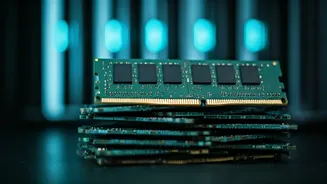

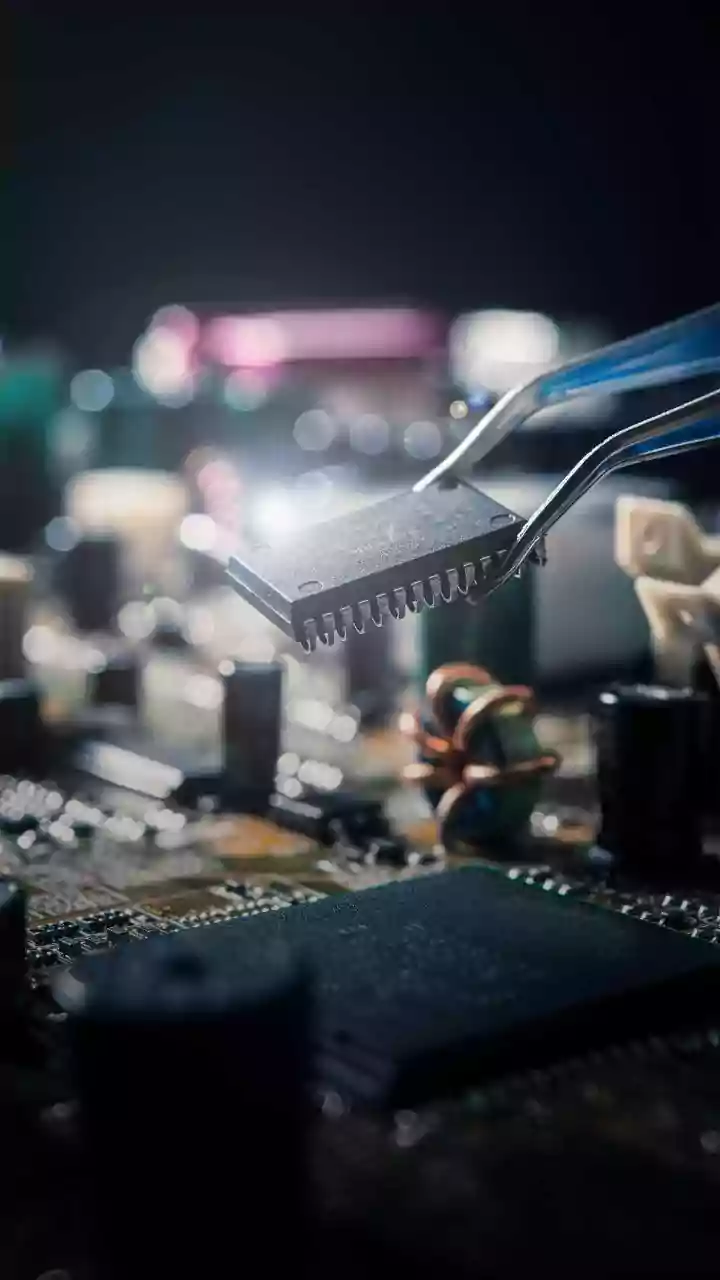

New Delhi: If you are planning to buy a new laptop, upgrade your gaming PC, or wait for the next PlayStation 6, 2026 may test your patience. A global shortage

of memory chips, commonly known as RAM or DRAM, is now squeezing supply chains across industries. Prices are rising fast. Production timelines are getting pushed.

The reason is simple. Artificial intelligence data centers are consuming huge amounts of memory. Companies like Nvidia, Advanced Micro Devices and Google are buying up large volumes of RAM for AI accelerators. Three companies, Micron, SK Hynix and Samsung Electronics, control almost the entire RAM market. Their supply is now heavily tilted toward AI servers.

Why is there a RAM shortage?: AI data centers

The scale is staggering. Nvidia’s latest Blackwell chip comes with 192 gigabytes of RAM. An integrated AI server system called NVL72 packs 72 Blackwell chips and 13.4 terabytes of RAM. Each NVL72 system uses enough memory for a thousand high end smartphones or a few hundred powerful PCs.

Meta, Microsoft, Amazon and Alphabet are ramping up data center spending from $217 billion in 2024 to an estimated $650 billion in 2026. That money flows straight into AI chips loaded with memory. As one industry term puts it, “RAMmageddon” is the word some use to describe what’s coming.

Micron has already reshuffled priorities. In December, it said it would discontinue a part of its 30-year-old Crucial brand that served consumer PC builders, to save supply for AI chips and servers.

PS6, Steam Deck OLED and gaming hardware at risk

According to a Bloomberg report, Sony Group Corp. is considering pushing back its next PlayStation (PS6) console to 2028 or even 2029. Nintendo is also thinking about raising the price of its Switch 2 in 2026. Gaming hardware depends heavily on DRAM. If supply tightens, launch plans shift.

Even checking DDR5 RAM prices on Amazon, or even at Nehru Place shows sharp spikes over the past six months. We have been tracking this since November, and the numbers are hard to ignore.

Smartphones, cars and EVs feel the heat

Chinese smartphone makers including Xiaomi, Oppo and Transsion are trimming shipment targets for 2026. Oppo may cut its forecast by as much as 20 percent, according to Chinese outlet Jiemian.

The auto sector is not immune. Legacy chips used in ICE cars are losing priority as memory makers pivot to AI focused products. This has echoes of Covid era chip shortages that hit automakers from German car makers to the Indian auto industry.

Industry leaders including Elon Musk and Tim Cook have warned of a growing crisis. Since the start of 2026, Tesla Inc. and Apple Inc. have signaled that DRAM shortages will constrain production.

For consumers, the message is clear. ChatGPT, Claude, Gemini are useful and AI-generated videos are fun. But the cost could show up in your next gadget bill.