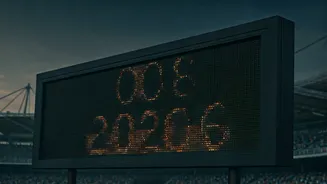

Budget 2026 Overview

Budget 2026 represents a crucial fiscal policy announcement, setting the course for economic and financial conditions. It is expected that the budget will

outline revenue projections, expenditure plans, and potential shifts in taxation policies. These components are vital for evaluating the economic strategy of the government and anticipating changes that may influence various sectors. Discussions often concentrate on specific sectors, such as infrastructure, healthcare, education, and social welfare programs, including funding allocations and policy interventions.

Economic Expectations

Economic experts and financial analysts are keenly watching several key indicators. Anticipations often cover aspects like inflation rates, GDP growth forecasts, and employment figures. Specific areas of focus include anticipated government spending directed towards infrastructure projects, which might boost construction and related industries. Furthermore, revisions to tax regulations, corporate tax rates, and personal income tax slabs are potential subjects of interest, affecting investment decisions and the disposable income of individuals. Such changes could lead to significant impacts on the overall economic climate.

Policy Impact Analysis

Budget 2026’s policy implications could encompass several dimensions. Tax changes could influence investment decisions, affecting the stock market and corporate earnings. Investment incentives may stimulate economic activity, thus increasing job opportunities. Regulatory modifications in crucial sectors, such as banking and insurance, might result in new market dynamics and investment prospects. Infrastructure spending is often anticipated to benefit industries such as construction, transportation, and logistics. Simultaneously, modifications in social welfare schemes may influence consumption patterns and societal welfare.

Financial Planning

Understanding the intricacies of Budget 2026 is critical for individuals and businesses alike. Personal financial planning may require adjustments based on alterations to tax slabs or new incentives. Investors may need to re-evaluate their portfolios, considering investment options and sector dynamics. Businesses should analyze the impact of changes in corporate tax rates and regulatory environments, planning their operations accordingly. Consulting financial advisors and tax experts is recommended to formulate informed strategies and adapt to evolving fiscal landscapes. Vigilance and proactive planning are essential to optimize financial outcomes amid budget-related shifts.

Sectoral Implications

Different industries are expected to see varied effects from Budget 2026. The infrastructure sector may experience substantial growth through increased government investments, leading to new project launches and business prospects. The healthcare and education sectors may benefit from escalated allocations and policy reforms. The real estate market could be affected by changes in property tax regulations and incentives, potentially leading to alterations in market activity. The manufacturing sector may be impacted by adjustments in customs duties and production-linked incentives. Assessing these sectoral implications will prove critical for strategic planning in the future.

Long-Term Outlook

The Budget 2026 is expected to set a roadmap for the Indian economy, projecting its direction over the coming years. Fiscal policies could promote long-term economic growth by influencing investor confidence and business investments. Sustainable development goals might be integrated, prioritizing environmentally friendly initiatives. The budget could drive initiatives towards innovation, digital transformation, and skill development, which will play a critical part in long-term economic advancement. Proactive evaluation and strategizing are key to leveraging opportunities and mitigating risks for both businesses and individuals, setting the stage for future financial planning.