What's Happening?

Foxconn Industrial Internet (FII) has reported a significant increase in its H1 2025 financial results, with a net profit rise of 38.6% year-over-year. This growth is attributed to the company's strategic shift towards artificial intelligence (AI) and cloud infrastructure. Foxconn's cloud and networking division now accounts for 30% of its total revenue, with AI servers making up 40% of server sales. The company has secured exclusive contracts to assemble NVIDIA's Blackwell-powered GB200 chips, which have contributed to its profitability. Despite facing margin pressures due to cost inflation and supply chain complexities, Foxconn has demonstrated disciplined capital allocation, including a $900 million investment in an AI server plant in Mexico.

Why It's Important?

Foxconn's strategic pivot towards AI and cloud infrastructure is crucial as the global manufacturing landscape evolves. By focusing on high-margin innovations and vertical integration, Foxconn is positioning itself as a leader in the AI supply chain. This move not only mitigates geopolitical risks associated with U.S.-China trade dynamics but also diversifies its revenue streams into AI servers and electric vehicle infrastructure. The company's robust liquidity position and strategic partnerships with industry leaders like NVIDIA and Siemens enhance its resilience against market volatility. As AI infrastructure spending accelerates, Foxconn's ability to deliver comprehensive solutions could significantly impact its long-term growth and market dominance.

What's Next?

Foxconn's upcoming H1 2025 earnings report on August 14 will be a critical indicator of its future performance. Analysts are closely monitoring the company's margin expansion and AI server growth, which could lead to a stock rebound. Investors are advised to watch for dips below NT$40, which may present a compelling entry point. The company's continued focus on AI infrastructure and strategic partnerships suggests potential for sustained growth and innovation in the tech manufacturing sector.

Beyond the Headlines

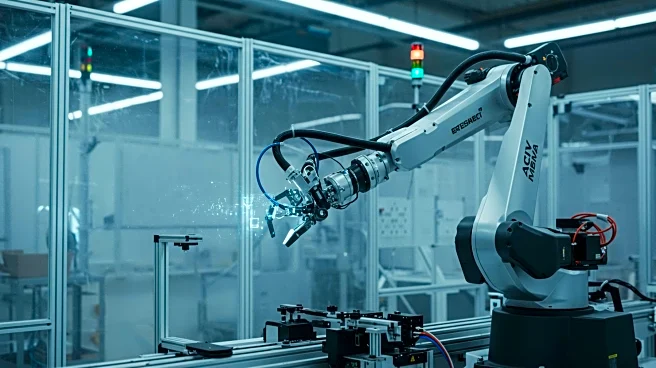

Foxconn's transformation from a traditional iPhone assembler to an AI infrastructure leader reflects broader shifts in tech manufacturing. Its ability to navigate geopolitical tensions and market volatility while focusing on high-margin innovations highlights its strategic vision. This evolution underscores the importance of adaptability and foresight in the rapidly changing tech industry, positioning Foxconn as a key player in defining the future of AI-driven manufacturing.