What is the story about?

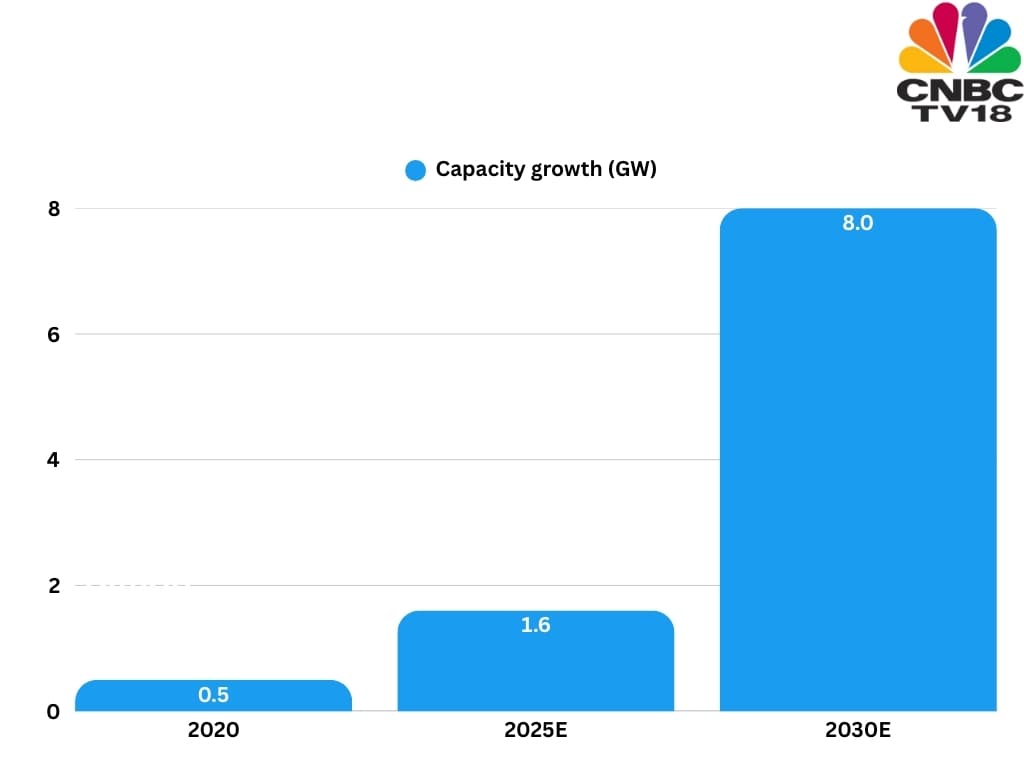

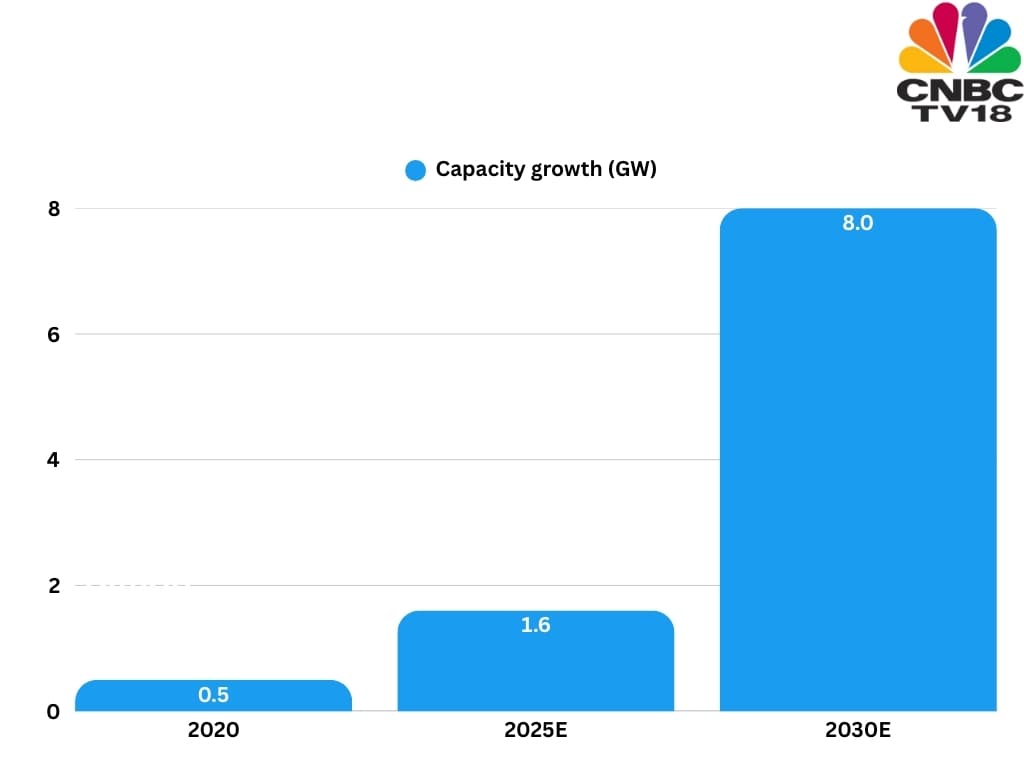

India’s data centre industry hit a turning point in 2025. Capacity has grown more than threefold in just five years — from around 0.5 gigawatt (GW) in 2020 to an estimated 1.6 GW in 2025.

This expansion is linked to a nearly 30-fold jump in data consumption since 2017. India now has close to 900 million internet users, and artificial intelligence (AI) usage is rising fast.

