What is the story about?

What's Happening?

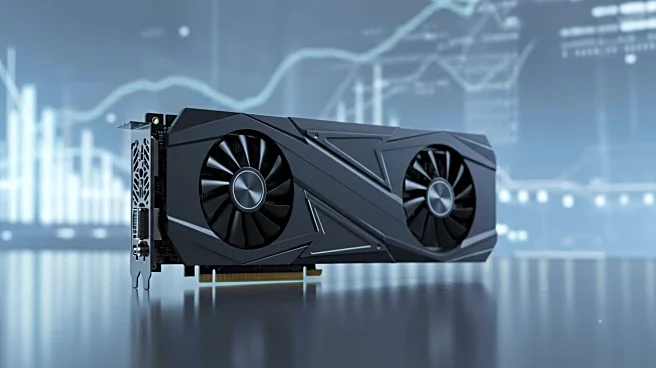

Nvidia Corp, a leading GPU manufacturer, is preparing to release its second-quarter 2026 earnings on August 27. Ahead of this, UBS's top analyst Timothy Arcuri has increased his price target for Nvidia shares from $175 to $205, maintaining a Buy rating. Arcuri cites strong demand signals and anticipates Nvidia will exceed current revenue forecasts by approximately $1 billion. Nvidia's recent financial performance includes revenue of $44.06 billion and profit of $18.78 billion for the quarter ending April 27, compared to $26.04 billion in revenue and $14.88 billion in profit during the same period last year. The analyst also notes significant momentum in data centers and a deal with the U.S. government facilitating H20 chip sales in China, potentially contributing 15% of future revenue.

Why It's Important?

The raised price target and positive outlook from UBS reflect strong market confidence in Nvidia's growth prospects, particularly in data centers and international sales. This optimism is echoed by other analysts, with 34 out of 38 rating Nvidia as a Buy. The company's ability to secure government deals and expand its product offerings in China could significantly boost its revenue, impacting the tech industry and investor sentiment. Nvidia's performance is crucial for stakeholders in the semiconductor sector, as it influences market trends and investment strategies.

What's Next?

Nvidia's upcoming earnings report on August 27 will be closely watched by investors and analysts. The company's ability to meet or exceed expectations could further bolster its stock price and market position. Continued expansion in data centers and successful execution of international sales strategies will be key areas to monitor. Stakeholders will also be attentive to any new developments in Nvidia's partnerships and product innovations.

Beyond the Headlines

Nvidia's strategic moves, including its government deal for chip sales in China, highlight the geopolitical dimensions of tech industry operations. The company's growth in data centers underscores the increasing demand for advanced computing solutions, which could drive long-term shifts in technology infrastructure and innovation.