader Indian economy. Observations frequently center on its quarterly earnings, expansion plans, and its influence on market sentiment. Studying the interplay between Wipro and RIL can provide insights into the overall health and direction of the Indian stock market.

Banking Giants

ICICI Bank and HDFC Bank are at the forefront of India's banking sector. These financial institutions are crucial in providing a gauge of the economy. Investors and analysts frequently examine their financial results, including loan growth, asset quality, and digital banking initiatives. They are also considered for regulatory changes, competitive landscape, and their strategic direction. Their performance can indicate the financial health of businesses and consumers across India. Keeping track of banking stocks is very important for the Indian stock market, as they can heavily influence market sentiment.

Industrial Players

BHEL, LTIMindtree, and Hindustan Zinc are influential players within the industrial sector of India. BHEL, Bharat Heavy Electricals Limited, is a key provider of power generation equipment and industrial products, and its performance reflects activity in infrastructure and manufacturing. LTIMindtree, a technology consulting and digital solutions company, is a sign of the IT sector and provides insights into digital transformation. Hindustan Zinc, a major producer, represents the mining industry and is significant in metal prices and production volumes. Tracking these sectors is important for gauging the health of the Indian economy.

Other Stocks

The broader scope includes the analysis of other key stocks. This could involve smaller companies and sector-specific businesses, which offer a complete view of the market's diversity. This part provides a snapshot of various sectors beyond the prominent companies, and it highlights potential opportunities. Considering these other stocks will help give a more comprehensive view of the market.

Market Implications

The performance of the stocks analyzed offers important implications for the Indian market. The performance of these companies helps give insights into overall economic growth, sector-specific dynamics, and market sentiment. For investors, this analysis enables informed decision-making based on current trends. For financial analysts, it gives context for forecasting market movements. A deep understanding of these elements equips individuals with the knowledge to navigate the market effectively, adjust investment strategies, and capitalize on opportunities that appear.