Capacity Growth

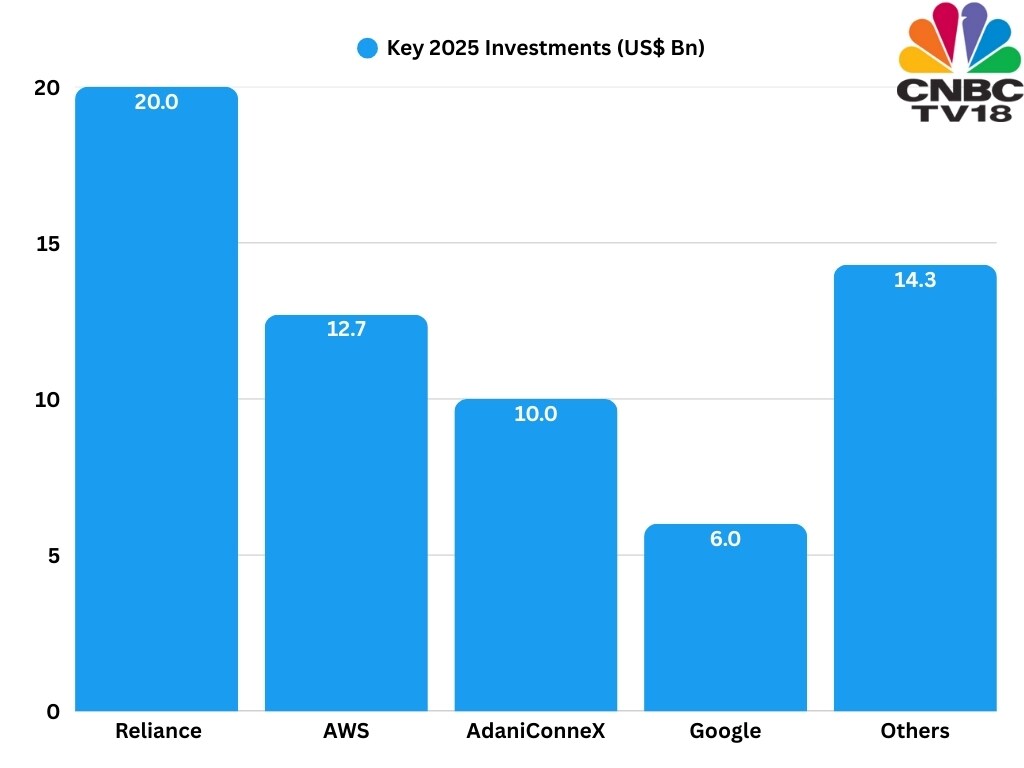

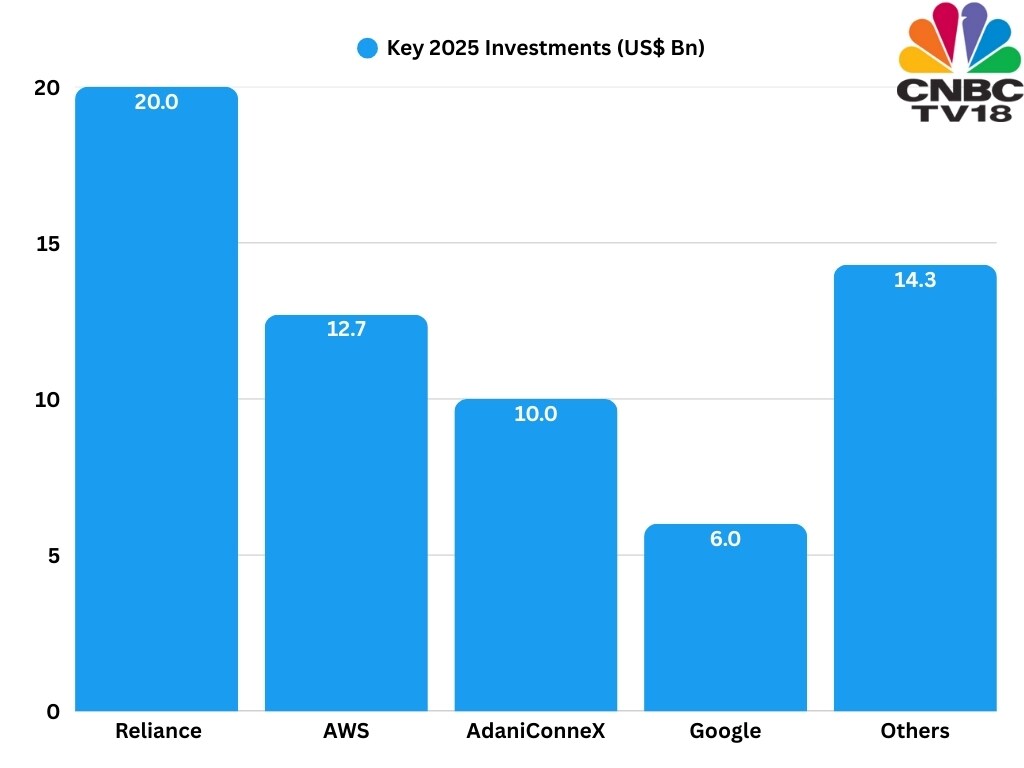

The year also saw a wave of mega announcements. Reliance Industries unveiled world’s largest data centre in Jamnagar, along with a 1 GW AI facility built with Nvidia. TCS announced HyperVault targeting 1–1.2 GW over five years. OpenAI committed 1 GW of capacity as well.

Overall, 2025 saw $63 billion worth of announcements ($43 billion excluding Reliance), according to Bernstein.

