Whether you want it or not. Whether players want it or not.

A salary cap is going to be proposed by MLB owners for the next collective bargaining agreement with the MLB Players Association. The current CBA, as you know, expires on Dec. 1. There will, absolutely, positively, be a lockout on that day. You can count on that. The only question is: How long will that lockout last?

Last week, Evan Drellich of The Athletic took a deep dive into the concept of a salary cap and floor. It’s a given, I believe,

that players would not accept any sort of cap unless it had a floor, and with that a guaranteed percentage of league revenue given to players. If — and that’s a BIG if — a system like that were accepted, players would likely make more money, because the teams that currently don’t spend money to around the MLB per-team average would be forced to bring up their payrolls. That’s illustrated very well in the table below. Many thanks to Benjamin Jones, my counterpart at the SB Nation Twins site Twinkie Town, for producing this data. The numbers are from Spotrac as of last Thursday. We’ll have a Cubs payroll update here before the regular season begins.

The $14,355,920 would be the total that players would net under a 240/16o cap/floor system. Obviously those numbers are a starting point, and the ones used in Drellich’s article. He writes:

“The biggest beneficiaries are going to be the biggest markets, and the biggest losers will be the small markets,” said the management source. “They’ll have to spend money in order to be a part of this. And the big markets will do well because there will be no pressure from fans to go to $300-400 million payrolls and so forth.”

The cap and floor would not take full effect immediately. A phase-in period would be needed over a number of years where teams would have grace periods to comply, raising or lowering payroll.

Industry sources said it was unlikely owners would ask to alter existing player contracts: long-term deals reached agreed to in the current system would be honored. The union would oppose clawbacks in any system.

Okay, all of that makes sense, I think. If you are following that line of thinking, it could continue in this manner:

MLB and the players would negotiate what percentage of the industry’s revenue goes to each side. For 2024, MLB estimated the total haul to be about $12.1 billion. Caplin said he could not provide a 2025 figure because it is not yet final.

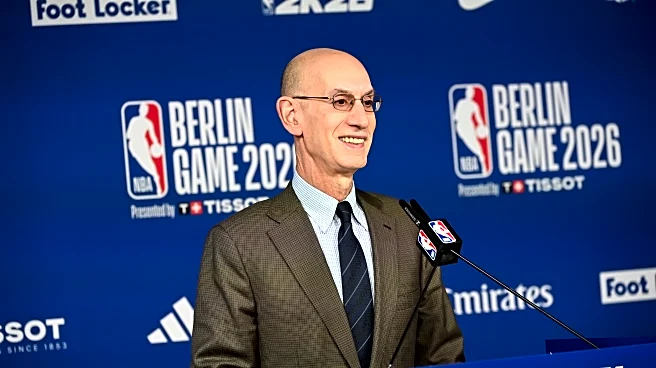

The league office and the union can calculate how much of that money goes to the players and how much to the owners, and the percentages change, at least a little, every year. Last summer, commissioner Rob Manfred said the players’ share was about 47 percent.

[MLBPA Deputy Director Bruce] Meyer countered Wednesday that, “if you include all the compensation paid pursuant to the current major league CBA, the players’ share is comfortably over 50 percent.”

A cap system eliminates year-to-year variability. The sides would negotiate the percentages they receive in advance. Importantly, the league could offer players a larger share than they receive now if they agree to a cap.

“My first deal where I was the chief negotiator in 2002, we were spending 63 percent of our revenue on players,” Manfred said.

That 63 percent figure sounds a bit too high to me, but 47 percent is likely too low. I believe players should get at least 50 percent of league revenue. That would still leave most teams with very large profit figures. How would such a system work?

If MLB gets its way, contracts like the 15-year, $765 million deal Juan Soto signed with the New York Mets could never be given out again.

MLB is eyeing a NHL-style “hard cap,” a source said, which would create firm limits in three areas: club payroll, individual contract length and individual player salary.

