The Los Angeles Dodgers won the World Series for the second year in a row, and did so with the highest-paid team in Major League Baseball history. The Dodgers’ payroll in 2025 for competitive balance tax purposes was $417.3 million, per Ronald Blum at Associated Press, which resulted in a record-setting luxury tax levy of $169.4 million.

At $417,341,608 in 2025, the Dodgers bested the $374.7 million by the 2023 New York Mets for the highest payroll in MLB history. The 2024 Dodgers at $353 million had

the third-highest payroll.

The $169,375,768 million in competitive balance tax is also a new MLB record, surpassing the $103 million paid by the Dodgers last season.

This is the fifth season in a row the Dodgers have surpassed the competitive balance tax threshold. Any team repeating three or more years in a row as payers are subject to the highest tax rates at each level. In 2025, the initial CBT threshold was $241 million. The Dodgers paid a 50-percent tax for the first $20 million over the threshold, 62 percent for the next $20 million, 95 percent for the next $20 million, and 110 percent on everything above $301 million.

A total of nine teams paid competitive balance tax in 2025, including the Mets, Yankees, Phillies, Blue Jays, Padres, Astros, Red Sox, and Rangers.

The Dodgers surpassed the third threshold of $281 million, which in addition to the elevated tax rate comes with the extra penalty of their first draft pick in 2026 dropping 10 slots, which was also the case for Los Angeles in the 2022 draft, 2023 draft, and 2025 draft as well.

Adding Shohei Ohtani, Yoshinobu Yamamoto, and Tyler Glasnow on big deals and extending Will Smith for 10 years prior to the 2024 season ensured the Dodgers would be paying the luxury tax for the foreseeable future, a trend that continued last offseason by signing Blake Snell, Tanner Scott, Teoscar Hernández, and Tommy Edman, and this month with Edwin Díaz.

The Dodgers have 15 players under contract for 2026, and adding in assumptions for minor leaguers on the 40-man roster, the pre-arbitration bonus pool, and standard team benefit costs, the estimated payroll next season for CBT purposes is already over $315 million, and that’s before the four remaining players eligible for salary arbitration plus filling out the rest of the roster.

The first CBT threshold is $244 million in 2026 – the final season of the current collective bargaining agreement – with the fourth and highest threshold at $304 million.

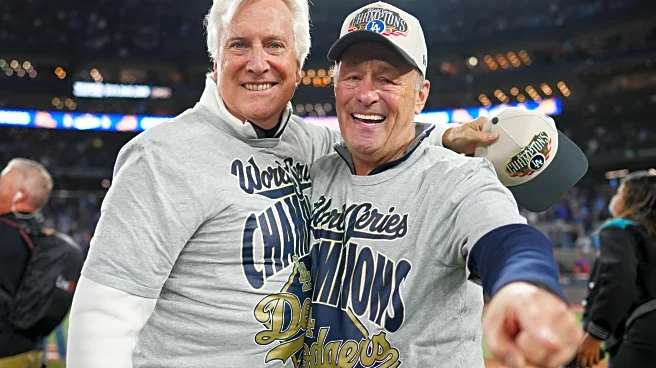

Guggenheim Partners has owned the Dodgers since May 2012. In the 13 full seasons under this group, beginning in 2013, the Dodgers have paid the competitive balance tax 10 times, averaging $272.9 million in payroll per season with a total tax paid of $506.6 million. Both of those figures lead MLB in that span, with the New York Yankees second in each category, totaling $299.6 million in tax with an average payroll of $249.6 million.

Competitive balance tax payments are due to Major League Baseball by January 21. The first $3.5 million of the total tax collected is used to defray costs associated with teams’ funding of the players benefit plans. The rest is divided as follows, per the collective bargaining agreement:

(a) 50% of the remaining proceeds collected for each Contract Year, with accrued interest, shall be used to fund contributions to the Players’ individual retirement accounts, as provided in the Major League Baseball Players Benefit Plan Agreements.

(b) The other 50% of the remaining proceeds collected for each Contract Year, with accrued interest, shall be used to fund a Supplemental Commissioner’s Discretionary Fund.