Key 2025 Investments

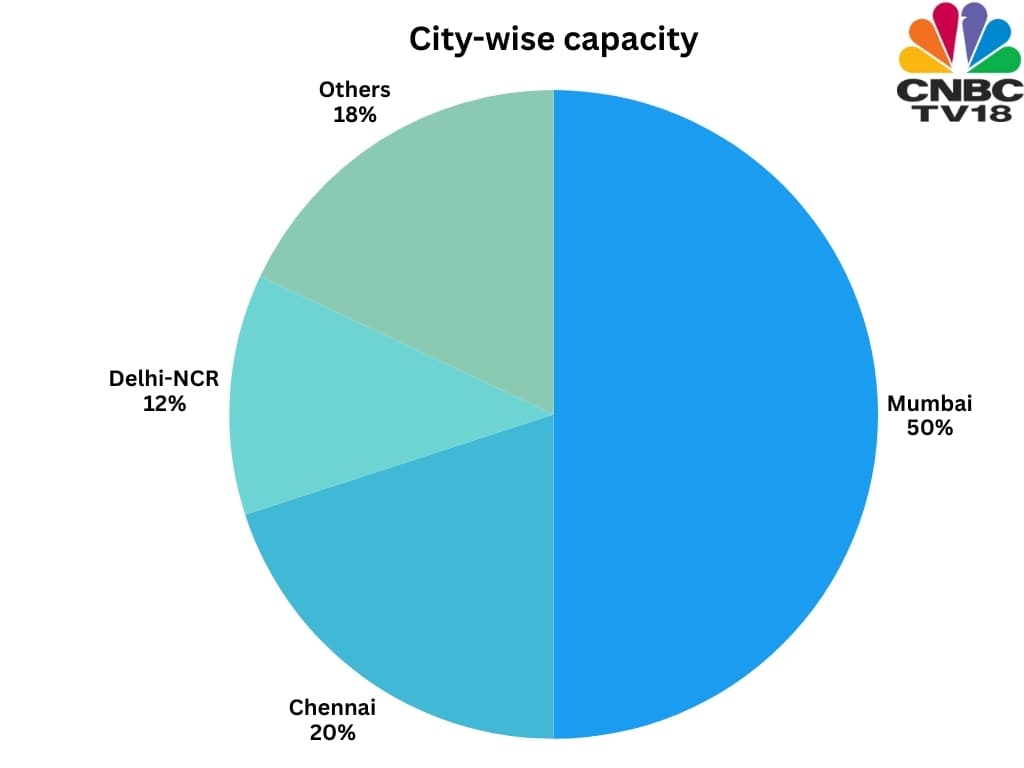

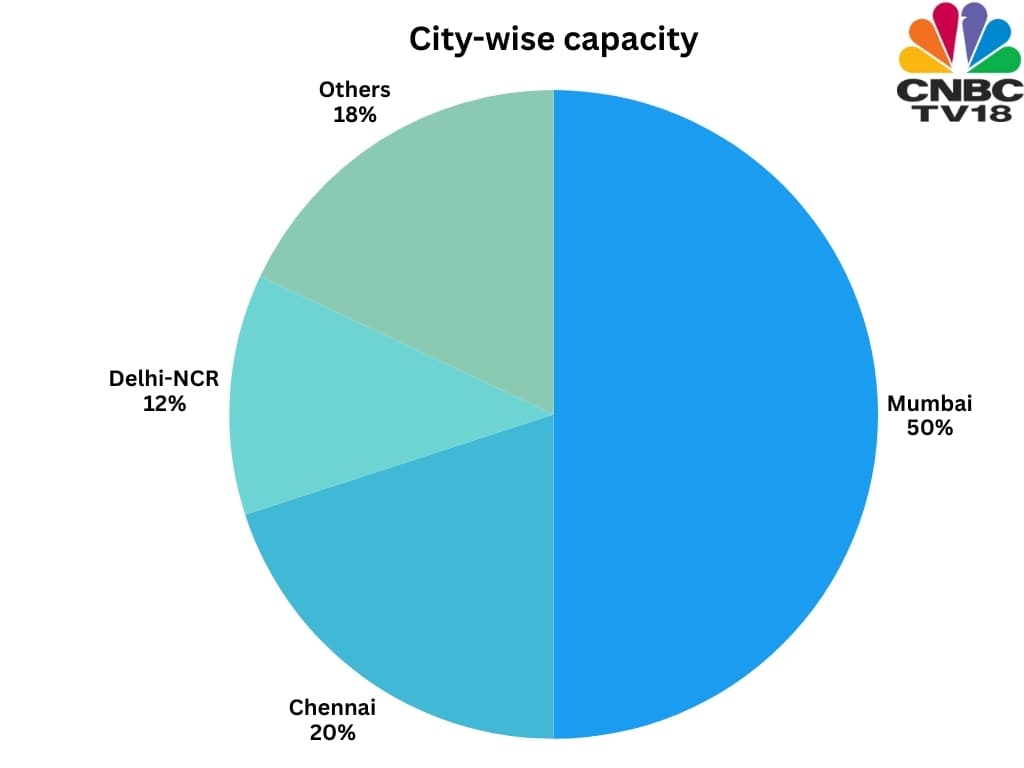

Hyperscalers leased nearly 98 MW in the first half of the year alone, and occupancy stayed high at about 97%. Mumbai continued to dominate with half of India’s capacity thanks to its undersea cable connectivity.

Capacity by City

Power and infrastructure get their own tailwind

Power is becoming a big differentiator for India’s data centre growth story. The country added a record 30 gigawatt (GW) of renewable energy in FY24–25, the third-highest addition globally. This push has been helped by low-cost solar power and strong policy support — a clear advantage at a time when AI data centres consume five to six times more energy than traditional ones.

Global demand for data centre power is rising fast, growing at about 17% a year until 2030. In India, that number is even higher, with demand expected to grow at roughly 33% annually.

