Budget 2026 Overview

The 2026 Union Budget has garnered significant attention, prompting widespread analysis across various sectors of the Indian economy. One of the central

themes emerging from the budget is the government's commitment to bolstering infrastructure, manufacturing, and the integration of artificial intelligence (AI) across multiple domains. These measures suggest a strategic focus on long-term economic growth and development. The budget also introduces changes to income tax regulations, specifically providing relief for accident victims and rationalizing the Tax Collected at Source (TCS). Discussions also included a first-ever Global Big Cat Summit to be hosted by India. The budget aims to stimulate investment, improve the business environment, and support inclusive growth, reflecting a broader vision for a 'Viksit Bharat'.

Infrastructure and Capex Boost

A significant aspect of Budget 2026 is the substantial boost to capital expenditure (Capex). This investment is designed to drive the 'Reforms Express,' particularly in areas of infrastructure development. Increased investment in infrastructure has the potential to create a multiplier effect throughout the economy. It boosts employment opportunities in construction, engineering, and related sectors. Beyond direct employment, improved infrastructure leads to better connectivity. It eases transportation of goods and services, which promotes trade and reduces logistics costs. This will directly support sectors like manufacturing, by lowering operating costs and enhancing competitiveness in the global market. The budget's emphasis on capital expenditure indicates a proactive strategy to foster sustainable and inclusive economic growth by enhancing physical infrastructure.

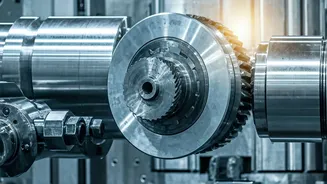

Manufacturing and AI Integration

Budget 2026 highlights the importance of the manufacturing sector. Government policies are likely geared towards boosting domestic production, attracting foreign investment, and improving the overall competitiveness of Indian industries. Investment in manufacturing goes hand-in-hand with technological advancements, especially in AI. AI has the potential to transform industrial processes, improve efficiency, and create new opportunities. Budget initiatives promoting AI may include support for research and development, skills training, and adoption of AI technologies across manufacturing. Such developments can lead to the creation of higher-skilled jobs, stimulate innovation, and enhance India's position in the global manufacturing landscape. This strategic alignment underscores the government's vision for a modern, technology-driven economy.

Income Tax Reforms

The budget also brought changes to income tax regulations. These changes have direct implications for taxpayers and reflect the government's efforts to provide relief and streamline the tax system. Specifically, the budget provides income tax relief for accident victims. This measure acknowledges the financial strain that follows accidents. It offers support and aligns with the government's broader social welfare objectives. Additionally, the budget rationalizes Tax Collected at Source (TCS). Streamlining TCS can reduce compliance burdens for businesses. It also ensures greater efficiency in the collection process. These income tax measures indicate a balanced approach to supporting individuals and businesses, contributing to both economic and social well-being.

Adventure Tourism Push

The Union Budget 2026 also shows the government's focus on tourism, with specific initiatives aimed at adventure tourism. This sector has the potential to attract both domestic and international tourists, leading to economic gains in various regions. States that can potentially benefit from adventure tourism initiatives might include those with diverse geographical features. They include regions with mountains, forests, rivers, and coastal areas. This push supports growth in local economies. It promotes job creation, and provides the opportunity to showcase India's natural beauty and cultural heritage. The government's investment in adventure tourism can contribute to a more diversified and robust tourism sector.