But caps can take different forms. MLB could initially propose a max number of years for individual contracts and then relent, for example.

The NBA has what is referred to as a “soft cap,” where the limit on team payroll has some flexibility — but when the dust settles, everything still falls in line with the overall split.

The free agency and arbitration processes would also change. In the current system, it would be almost unthinkable for owners to let players become free agents sooner than the current wait time of six years, or to hit arbitration earlier than the current standard of three years. But a cap could reduce those wait times.

A big bump in the minimum salary, which is $780,000 this year, would likely be on the table as well, one larger than the league would otherwise propose.

“I think it’s going to be very persuasive for a lot of the players,” a management source said. “You’re seeing a lot of players now see the NBA, NFL and NHL, nobody’s in the poor house. There’s a lot of money going around to a lot more people.”

Sorry for the very long quotes from Drellich’s article, but I believe they are necessary to understanding how a salary cap system would work. The point about “a lot of money going around to a lot more people” is a salient point. As noted, the minimum salary would likely go way up from its current level, and as noted, perhaps owners offer earlier free agency to players, or earlier arbitration, or both. Ownership did throw pre-arb players a bit of a bone in the last CBA by creating the pre-arb bonus pool, where each team puts $1,666,667 ($50 million total) into a pool that is then divided among the top-performing pre-arb players. As I noted here last November, Pete Crow-Armstrong, Cade Horton and Michael Busch all got payouts from the pre-arb bonus pool for 2025:

PCA received $1,206,207 (which included the $500,000 for making the all-MLB second team), Horton $858,806 (which included the $500,000 for finishing second in Rookie of the Year voting) and Busch got $483,708.

There’s a lot more to Drellich’s article and I would commend it to all of you. I realize it’s behind a subscription paywall, but The Athletic has quite a number of really good baseball writers and it’s worth the price. No one paid me to say that, I truly believe it. Drellich, in particular, does outstanding coverage of the business of baseball. His article concludes:

In this negotiation, a cap is not only a potential end, but a means to an end. Amidst dwindling local TV revenues, Manfred wants to change baseball’s media rights structure, and a cap is a lever to do so.

Manfred wants to take more local games national, and ultimately, spread TV money around more evenly between clubs. Revenue sharing is a hotly contested topic, and the big-market teams won’t give up their prized local rights for free. But that’s where a cap comes in: it’s a unifier for owners in making other trade-offs.

The rub, of course, is that a cap has long been a unifier for players as well.

“What would really be bad for the sport and for the media rights,” Meyer said, “would be for the league, coming off a season with all this momentum, to choose to shut it down and miss games to get a restriction that they don’t need.”

This is undoubtedly true. Maybe 240/160 isn’t the right balance for a cap/floor system. That would put the floor at only 67 percent of the cap. Other North American sports that have salary cap systems have their floor closer to the cap, or have cap “exceptions” or other rules that make them less of a “hard” cap, though Drellich notes that MLB owners would lean toward a NHL-style system which is more of a “hard” cap.

It’s been more than 50 years since MLB players first went out on strike in 1972 because a salary cap was proposed by team owners. We lost a third of the 1994 season, that entire postseason and part of the 1995 season because hard-line owners wanted a cap. That’s more than 30 years ago and ownership still wants some sort of cap. Players have been against it for more than half a century. I’m not going to take ownership’s side here because they’re all billionaires and the money that flows into the game — as noted above, somewhere around $12.1 billion last year — is only there because the players make MLB what it is. Players should get their fair share of the revenue. If a cap/floor system would send more money to players, then perhaps it’s the way to go.

Two other national writers weighed in on this issue last week, and both are worth reading. Jeff Passan of ESPN focused on the Kyle Tucker contract and where that’s leading. Ken Rosenthal of The Athletic wrote about some ideas to change baseball’s financial structure without a salary cap.

And if there’s no agreement on a cap/floor system with a guaranteed percentage of revenue to players? Well, then we might be in store for a long lockout. As always, we await developments.