At the same time, long wait times for power access in the US and Europe, along with their permitting delays, are making India an increasingly attractive destination for new capacity

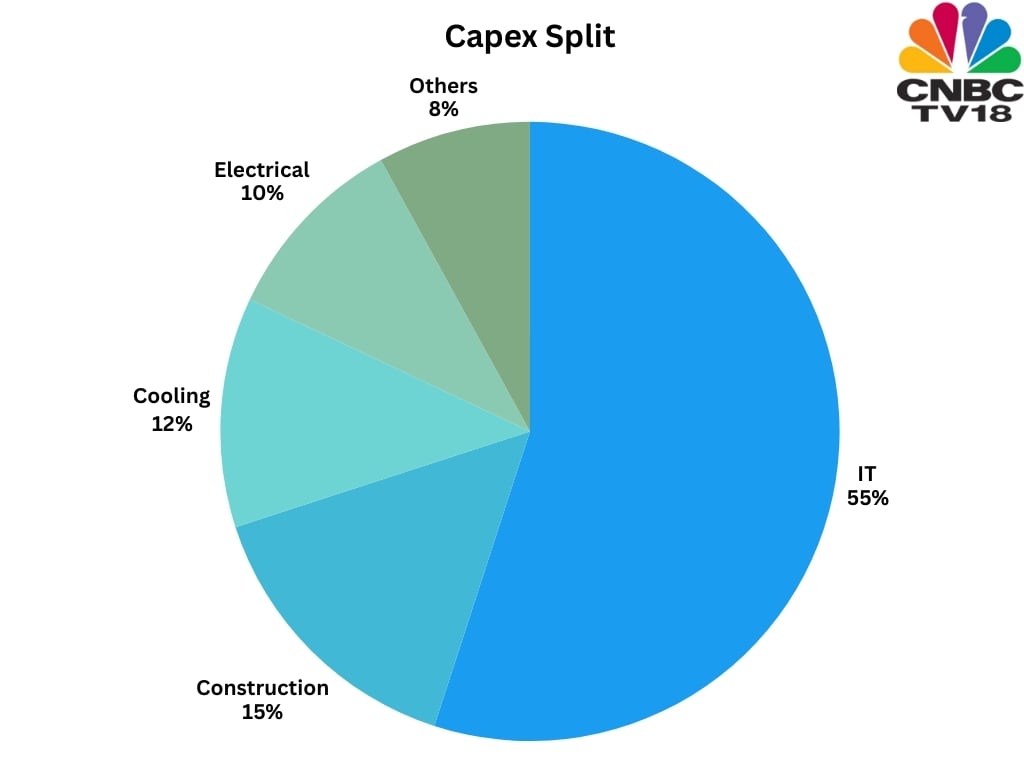

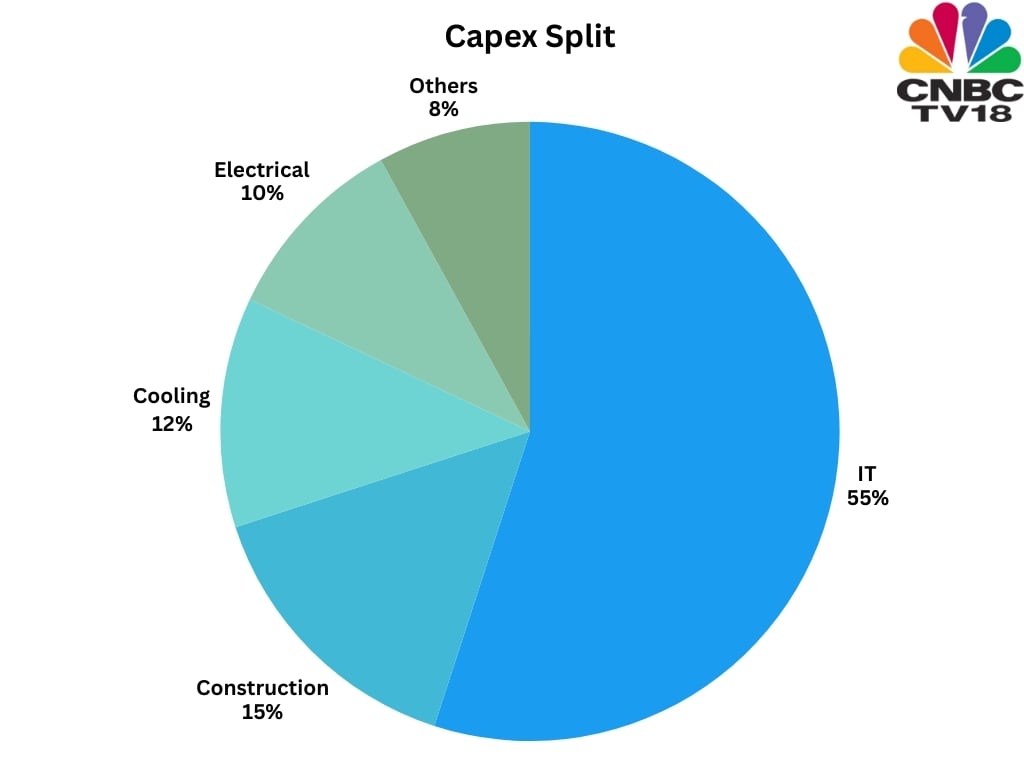

A large part of the investment opportunity sits beyond IT.

