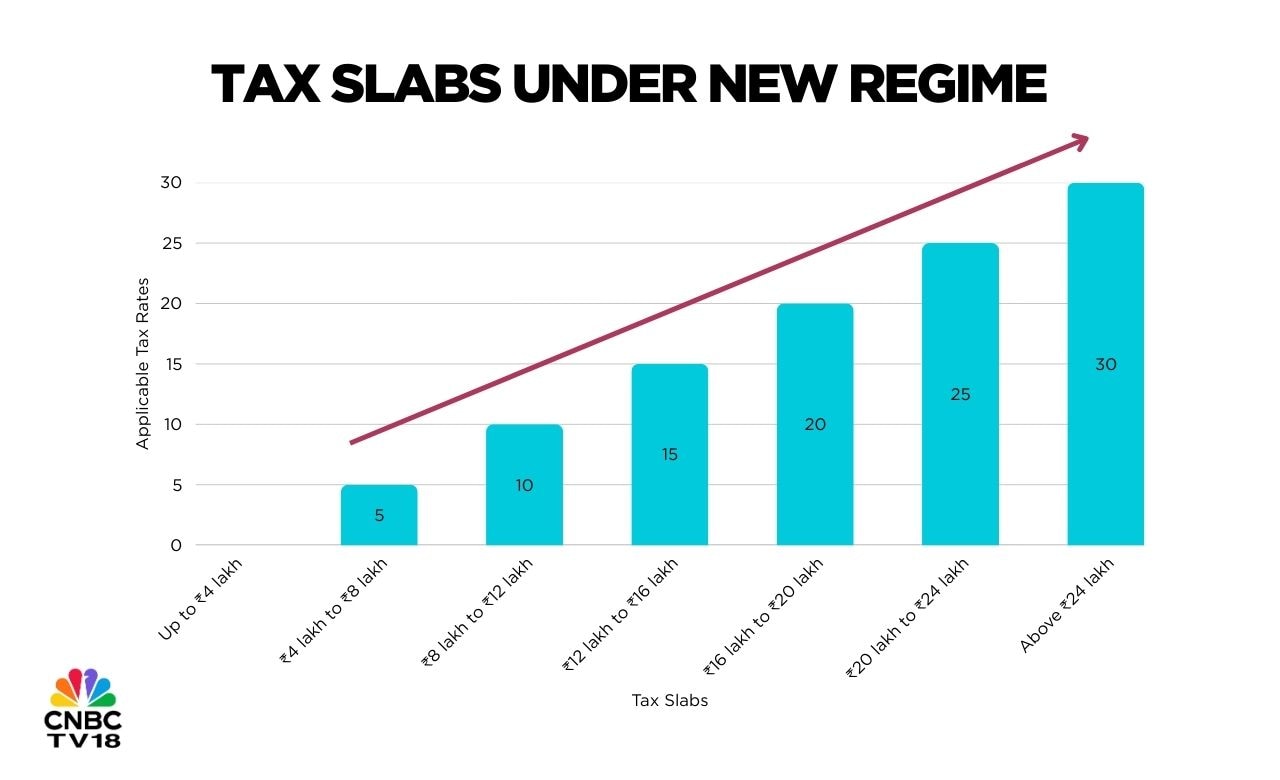

Current income tax slabs under the new regime

The revised income tax slabs under the new tax regime, applicable from assessment year 2025–26, are:

- Nil: Income up to ₹4 lakh

- 5%: ₹4 lakh to ₹8 lakh

- 10%: ₹8 lakh to ₹12 lakh

- 15%: ₹12 lakh to ₹16 lakh

- 20%: ₹16 lakh to ₹20 lakh

- 25%: ₹20 lakh to ₹24 lakh

- 30%: Income above ₹24 lakh

In a major relief measure, Budget 2025 effectively raised the tax-free income threshold to ₹12 lakh under the new regime through rebates. While income up to ₹12 lakh attracts tax under slab rates, rebates fully offset the liability.

For salaried individuals, a standard deduction of ₹75,000 further reduces taxable income, allowing zero tax liability on income up to ₹12.75 lakh.

Other tax relief measures currently in force

The previous Budget also introduced a series of changes aimed at simplifying compliance and improving taxpayer outcomes:

- Second self-occupied house: From April 1, 2025, taxpayers can treat two self-occupied residential properties as tax-free, removing notional rental income from taxation.

- Senior citizens’ interest income: The deduction limit on interest income was increased from ₹50,000 to ₹1 lakh.

TDS and TCS rationalisation:

- TDS threshold on rent raised to ₹6 lakh per year

- TCS exemption limit under the Liberalised Remittance Scheme increased to ₹10 lakh

- TCS removed on education-related remittances funded by education loans

- TCS on sale of goods eliminated

The government also extended the time limit for filing an updated Income Tax Return (ITR) from two years to four years, allowing taxpayers additional time to correct errors or disclose missed income.

New Income Tax Act from April 2026

Beyond rate structures, taxpayers are also preparing for a structural shift.

The government is set to implement the Income Tax Act, 2025, from April 1, 2026, replacing the six-decade-old Income Tax Act, 1961.

While the basic framework of taxation remains unchanged, the new law focuses on simplified procedures, updated forms, and greater use of technology. The Central Board of Direct Taxes (CBDT) has begun training officials to ensure smoother guidance and taxpayer facilitation during the transition.

What to watch in Budget 2026

With the new tax regime now the default option and a new tax law around the corner, Budget 2026 is expected to indicate whether the government will further recalibrate slabs, deductions, or compliance norms to sustain taxpayer confidence while managing fiscal priorities.