What's Happening?

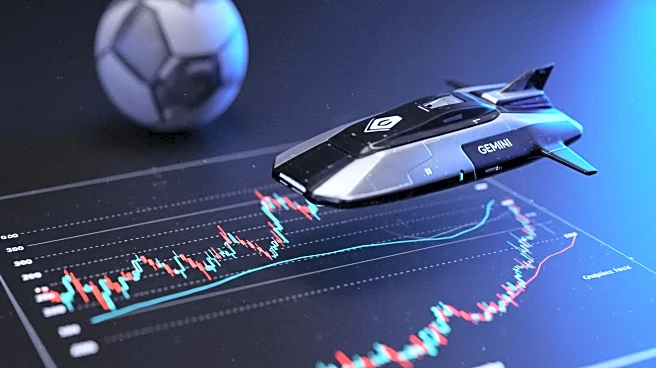

Velo3D, a prominent player in the additive manufacturing industry, has recently completed its uplisting to Nasdaq under the ticker 'VELO' following a $17.5 million public offering. Despite a 32% year-over-year revenue increase to $13.6 million in Q2 2025, driven by system sales and Rapid Production Services (RPS) bookings, the company faces significant financial challenges. GAAP net losses widened to $13.8 million, and adjusted EBITDA was -$8.9 million, indicating reliance on external financing. With only $854,000 in cash reserves as of June 30, 2025, Velo3D's liquidity is concerning, given its high burn rate of $13-14 million per quarter.

Why It's Important?

Velo3D's financial struggles highlight the broader challenges within the additive manufacturing sector, which is known for its high-risk, high-reward nature. The company's focus on aerospace and defense sectors, while strategically beneficial, exposes it to market volatility and cyclical spending patterns. Investors in the sector must consider the implications of Velo3D's financial health on their investments, as the company's ability to achieve profitability remains uncertain. The situation underscores the importance of capital discipline and operational execution in high-growth industries.

What's Next?

Velo3D aims to achieve $50-60 million in revenue and a gross margin exceeding 30% by Q4 2025, with a path to EBITDA positivity by mid-2026. Key factors include scaling RPS, improving operational efficiency, and managing liquidity without dilutive financing. Investors should monitor upcoming financial results for signs of improvement and assess macroeconomic risks in aerospace and defense sectors, which could impact Velo3D's strategic positioning.

Beyond the Headlines

The company's journey serves as a cautionary tale for the additive manufacturing industry, emphasizing the need for financial resilience and strategic partnerships. Velo3D's reliance on niche markets like aerospace and defense could lead to long-term shifts in industry dynamics, affecting investment strategies and technological advancements.