Nearly 45% of data centre capex goes into construction, cooling, electrical systems and other equipment.

Data Centre Capex Split

This creates openings for EPC players, cooling companies, wiring manufacturers and power-equipment suppliers as new facilities come up.

India has a strong base of companies that supply the non-IT equipment needed for data centres — whether it’s engineering work from L&T, backup power from Cummins, cooling from Voltas, or wiring from Polycab.

Revenue estimates

Source: Jefferies

2026 and beyond: A multi-year opportunity

Building out the next phase of capacity will require heavy investment, with Jefferies estimating that every megawatt of data-centre capacity in India costs about $4–5 million. To reach the additional 6.4 GW expected by 2030, the sector will need close to $30 billion in capex.

This could create downstream opportunities for Real estate ($6 bn), Electrical and power systems ($10 bn), racks/ fitouts ($7 bn), cooling systems ($4 bn) and network infrastructure ($1 bn).

This wave of investment is set to benefit a wide range of players, from telecom operators and EPC firms to power suppliers and IT companies positioned along the data-centre value chain.

This expansion is linked to a nearly 30-fold jump in data consumption since 2017. India now has close to 900 million internet users, and artificial intelligence (AI) usage is rising fast.

Capacity Growth

Source: Jefferies

The year also saw a wave of mega announcements. Reliance Industries unveiled world’s largest data centre in Jamnagar, along with a 1 GW AI facility built with Nvidia. TCS announced HyperVault targeting 1–1.2 GW over five years. OpenAI committed 1 GW of capacity as well.

Overall, 2025 saw $63 billion worth of announcements ($43 billion excluding Reliance), according to Bernstein.

Key 2025 Investments

Source: Bernstein

Hyperscalers leased nearly 98 MW in the first half of the year alone, and occupancy stayed high at about 97%. Mumbai continued to dominate with half of India’s capacity thanks to its undersea cable connectivity.

Capacity by City

Source: Jefferies

Power and infrastructure get their own tailwind

Power is becoming a big differentiator for India’s data centre growth story. The country added a record 30 gigawatt (GW) of renewable energy in FY24–25, the third-highest addition globally. This push has been helped by low-cost solar power and strong policy support — a clear advantage at a time when AI data centres consume five to six times more energy than traditional ones.

Global demand for data centre power is rising fast, growing at about 17% a year until 2030. In India, that number is even higher, with demand expected to grow at roughly 33% annually.

At the same time, long wait times for power access in the US and Europe, along with their permitting delays, are making India an increasingly attractive destination for new capacity

A large part of the investment opportunity sits beyond IT.

Nearly 45% of data centre capex goes into construction, cooling, electrical systems and other equipment.

Data Centre Capex Split

Source: Bernstein

This creates openings for EPC players, cooling companies, wiring manufacturers and power-equipment suppliers as new facilities come up.

India has a strong base of companies that supply the non-IT equipment needed for data centres — whether it’s engineering work from L&T, backup power from Cummins, cooling from Voltas, or wiring from Polycab.

Revenue estimates

| Year | Estimated Revenue ($ bn) |

| 2025 | 1.5 |

| 2030 | 8 |

Source: Jefferies

2026 and beyond: A multi-year opportunity

Building out the next phase of capacity will require heavy investment, with Jefferies estimating that every megawatt of data-centre capacity in India costs about $4–5 million. To reach the additional 6.4 GW expected by 2030, the sector will need close to $30 billion in capex.

This could create downstream opportunities for Real estate ($6 bn), Electrical and power systems ($10 bn), racks/ fitouts ($7 bn), cooling systems ($4 bn) and network infrastructure ($1 bn).

This wave of investment is set to benefit a wide range of players, from telecom operators and EPC firms to power suppliers and IT companies positioned along the data-centre value chain.