What's Happening?

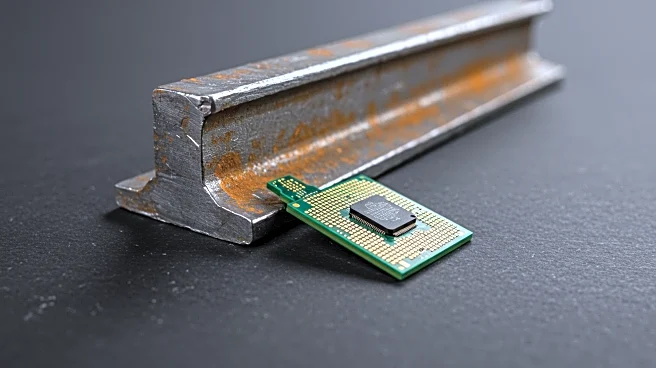

President Donald Trump has announced plans to impose new tariffs on steel and semiconductor imports, aiming to bolster U.S. manufacturing. During a trip to Alaska, Trump outlined a phased strategy where initial tariff rates would be low, allowing companies time to shift production to the U.S. before increasing sharply in the future. The proposed tariffs could reach as high as 300% in the long term. This approach is similar to previous efforts to incentivize domestic pharmaceutical production, with the goal of reducing reliance on foreign supply chains. While exact initial rates were not specified, the tariffs are intended to encourage local manufacturing. These measures follow earlier tariffs on steel and aluminum, which were increased to 50% in May 2025. The administration plans to finalize the details within the next two weeks, with implementation likely before August 8.

Why It's Important?

The tariffs are part of broader efforts to reindustrialize the U.S. economy and strengthen national security through supply chain resilience. The move aligns with recent announcements from companies like Apple, which has committed $100 billion to domestic operations, supporting the administration's industrial policy goals. Analysts suggest the tariffs could significantly impact global markets, particularly in the technology and metals sectors, potentially leading to shifts in semiconductor supply chains. Domestic producers have shown support for the tariffs, while international trade partners have expressed concerns over escalating tensions. The potential impact on financial markets, including cryptocurrencies, is also noted, as trade tensions can increase market volatility.

What's Next?

The final implementation of the tariffs will likely shape global supply chain strategies and influence market sentiment in the coming months. The administration is expected to finalize the details within the next two weeks, with implementation likely before August 8. The timing of the announcement, coinciding with Trump's meeting with Russian President Vladimir Putin, suggests a strategic effort to reinforce domestic economic priorities while maintaining diplomatic flexibility.

Beyond the Headlines

The tariffs could lead to long-term shifts in global supply chains, with manufacturers potentially relocating to avoid tariffs or qualify for exemptions. This development may also influence decentralized financial instruments as investors seek hedges against geopolitical uncertainty. The broader economic adjustments resulting from the tariffs could have lasting impacts on U.S. industries and international trade relations.