What's Happening?

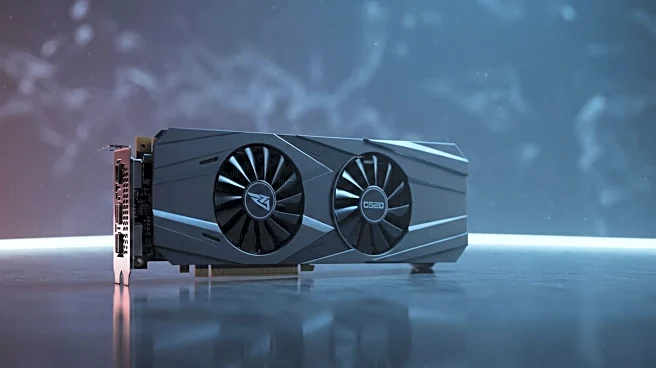

Nvidia, a leading semiconductor company, is set to release its quarterly earnings report this week, drawing significant attention from Wall Street. The company's stock has been a focal point in the tech sector, with analysts adjusting their projections to reflect a higher price target of $194 per share. Nvidia's performance is seen as a bellwether for the broader technology market, which has experienced volatility due to tariff wars and competition from emerging companies like DeepSeek. Despite these challenges, Nvidia remains a dominant player in the AI and semiconductor industries, with expectations of continued growth.

Why It's Important?

Nvidia's earnings report is crucial for investors and analysts as it provides insights into the health of the tech sector, particularly in the semiconductor industry. The company's ability to maintain its growth trajectory amidst external pressures, such as competition and geopolitical tensions, will be closely scrutinized. Nvidia's performance could influence market sentiment and investment strategies, impacting not only its stock but also the broader tech market. The company's strategic moves, including potential collaborations with the U.S. government, highlight its role in shaping the future of AI and semiconductor technologies.

What's Next?

Investors will be watching Nvidia's earnings report for indications of its future growth prospects and market positioning. The company's ability to navigate challenges and capitalize on opportunities in the AI and semiconductor sectors will be key to sustaining its market leadership. Additionally, Nvidia's potential collaboration with the U.S. government on new chip production could have significant implications for its strategic direction and competitive advantage. The outcome of these developments will be critical in determining Nvidia's long-term success and its impact on the tech industry.